Stop Wasting Money

The internet and your next-door neighbor are full of ideas on how to stop wasting money and how to save money. While some of these suggestions may be helpful, it’s important to recognize that there is more to it than simply cutting out small expenses like your morning Starbucks coffee.

Although reducing unnecessary expenses is a good start, stopping the waste of money goes beyond just eliminating small indulgences. It requires a deeper understanding of how you are spending your money and making conscious choices about where your money goes.

Saving money and not wasting money are similar concepts, but they are different. Saving money involves setting aside a portion of your income for future use or emergencies. On the other hand, not wasting money means avoiding spending on things that do not improve your life or bring you closer to your goals.

Not wasting money involves being mindful of your spending habits and making intentional decisions about where your money goes. It means questioning whether a purchase is necessary or if it aligns with your values and goals. By avoiding unnecessary expenses, you can free up more money for things that matter to you.

Saving money, on the other hand, is about allocating your resources towards specific categories or goals that fulfill a need or bring you closer to your objectives. This could involve setting up an emergency fund, saving for a down payment on a house, or investing in your education or career development.

Stop wasting money

Many people would like to stop spending so much money but find it challenging. However, it is possible to break the cycle of wasteful spending by taking proactive and consistent actions.

To stop wasting money, it is crucial to be proactive and actively make choices that align with your financial goals. This means being mindful of your spending habits and making conscious decisions about where your money goes. It requires taking control of your finances rather than letting them control you.

Now, let’s dive deeper into what exactly constitutes wasting money.

Wasting money can be defined as spending money on things that do not satisfy a genuine need or bring you closer to your goals. It involves making purchases that do not align with your values or priorities.

It’s important to take a closer look at your spending habits and evaluate whether each expense is truly necessary or if it contributes to your overall well-being and progress toward your goals. Doing so, you can identify areas where you may be wasting money and make necessary adjustments.

What is wasting money?

As mentioned earlier, wasting money refers to spending money that does not fulfill a need or contribute to your goals.

When considering what is truly important to you, it is essential to reflect on your values and priorities. What matters most to you in life? What are your long-term goals and aspirations?

What’s important to you? Each individual has different dreams, desires, and priorities in life. It’s crucial to identify what truly matters to you personally.

There are countless experiences and opportunities in life, and it’s important to align your spending with what brings you joy and fulfillment. For example, suppose your dream is to retire early. In that case, you may save money by avoiding frivolous expenses like eating out frequently or maintaining a gym membership you rarely use.

It’s okay to be selfish and plan for that vacation, wedding, or retirement.

Planning and saving for important events or milestones is not selfish; it’s a responsible and proactive approach to managing your finances.

By setting aside money specifically for these significant moments, you can ensure that you have the means to enjoy them without going into debt or compromising your financial well-being, whether it’s a dream vacation, a wedding celebration, or saving for retirement, having a plan in place allows you to make these experiences a reality.

It’s okay to splurge occasionally.

While it’s important to be mindful of your spending and avoid wasteful expenses, it’s also essential to allow yourself the occasional indulgence or treat.

Treating yourself from time to time can bring joy and happiness into your life as long as it fits within your overall financial plan. It’s about balancing responsible spending and rewarding yourself for your hard work and achievements.

However, it’s crucial to approach splurging cautiously. Overspending on unnecessary items or experiences can quickly lead to financial strain and undermine your efforts to stop wasting money. It’s essential to evaluate each splurge and ensure that it aligns with your values and goals.

Social Media (stop comparing yourself to the Joneses)

Social media has become a platform where people showcase the highlights of their lives, often presenting an idealized version of reality.

It’s important to remember that what you see on social media is only part of the picture. People share their best moments and achievements, creating a skewed perception of their lives.

It’s important to recognize that what you see on social media is not necessarily the truth. Comparing yourself to others based on their social media presence can lead to feelings of inadequacy and unnecessary spending to keep up with unrealistic standards.

Recently, I saw pictures of a vacation a friend took.

The pictures portrayed an idyllic and perfect experience filled with excitement, good-looking food, and breathtaking sites.

However, later, my friend revealed the real truth behind the pictures.

They experienced long lines, restaurants not having the items on the menu, and canceled events they had signed up for.

Later, he told me the honest truth.

