How To Make A 50/30/20 Budget

Budgets are essential for financial success. Think about a budget as a road map for your money. Using a budget makes saving money and planning for the future easier.

This article is intended for that beginner. If you have no experience or some experience with budgeting, you are in the right place. If you need to know how to make a budget or make a better budget read on.

I’ll explain how to make a 50, 30, 20 budget, sometimes called the 50, 30, 20 rule, and give examples and introduce you to tools to make your job easier.

I will also explain the importance of a spending journal.

You can profit from this article even if you are of low-income status.

A good budget will help you save money, plan for the future, build wealth, and have a better lifestyle.

Budgets are easy to make and are liberating. Let’s get started.

How To Make A 50/30/20 Budget

A budget will help keep your finances together.

There’s no more forgetting and overspending if you follow your budget. You’ll need a spending journal and a budget.

Budgeting Tools

- Spending journal

- Budget

- Sinking funds

Why Do You Want A Budget

Why have you decided you need a budget? That may sound like an odd question, but why are you taking the time and trouble to do this? Are you tired of being broke all of the time? Are you having difficulty paying your bills? Are you constantly playing a game of financial catch-up? Do you want to save for a memorable vacation? Your child’s college education? Retirement? Or any number of other things? What do you want your money to do for you? You’ll want to keep that purpose in mind when you start to develop your budget because it should be (or at least will eventually become) an important component: For many people, it’s getting out of debt. But if it’s a fantastic vacation, you must include that as a category in your budget. Otherwise, you’ll never take it because you can’t afford to. Or someday, you’ll take it—with disastrous financial consequences that could last the rest of your life.

Before you begin a budget, you’ll need to consider your long-and short-term financial goals. You’ll also need a spending journal in which you track all of your daily expenditures. You do this first (before trying to put together a budget) to track your spending patterns and determine what is important to you daily. This is where you’ll find habits that consume your cash that need to be changed. Think about those five—or six—or seven-dollar lattes. If you buy one every day, you’re spending somewhere between $25 and $50 a week, possibly upwards of $2000 a year. On coffee??? How far could that much money go toward meeting your financial goals?

Most budgets begin as good guesses. Did you know you spend that much on coffee—or if not coffee, something else? A spending journal or log takes all the guesswork out of how your money was spent.

How To Make A Simple Budget

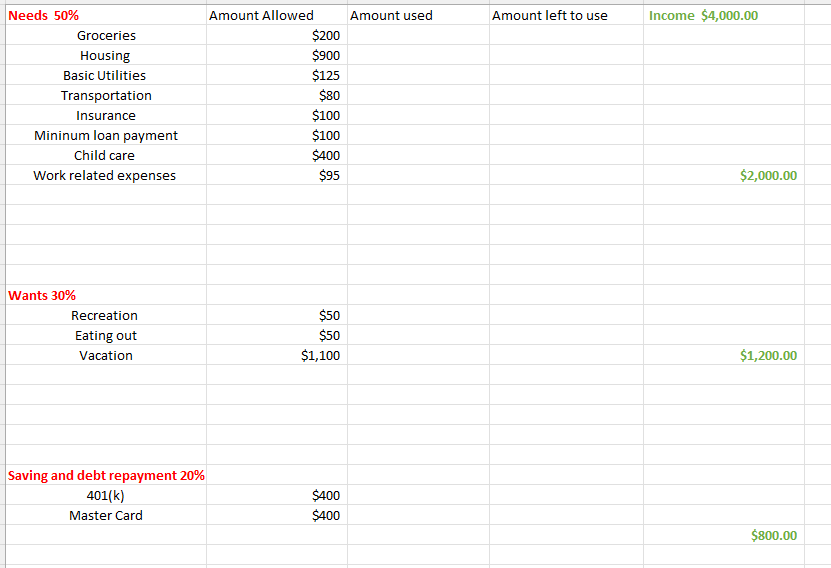

- Determine your after-tax income

- Determine the amount for each category by multiplying the percent by the amount of the 50 30 20 budget. Example (Needs) $4,000 X .50 = $2,000. Don’t forget the decimal. Then (Wants)$4000 x 30 = $1200 finally (Saving and debt repayment)$4000. X .20= 800

- If your employer takes deductions from your income, apply the deductions to the correct category.

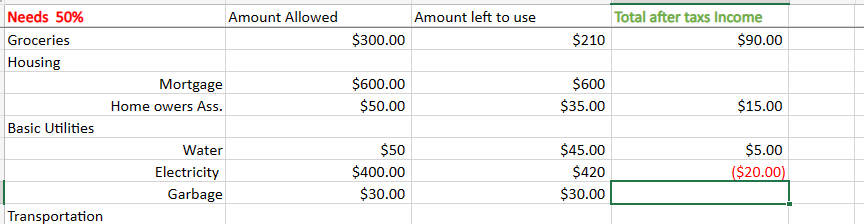

- Fill in the expenses per category and subcategory. While filling in the categories and subcategories, you are trying to correct the percentage. Look at the right side of the spreadsheet. It’s in red.

