Why Do I Need A Spending Journal

When I first started using a spending journal, I discovered two things. I was spending a lot of money on parking tickets. The other issue is related. The

funds I spent on parking tickets—and some other frivolous things—I could have spent on something I needed or at least wanted. Another option would have been saving it. This was a big deal! Even though I paid at least one every month, I certainly had not included parking tickets in my budget. (Who would??? And, of course, you have to realize this was years ago, and I was becoming familiar with the idea of being frugal.)

To answer the basic question, why do I need a spending journal? The answer is to know where my money is going and why. A spending journal will help you save money.

Note: The concept behind being frugal is to direct your money in a way that will give you the most satisfying lifestyle. Knowing how to make a budget (and adhering to it) is foundational, and a spending journal is essential to developing and maintaining your budget. Without a spending journal, we are more likely to spend money too freely and ruin our budgets.

What Is A Spending Journal/ Spending Log

A spending journal (or spending log) is simply a written record of your daily spending. It needs to be accurate to the penny. The idea is to compare the sum of the various categories in your spending journal to your budget to determine how well you’re keeping to that budget and to determine if you need to adjust your budget or your spending habits. Ultimately, you are looking for waste (money leaks). Waste, in this case, is money spent that doesn’t get you what you really want and, to an even greater extent, what you need.

Why Do I Need A Spending Journal

A good spending journal is a record of any and all expenditures. It will tell you when, where, (and largely why) your money is gone. If you’re dedicated to becoming debt-free, you will find it to be a great tool for exposing small leaks that are costing you. If you have a savings goal, you’ll see habit patterns that are slowing you down because they drain your funds.

A spending journal is a tool to help you find waste. It keeps you mindful of what you’re spending your money on—and why. As you analyze your spending patterns, you will find places you can improve. For example: Do you really need that many lattes?

A Closer Look At Spending Journals

Your budget tells you how much you have allotted to spend on groceries (or any other category). A spending journal tells you everything you did spend your money on. If you think about it, a spending journal is the opposite of a budget. The budget tells you how much money you have for spending and where you intend to use it. A spending journal tells you what you really did with your money—and why the grocery fund keeps coming up short.

How To Start A Spending Journal

Neither starting nor keeping a spending journal has to be complicated. And it shouldn’t be! The whole idea behind managing my finances is to enjoy life more. I’m pretty sure that’s how most of us feel about just about everything: We want to add to our sense of well-being.

So…

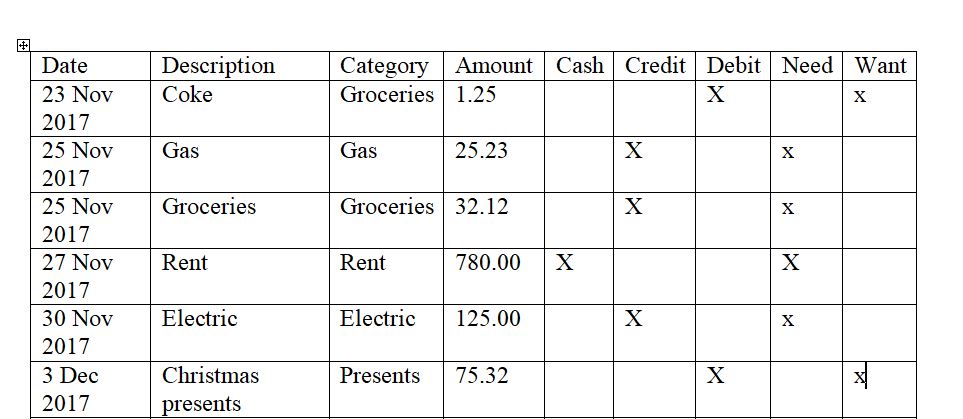

When you spend money—cash, credit, or you take out a loan—write it down. It’s important to keep good records. The following information needs to be included:

Date: The date of expenditure

Description: What was the money spent on

Category: Your budget is (or will be) divided into categories. Where does this outlay of funds fit best?

Amount: How much you spent

Cash: Check this column if you spent cash

Credit: Check this column if you used credit

Debt: Did you secure a loan for this item

Need: Be honest. Was this expenditure a need (“Need” includes obligations—like rent)

Want: Did you want it.

You’ll want to have all this information in your spending journal. When you review it, it will help you see your spending patterns. Which of those transactions got you what you really wanted—or at least closer to it? How much did the others hinder you from reaching your goals? As you think about your spending from those perspectives, you can make decisions and adjustments to your budget and how close you stick to it that can make your finances work better for you.

You can make your own spending journal similar to the one I have above, or you can buy one.

How To Use A Spending Journal

Periodically—weekly or at the end of each pay period tends to work well—you need to review and do a bit of analysis on the information you’ve been collecting in your spending journal. Of course, you’ll get the sum of all your expenditures. Overall, did you stay within your budget?

Now is the time to consider how your money is working for you. Is it getting you (at least closer to) the life you want?

How you are doing in keeping with your allotments to the various categories of your budget? (It’s important to assign each of the entries in your spending journal to a category.) It’s here you’ll find your spending patterns. These patterns will help you decide where you can (should?) make adjustments to your budget or to your spending.

Look at the “Need” and “Want” columns in your spending journal. How many entries were in each? In which budget categories do most of either appear? When you consider them now, would you reassign any needs to wants—or vice versa? Your pattern of need/want spending can tell you what is important to you. It can also tell you where it is costing you to be indulgent. Would you rather have lattes today or vacation this summer? On the other hand, could your steel-toed shoes (which are necessary for work) have lasted another couple of weeks so you could get a professional to take family photos while your grandparents were here visiting from overseas?

Needs and wants are subjective. You make choices when you spend money, and your LIFE is affected by those choices.

Improve Your Budget

A spending journal allows you to know exactly where every penny is going. You probably already know what your financial obligations are, but unless we track our spending, most of us have a very vague idea as to just how much money we spend—impulsively? Frivolously? A spending journal gives us that

information. It will take the guesswork out of your budget and help you make your money work better for you.

You can decide whether your budget or your spending habits need adjustment. In other posts, I’ve said that budgets are guides or tools based on your needs and goals that can help you make the most of your money. After you’ve dedicated money to meet your financial obligations, there is no reason you can’t accommodate yourself.

You can make choices, and those choices will have results. If you want to spend your money on a couple of lattes and lunch out every day…it’s your money. But. Could that choice make the difference between a vacation or a staycation next summer?

What do you want? What do you really want?

Helps You Make A Budget

In this post, I mostly talked about using your spending journal to help you keep your spending in line with your budget. I did, however, mention earlier that you need one to even set up a budget. And believe me, you do. A budget is a set of allotted categories, but before we start tracking our expenditures, most of us really don’t have any idea how we should group them, let alone how little we manage our spending.

Most first budgets are little more than good guesses. In fact, many are nothing more than wishful thinking. Before you can address any issues about managing your money, you need to know how much you’re bringing in and how much you’re spending–and on what. If a person doesn’t know where the money is going, all too often, a budget never progresses beyond being more than those few good (or bad) guesses. A budget should not be confused with a spending journal.

Conclusion

Why do I need a spending journal? You need a spending journal to effectively track your expenditures. The information it provides can help you adjust your budget and spending habits. Those changes should improve your ability to meet your financial obligations, save, and enjoy more of what you really want your money to do for you.