This serves as a reminder that social media often presents a filtered version of reality. It’s essential to take what you see with a grain of salt and not let it influence your spending choices or make you feel inadequate.

On Facebook, it looked great.

It’s important to recognize that what you see on social media, such as Facebook, may not always reflect the reality of a situation.

Regarding my friend’s vacation, the pictures may have portrayed an amazing experience. However, in reality, it turned out to be a horrible experience, causing disappointment and potentially leading to spending too much money on something that didn’t live up to expectations.

Anyone can make it look and sound good.

This applies not only to individuals on social media but also to marketers and advertisers.

There are two key points to consider:

Marketers can sell anything on the internet. They can create appealing advertisements and promotions that make products or experiences irresistible.

It’s crucial to keep your life or financial decisions from what you see on social media or what marketers present. Remember that these platforms often showcase an idealized version of reality, and it’s essential to make financial choices based on your own needs, goals, and budget.

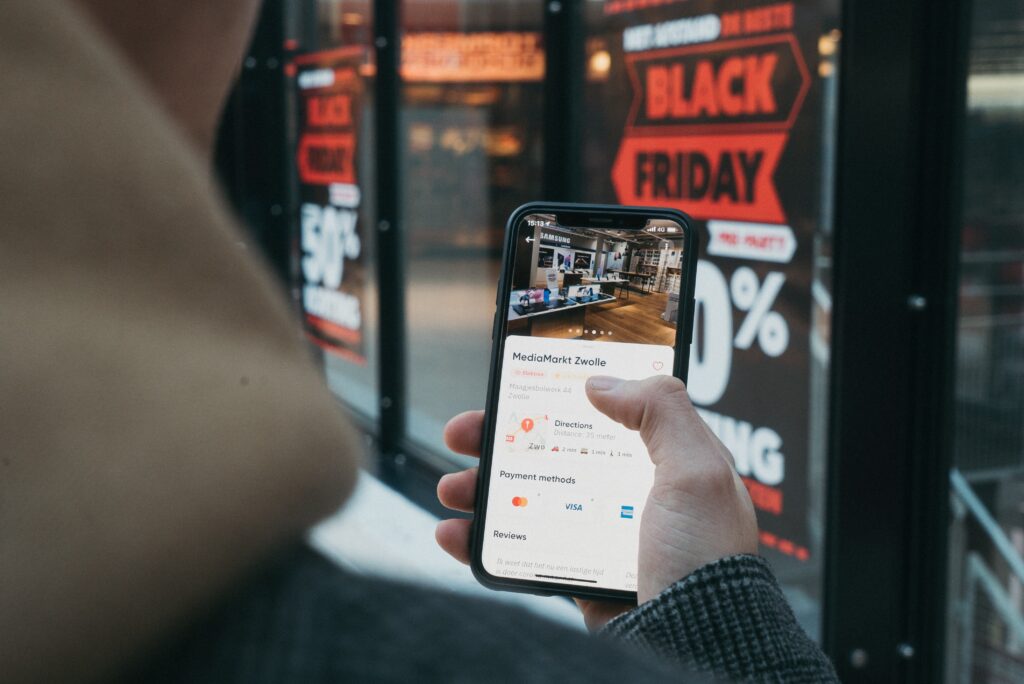

Control your shopping online.

Shopping online has become incredibly popular due to its ease and convenience.

It’s true that shopping online offers convenience and the ability to purchase almost anything with just a few clicks. Additionally, the items are delivered right to your doorstep.

However, there is a dark side to online shopping that can lead to wasteful spending and financial strain.

People often make impulsive purchases online without considering their budget or upcoming events. They may buy things they don’t truly need but want.

The ease and accessibility of online shopping can lead to a lack of consideration for whether a purchase is necessary or aligns with long-term financial goals.

Some individuals fall into the trap of mindlessly buying items without considering the financial implications or practicing good money management skills.

E-commerce has made it incredibly easy to abandon good money management practices and get caught up in the allure of shiny objects or the convenience of instant gratification.

