Protect Everything

Protect everything, this is an example of why. One Thanksgiving (years ago), my wife decided to get a jump on the holiday dinner. Around noon on Wednesday—the day before Thanksgiving—she put the turkey in the oven to bake. An hour later, when she

checked on its progress, the oven had stopped working. You can only imagine the frenzy. The company was coming tomorrow: As hosts, the turkey, along with gravy and stuffing, was to be our contribution to the dinner.

I went to work trying to locate the problem. Maybe it was just a loose wire? Something easy to fix? It didn’t take long to figure out that the lower heating element was burned out. A couple of calls later, I headed to one of the local hardware stores. (I am so-o-o thankful this happened before the stores closed for the holiday.) I bought a new element. It wasn’t hard to install—basically, just pull out the old one and plug in the new one. The turkey was back in the oven in a little over an hour. Hooray! Thanksgiving dinner was great—turkey with all the fixings.

The story’s point is that a calamitous event doesn’t need to occur to precipitate a disaster. The loss of something we rely on can have enormous consequences (at least in our minds). In this case, it was just a blown heating element for the oven. They aren’t even very expensive. (Granted, the timing was fortuitous.) But what if I hadn’t had the money to replace it? You see, this event occurred very early in my navy career. Credit cards were not used as much then as now (and you certainly didn’t get any “rewards” for using them). I don’t remember the existence of debit cards. It wasn’t unusual in our circle of friends for something like Thanksgiving dinner to be an event that ate up (pun intended) any cash reserves a family had. I had to write a check. And since you know how I feel about debt, you know I would have refused to write a bad check: They are debt—not to mention illegal—and lead to nothing but more debt.

Many of the things we take for granted would be sorely missed if we lost them. I’m talking about things we use daily: hair dryers, food processors, washers/dryers, cell phones, computers, and so on. Some of them are necessary and all add convenience to life. But, they’re all subject to breaking and wearing out. The loss of any of these items detracts (at least to some extent) from the quality of our lifestyle. And the sole responsibility for repairing or replacing your stuff is on you.

What do you have—something that you use just as a matter of course—that you would miss? Are you into home

renovation? If its motor goes out, do you have the money to conveniently replace your drill? Maybe you’re the family baker? Your cakes are beautiful. And delicious! You make all the cakes for the family birthdays and other special occasions—not just for your household, but for the extended family. And, maybe, just maybe, you supplement your income occasionally (or regularly) baking for others? Can you afford, right now to replace that wonderful professional mixer that costs somewhere between $200 and $600. What about the family computer? The kids use it to do their homework. You and your spouse probably use it to surf the net, get news, keep track of finances, stay connected with others…

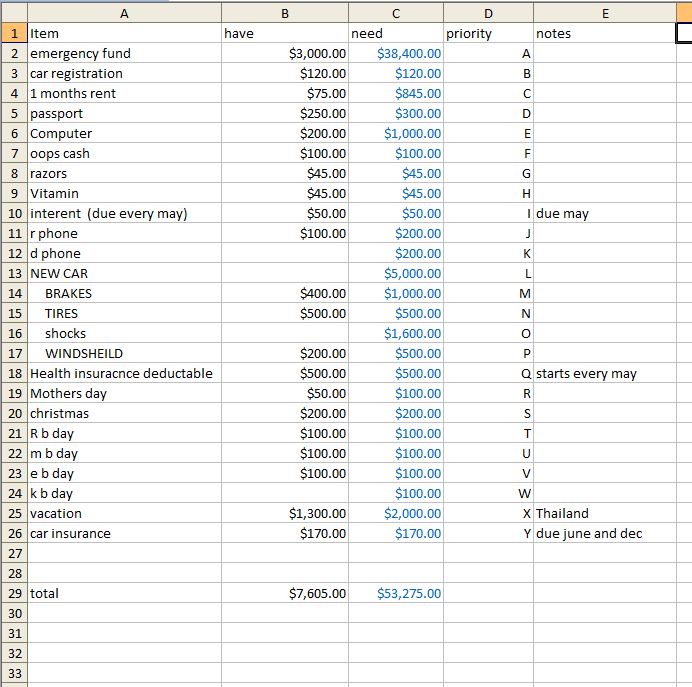

I use my computer every day. When the time comes to replace it, I want to have money available to do so. I’m going use the idea of replacing my computer as an example of my plan to have ready funds for routinely replacing my “stuff.” I use this plan to finance everything I may need to replace and for scheduling payment of upcoming bills. (Note: The numbers are hypothetical, but the application is real.)

First, I do research to find the computer I’ll purchase to replace the one I have. This means I know how much I’ll need to spend on it. I started the process almost as soon as I got home with the one I’m using now, and it’s ongoing: As technology develops and prices change over the 2-3 years before I’ll need a new one, I want to stay updated. I plan to have the money I’ll need to replace my current computer in our “miscellaneous fund” long before the day it crashes and can’t be repaired. You might be thinking, “Must be nice.” Believe me, it is. But … the money is not going to get there by accident. I have to live by my plan to regularly set funds aside. I keep track of these available funds on a spreadsheet. (See the example below.)