Budget Example

If your essentials exceed 50%, you may need to dip into your wants or your savings and debt repayment.

Even if your essentials fall under 50%, it’s a good idea to revisit your fixed expenses to ensure you get the best deals. You may find a cheaper phone plan or better insurance rates.

With the surplus, you can apply to credit card debt, mortgage—retirement, or anything else.

30% for wants

Sometimes it’s easy to decide what your wants are. Usually, choosing to eat out, go to the movies, vacation, and more are easy decisions.

Others are more challenging to decide. Like a second car, You and your spouse can get to work and home ok, but it costs one of you more time on the road to and from work. If you weren’t on the road, you could be home taking care of your house and maybe doing a little work or studying.

These kinds of decisions are very personal. You must decide and then put the item or event in the correct need or want category.

Needs are essential for you to live and work. Wants are usually dinners out, vacations, travel, and other similar events.

If you are anxious to become debt free or save a large amount of money. Your wants can wait until later. This decision will vary from person to person.

Remember, every budget needs a little room for fun. You’re less likely to stick to your budget if there’s no money for fun.

20% of your income goes to savings and debt repayment. If you are in debt, you will be better off if you aggressively pay your debt off as soon as possible. This will free up money for other things.

Other Deductions

Some people may have other deductions taken from their paychecks. Depending on what it is will determine what category the paycheck deduction is. If your employer automatically withdraws your 401(k), it will come from the 20% savings and debt repayment.

If your employer deducts your child support, that will come from 50% Needs.

These amounts are after tax. But including other deductions are

50% goes to needs

30% goes to wants

20% of your income to savings and debt repayment

Make a Budget

This is where you decide how much you’ll spend on what. When you begin, you may not know how much you should put in each category. Using your spending journal after each purchase will make it obvious how much you should send to each category.

Income First

Pay records and other income; think of child support and any investments you have that provide any income. If you receive public aid, you should include it also. All money you receive needs to be in your budget.

Expenditures

Look at the budget template I provided and fill in the areas that apply to you. There’s extra room if you need to add more categories or subcategories.

Determine how much you spend and what you spend it on. An excellent place to look will be your spending journal or look to examine receipts.

Be as accurate as you can.

Even after you finish your budget, this time, keep using your spending journal to refine the amounts of expenditures you have.

Take Your Budget To The Next Level

A simple budget is good and is better than nothing, but when a person is budgeting their money, it’s for a reason. Some of the reasons are to find ways to save more money or to become debt free.

By adding subcategories to your Needs, Wants, savings, and debt repayment, you can find opportunities to save more.

If a person is saving money, it’s usually for a set event or an item.

If a person is trying to become debt free, they are looking to spend less to save more.

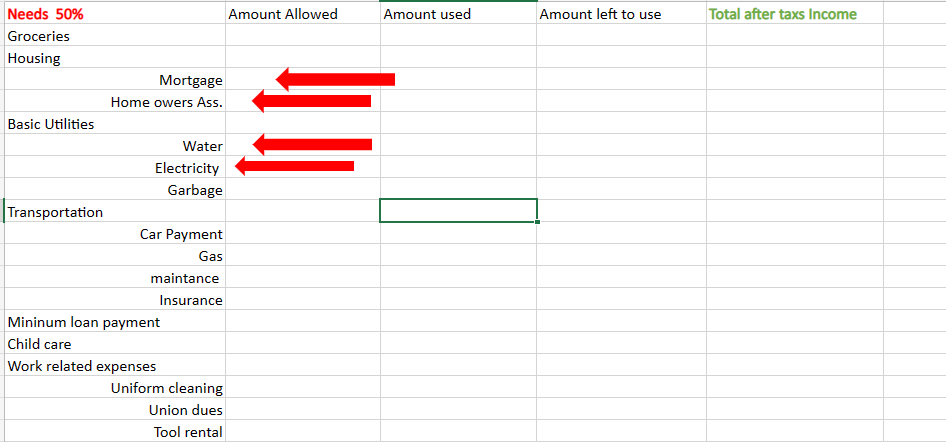

Add subcategories

What Are Sub-Categories

Sub-category is a minor part of a larger category.

As an example, look at basic utilities. The subcategories are water, electricity, and garbage. If you are trying to spend less, you can easily track your spending for each item by using subcategories.

You can’t save money on your mortgage because it’s a fixed rate, but you can save money on water, electricity, and garbage disposal.

You see electricity. We can save money on electricity by turning off the lights that are not being used.

Subcategories make it easier to work with your budget.

I’m sure you get the idea.

We used subcategories to locate money leaks and save more money.