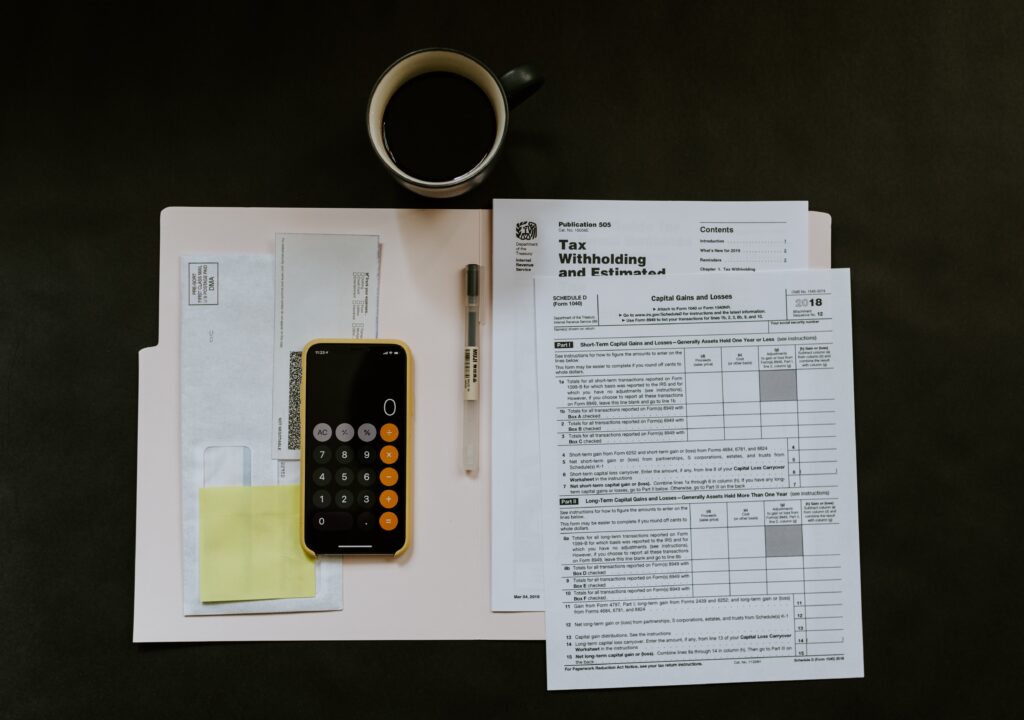

Not tracking your finances.

Many people struggle to recall what they had for breakfast, let alone remember how much they spent and on what.

By actively tracking their expenses, it becomes easier for individuals to have a clear understanding of their financial situation. They may need help to accurately determine where their money is going or identify areas where they waste money.

This lack of tracking can lead to financial disarray and make it difficult to make informed decisions about spending and saving.

Tracking your expenses is crucial for effective financial management.

By keeping track of your expenses, you gain insight into where your money is being allocated. This knowledge lets you identify unnecessary or wasteful spending and adjust your purchases to your needs and goals.

It helps you make informed decisions about your spending, ensuring that each purchase serves a purpose and brings value to your life.

Shopping to feel better

There are many jokes and stereotypes about shopping as a means to feel better or lift one’s mood.

However, these jokes should not be taken as truth. While shopping may provide temporary satisfaction or a momentary boost in mood, it is not a sustainable solution for true emotional well-being.

The feeling of happiness or contentment derived from shopping is often short-lived and can quickly be replaced by buyer’s remorse or regret.

Additionally, the consequences of excessive or impulsive shopping can lead to financial stress and the erosion of savings or financial goals.

Lack of self-awareness

One of the main reasons why people struggle with their financial goals is because they lack self-awareness. Many individuals are not even aware of what their goals are or if they have any goals at all.

It is crucial to understand that what you do today has a direct impact on your future goals. With a clear understanding of what you want to achieve financially, it becomes easier to make impulsive decisions and spend on frivolous things.

Most people would like to see their goals come true sooner rather than later. However, with self-awareness, it becomes easier to align your spending habits with your long-term objectives.

Being unaware of how much you are spending on unnecessary items can easily lead to overspending. Monitoring your expenses is necessary to stay on track and make conscious choices that support your financial goals.

On the other hand, if you are self-aware, you are actively monitoring yourself and your financial decisions.

Being self-aware means knowing how much money you can spend. You are aware of your income, savings, and any financial obligations you may have.

Additionally, self-awareness involves knowing how much you have already spent. By keeping track of your expenses, you have a clear understanding of where your money is going and can identify areas where you may be overspending.