Out of every paycheck I designate money toward our usual weekly needs and monthly commitments; the amounts are allotted according to our budget. The remaining balance is put into our miscellaneous fund, which includes our emergency account—I’ll explain that shortly. Except for our retirement accounts (IRAs and a few investments), the miscellaneous fund is the depository for all the money we don’t use on an immediate basis. It includes some bills that come due only once or twice a year. I pay attention to those due dates. As each gets closer, to make sure I have the required amount saved, a category may rise in priority.

The spreadsheet

Interpreting The Spreadsheet

Reading the chart from left to right there are five columns: THE ITEM—Any category for which I need to save money: HAVE – total I currently have designated toward that item: HOW MUCH— amount needed to fully fund that particular item: THE PRIORITY—a list from A to Z: NOTES—pertinent info I have on an item.

The Columns

Item: The item can be anything you’ll (probably) need to repair or replace in the future. You’ll never be able to provide funds for everything, but this method is especially helpful when you anticipate replacing larger ticket items. Oh, and it doesn’t necessarily have to be a physical thing. It could be something like a vacation.

Have: This column reflects the amount of money already set aside for each particular item or event.

Need: This column tells me what I expect to pay for the listed item. Use a set of new tires as an example. For a set of four tires after taxes, mounting, and balancing, I will need $500.00.

Priority: I list each item’s priority listed A-Z. “A” is the first item I want to fully fund, then I move on to item “B,” to “C,” etc., until I have all of them satisfied. I’m not there yet, and (probably) never will be; I’ve already allowed that as the need arises, I’ll change priorities. This is about being prepared—not perfect.

I prioritize my list is in the order of importance to me. When I started using this method, my car insurance was soon to be due, so that was the item I satisfied first. After that, I saved according to what I thought should be next. As of this writing I’m working on priority D—saving for a passport.

Later this month, the car insurance is due, again. I have the money to cover that bill. I’ll pay it. At that point, I’ll interrupt the funding of priority D and start replenishing priority A—the car insurance. (I’ll need to pay it again in six months.) Until priority A is satisfied, the weekly contributions I make from my paycheck to my miscellaneous fund will go to priority A. When I have the car insurance together again, I’ll return to making payments to priority D—my passport. When D is satisfied, I’ll move on to E. (Of course, that is conditional on not having had to take money out of another priority.) And so… I will continue to progress through my priorities.

Notes: I use this column to schedule payments and leave myself reminders and messages.

Why all the work

At all times, I can see how much I have, when money is due, and what progress I’m making towards having enough to replace or repair ____________. It’s a great scheduling tool. I do it this way because it works for me. I want the organization.

Robbing Peter To Pay Paul

Sometimes my plans haven’t come together as easily as I wanted them too.

As much as I hate to admit it, early on there were times I needed to “Rob Peter to pay Paul.” I forgot someone’s birthday or I had to replace something unexpectedly. I had to take money from another fund to finance the gift or whatever. (I was careful to not take it from a fund I knew I would need soon.) That’s when I decided to replenished the fund I borrowed from the following payday (or as quickly as I could) and then pick up with funding where I had left off.

Remember, I’m not a professional financial counselor. As I’ve lived, I’ve learned. By sharing what I’ve learned, I hope to make it easier for some folks to master their finances.

Is This The only Way?

NO. There are many viable financial plans on the internet and in print. I use this plan, because it works for me: Seeing my spreadsheet every week, allows me to keep track of what I’m saving. I use it as a scheduling tool, too. I know what is due when, how much I have in surplus, and (much as I don’t like doing it) where I can borrow from: Actually, I’ve been doing this long enough, now, that I rarely need to borrow from one fund to cover another.

Quite a few financial counselors tell you to establish your emergency account before you save for anything else. That’s not bad advice. The rule of thumb is to have three month’s worth of expenses available. I advocate, ultimately, setting aside a year’s worth of money for living as part of a financial safety net. I’m also on record for saying it’s best if debt can be paid off before an emergency fund is established: People in debt really do not own any of the money they “save”. But … they do have some discretionary control over it. That given, it can make sense to work on paying down debt, and at the same time, start putting aside funds to cover events that could reverse the progress of getting out of debt. It makes sense to develop an initial budget with heavy emphasis on paying off debt and setting aside three months of living expense. (That three month financial safety net would, of course, have to include funds for continuing to pay off your debt.) After you have a three month emergency fund, the budget could be revised to continue paying down debt, but change from funding the emergency account to funding some of your specific necessities/conveniences. Otherwise, every time something needs to be fixed or replaced it will be an “emergency,” and you will have to tap that fund. I want the emergency account viewed as untouchable except for extreme emergencies. It should not be used just because you did not plan correctly.

Conclusion

To keep life moving in a non-harried way, it’s necessary to plan for the inevitable. You know the possessions—necessary or convenient to your lifestyle—will wear out or break. They’ll need to be repaired or replaced. Those events don’t need to be dramatic crises. Include a miscellaneous fund with regular contributions to prioritized items (or events) in your budget. As part of your financial safety net, having those expenditures covered will help protect everything and your lifestyle.