Take Your Budget Up Another Notch

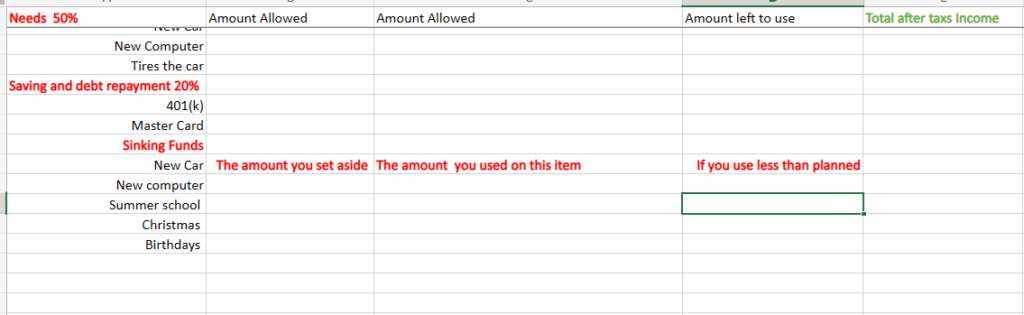

Have you ever saved for something and then bought it later? That’s a sinking fund.

Sinking funds in your budget is a great way to save for upcoming events and items. We all know of events like away football games or tires for the car. It doesn’t matter if you know it’s coming up. You can save for it.

I always advocate being debt free and saving for everything you can. I think financing a vacation is a horrible idea because of the financial stress you are under when it’s time to start paying for the vacation.

In the column, the amount allowed, you should put the amount you plan to use for this item.

In the amount used, you should put the amount you used for this item. If you use the money for something different, enter 00.

To keep track of how much you have saved for the subcategory item you are saving for. Put the total amount you have saved for that item.

I know the column says total after taxes, but you have a record of how much you have saved for that category.

Or you could make another column and label it sinking fund. It’s up to you.

How To Budget Money On A Low-Income

Budgeting for low-income individuals, in principle, is the same as budgeting for a more significant income. Live below your means and save money. Just because you don’t earn a lot of money doesn’t mean you shouldn’t budget your money. Budgeting your money will help you have a better life.

Using A Spending Journal And Budget Together

You’ll need to use a spending journal and a budget for the best results from your budget. This way you will always know how much you have to spend in any particular category.

Note: A spending journal may save your budget if you track every purchase you make. Many budgets are ruined because of instant gratification.

The spending journal you’ll fill out for each purchase then you will update your budget. This will help you spend your money wisely and find places to trim your spending.

Spending journal

Start Using A Spending Journal Today

Start using a spending journal; the sooner, the better. You can make it or buy it. The information you record is essential. We’ll use it later.

The information you need to record is the amount you spent, which category the money came from, and what you bought.

The idea of a spending journal is to track your spending as you go. When you make a purchase, log it into your spending journal. After you are done for the day, compare your spending journal to your budget.

I keep a running budget. Each day I make changes to my budget based on my spending journal. This way, I know how much money I have left in each category and how much I have left to spend. For more details, read the section Create A Budget Template.

If you are faithful to keep your spending journal after you have your budget, you can compare the two to make sure bad habits are not creeping in. You can find money leaks. You need to think about the things you waste money on.

A spending journal is essential in helping you write a budget and ensure you’re keeping to it.

I Can’t Make My Budget Work

Common problems

- When they begin budgeting, most people can’t make it work because one category or another requires more than they can send, and you need to find other areas to take from.

If your “needs” need more money than the 50%, you may need to take from your wants or your savings and debt repayment. You could get a part-time job to supplement your income, get a roommate, or move to a less expensive place.

- You can’t make your budget work because you don’t have complete spending history numbers. In other words, you don’t have all of the money you spent logging correctly. Maybe you just forgot about it ( think spending journal)

Making a budget that works is a process that takes time. Knowing how to make a 50/30/20 budget is easy but requires trial and error.

It’s essential to have a good budget. You have everything written out so you can reference where your money is being spent. The more accurate it is, the better results you will receive.

Changes In Your Budget

There will be times your budget will change. Like when you finally get out of debt and you have excess money without a category, it’s essential to redirect the funds. Now that you are doing well, you don’t want to end up in debt again.

When there’s a baby born, you expect to spend more money on baby things. You need to work that into your budget.

Create A Budget Template

If you don’t want to reinvent the wheel every payday. Use a template. You can print it off your computer, store it on your computer, or use it online. All you need is a blank copy of the previous pay period.

Earlier, I told you I compared my spending journal to my budget daily. This is where you will see that.

I use it online for convenience.

simple budget template excel

Simple budget template word

Conclusion

Budgets are essential for keeping track of your money. Because budgets are so important, everyone must know how to make a budget. One of the easiest budgets to use is the 50/30/20 budget. Learn how to make a 50/30/20 budget