By being self-aware, you are more likely to make informed choices about your spending habits. You can prioritize your financial goals and allocate your resources accordingly.

Paying with plastic

The ease of electronic commerce has made spending money incredibly convenient. With credit and debit cards, you no longer need physical cash to purchase.

The availability of plastic payment options has made it easy to spend money without immediately feeling its impact. This can lead to a disconnect between the act of spending and the consequences of that spending.

While using plastic may seem convenient, it is essential to remember that you will eventually need to pay for those purchases. Delaying the payment can sometimes lead to financial strain and debt if not managed responsibly.

If you find yourself routinely reaching for your credit or debit card to make purchases, it may be beneficial to change your mindset and opt for cash-only transactions.

Paying with cash can help you become more aware of how much you are spending. When you physically see the money leaving your hands, it creates a more tangible connection between your actions and their financial implications.

By relying on cash, you are forced to consider the value of each transaction more consciously. This can lead to better decision-making and a heightened sense of financial responsibility.

How to stop spending money

Understanding why you overspend or waste money is essential, but it is equally crucial to know how to stop this behavior. Let’s explore some strategies to help you curb unnecessary spending.

Some of the points mentioned below may have been touched on before, but let’s delve into them in more detail:

Know what you are spending money on

Tracking your spending is a fundamental step in gaining control over your finances.

Keep accurate records of your expenses. This can be done through various methods, such as using a budgeting app, creating a spreadsheet, or simply jotting your expenses in a notebook. The key is to have a clear picture of where your money is going.

Evaluate whether the money you are spending is satisfying a genuine need or getting you closer to a goal. If the answer is no, it may indicate you are wasting money on unnecessary purchases.

Recognize that every dollar you spend on non-essential items could have been allocated towards something more meaningful or aligned with your financial goals. By being mindful of this, you can make more intentional choices about spending your money.

Make your budget work for you

Creating and sticking to a budget is an effective way to manage your finances and control your spending habits.

Explore different budgeting methods and find one that suits your needs. For example, the zero-based budgeting approach allows you to easily add or subtract categories based on your priorities and financial situation.

Consider putting specific categories on hold. If there are expenses that are not urgent or essential, you can temporarily pause allocating funds toward those categories. This could include postponing discretionary purchases or delaying specific savings goals.

Prioritize your financial goals within your budget. If you have a specific purpose, such as saving for a car, evaluate whether you already have enough money to purchase it outright. If so, question the need to save more for that particular goal. Instead, you can redirect those funds toward other financial objectives.

Understand that all budgets have pros and cons. It is essential to find a budgeting method that aligns with your preferences and lifestyle. This will increase the likelihood of sticking to it and achieving your financial goals.

50/30/20 budget

The 50/30/20 budgeting method is a popular approach that allocates specific percentages of your income to different categories. It suggests assigning twenty percent for savings and paying off debt.

However, it is important to note that the 50/30/20 budget is a guideline and can be adjusted based on your circumstances and goals. If you want to pay more towards your debt, you can allocate more of your income for debt repayment.

Similarly, if you prioritize saving more than twenty percent, you can adjust the percentages accordingly. The key is to find a balance that aligns with your financial objectives and allows you to make progress toward your goals.

You have a budget for a reason.

The purpose of having a budget is to direct your money towards what is important to you. It helps you prioritize your spending and ensure that your financial resources are allocated appropriately.

Budgeting considers your basic needs, such as housing, clothing, and food. These essential expenses are typically given priority in your budget.

Additionally, a budget allows you to allocate funds towards other important aspects of your life, such as saving for vacations, weddings, college funds for your children, and retirement. The possibilities are endless, and it depends on your individual goals and aspirations.

Having a good budget

Selecting a budgeting style that works for you is essential. There are various budgeting methods available, and it is important to find one that resonates with your financial habits and preferences.

It is perfectly acceptable to use a mix of different budgeting styles to create a personalized approach. For example, you can combine elements of the 50/30/20 budget with other methods that work for you.

In this approach, you can decide how much you want to save for a specific item or event. This may not align with other budgeting styles, but as long as it works for you and helps you achieve your financial goals, it is effective.

Saving for everything you desire is possible with a well-designed budget. By allocating funds towards your goals and consistently saving, you can progress towards achieving anything you want.

Shop with a goal in mind.

When we think of shopping, our immediate goal is often to bring home the items we need, such as groceries. However, it is important to have a different plan in mind regarding our overall financial well-being.

This goal involves considering the future and what we want to accomplish, such as sending our kids to college or retiring comfortably.

While shopping, we should actively look for ways to save money. This can be done through various methods, such as coupons, store apps, or shopping during sales.

By saving a little here and there on our purchases, we can accumulate significant savings over time. These savings can then be applied toward our long-term goals, such as education or retirement.

It is crucial to keep these financial goals in mind not only when shopping but also when making any other spending decisions, such as getting an oil change for our car.

Salespeople often try to upsell us on additional products or services. It is important to evaluate whether we genuinely need these extras or if they are unnecessary expenses.

By being mindful of our financial goals, we can make informed decisions about where to allocate our money. This allows us to prioritize our spending and avoid unnecessary expenditures that do not align with our long-term objectives.

Stop spending money at restaurants and delivery

I’m not going to go into how much healthier home-cooked meals are than restaurants, but I will talk about how much cheaper it is to eat at home.

The average person gets into the habit of eating out without considering how much they could be saving if they ate at home.By choosing to eat out or order delivery, you will pay at least three times the price compared to cooking meals at home.

Learn to cook

Learning to cook is a valuable skill that can help you save money.

Eating out or ordering delivery is not only expensive but also a waste of money. By preparing meals at home, you can significantly reduce your expenses. Cooking can also be a fun and rewarding hobby. You don’t need to be a world-class chef to save money; simple recipes can go a long way. Start by mastering a few meals you enjoy and can easily prepare at home. Consider how many different types of meals you eat in a week, and try to learn how to cook them. Most people eat the same things repeatedly, so learning to cook those dishes can be a great way to save money. As time passes, you can expand your repertoire of recipes and try new dishes. There is a wealth of information available on the internet and YouTube to help you learn and improve your cooking skills.

Resist sales

Indeed, sales are often seen as a way to save money, but it’s important to approach them with caution.

While it can be tempting to buy items on sale, it’s important to ask yourself if you need them. If it’s something you usually buy, then it is worth taking advantage of the sale. However, if it’s something you don’t need or wouldn’t have bought otherwise, it’s better to resist the urge to purchase.

Sometimes, people buy more than planned because they see sale items and then continue shopping. It’s important to stick to your shopping list and only buy what you truly need.

While the savings from individual sale items may seem small, they can add up over time. Every little bit counts when it comes to saving money.

By being mindful of your spending and resisting unnecessary purchases, you can start saving money and building a stronger financial foundation.

Swear off debt

Debt can have a negative impact on your financial well-being, so it’s important to try to avoid it whenever possible.

Debt limits your available funds each month, as you have to allocate a portion of your income toward debt payments. This means you have less money to spend on other essential expenses or savings.

Additionally, debt often comes with interest, which means you pay more than the original amount borrowed. This can be a significant waste of money in the long run.

By avoiding debt, you can free up more of your income to save, invest, or spend on things that truly matter to you. It allows you to have more control over your financial situation.

While it may not always be possible to avoid debt altogether, especially if you’re working on improving your finances, it’s essential to strive towards minimizing it. Building an emergency fund and saving for purchases in advance can help reduce your reliance on debt.

If you find yourself in debt, it’s essential to become debt-free.

Start by creating a budget and cutting back on unnecessary expenses. This will help you free up more money to pay off your debts.

Consider using the debt snowball or debt avalanche method to prioritize your debts and pay them off systematically. This involves focusing on one debt at a time while making minimum payments on the others.

It may take time and effort, but with persistence and discipline, you can work towards becoming debt-free and improving your financial situation.

Delay self-gratification

Delaying self-gratification can be a powerful tool in improving your financial situation.

It’s natural to want to indulge in immediate pleasures and desires, but sometimes it’s better to delay gratification for a bigger purpose. By resisting the urge to make impulsive purchases, you can save money for more essential things in the long run.

Before purchasing, consider whether you genuinely need it or if it’s just a momentary desire. By prioritizing your long-term goals and financial stability, you can make more informed decisions about allocating your money.

How to stop overspending

Overpending can harm your financial health and hinder your ability to save and achieve your goals.

When you overspend, you’re wasting money that could have been put towards more meaningful purposes. By being mindful of your spending habits, you can avoid unnecessary expenses and save more money.

It’s important to recognize the value of saving even small amounts. While some may argue that saving a few dollars here and there doesn’t make a significant difference, these small amounts can add up over time and contribute to your overall financial well-being.

It’s essential to strike a balance between enjoying your hard-earned money and saving for the future.

It’s important to acknowledge that you deserve to enjoy your money and treat yourself occasionally. However, it’s equally important to prioritize saving for a robust emergency fund and retirement.

When indulging in splurges or discretionary expenses, do so with care and consider finding ways to save money simultaneously. Look for discounts, compare prices, or find alternative ways to enjoy similar experiences at a lower cost.

By finding a balance between enjoying the present and planning for the future, you can ensure that you’re making progress toward your financial goals while still allowing yourself to enjoy the fruits of your labor.

It’s great that you have a plan in place to save money and still allow yourself to splurge. Finding a balance between saving and enjoying money is key to maintaining a healthy financial lifestyle.

When you spend less than you planned, it’s a smart move to allocate that extra money towards both savings and your splurge fund. By dividing it equally, you can prioritize saving for the future and treating yourself in the present.

For example, if you planned to spend $100 on a pair of shoes but only spent $80, you have $20 left over. Allocating $10 to savings and $10 to your splurge fund allows you to build up your savings while still enjoying a small reward.

Saving a little bit daily by making small changes in your spending habits can add up over time. Skipping that daily cup of coffee or being mindful of your expenses when eating out can lead to significant savings in the long run.

By implementing this strategy, you can increase your savings while still allowing yourself to enjoy occasional splurges. It’s all about finding a balance that works for you and aligns with your financial goals.

Proactive strategy to stop wasting money

Knowing your why is essential in motivating yourself to stop wasting money.

Take the time to understand why you want to stop wasting money. It could be to save for vacations, have more disposable income, or achieve financial security. Knowing your why will help you stay focused and committed to your goal.

Setting goals that align with your why can provide a clear direction for your saving efforts.

Identify specific goals you want to achieve, such as saving for a particular item or event. This will give you a tangible target to work towards and help you stay motivated.

Remember, every time you spend money, you can accelerate your savings by saving a little each time. Look for ways to cut costs or find more affordable alternatives without compromising quality or your needs.

Be cautious of upselling tactics. Only give in to unnecessary purchases or upgrades if they align with your goals or provide significant value.

Creating and following a budget is crucial in managing your finances effectively.

Regularly review your budget and actively look for areas where you can save money. This could involve cutting back on discretionary expenses, finding cheaper alternatives, or negotiating better deals on essential expenses.

Just because you have allocated a specific dollar amount to a category in your budget doesn’t mean you need to spend it all. Be mindful of your spending and consider saving any remaining funds in that category instead.

Making a shopping list can be a helpful tool in managing your spending and avoiding unnecessary purchases.

It’s important to be self-disciplined and stick to your shopping list. If you struggle with impulse purchases, consider adding those items to your budget. This way, you can plan for them and decide whether they align with your financial goals.

Accuracy and awareness of your spending habits are crucial when managing your money effectively. By being mindful of your purchases and the money you’re saving for specific goals, you can make better choices and resist unnecessary spending.

Sometimes, simply thinking about the money you’re saving for a splurge or a specific goal can help you talk yourself out of unnecessary purchases. Remember what you’re working towards and how each purchase impacts your progress.

Resisting temptation is key to avoiding unnecessary spending and staying on track with your financial goals.

One way to resist temptation is to avoid putting yourself in situations or environments that may lead to impulsive spending. If some specific places or events trigger your spending habits, consider finding alternatives or adjusting your routines to minimize exposure.

Identify your weaknesses when it comes to spending and take proactive measures to overcome them. For example, if all-you-can-eat buffets tempt you to overspend and overeat, consciously avoid them and opt for more cost-effective and healthier alternatives.

Plan and ensure you’re not hungry or in a rush when you go shopping or attend events where spending may be involved. Eating before you go or bringing your snacks or lunch can help you resist the temptation to make unnecessary purchases.

Learning to say no to yourself and practicing self-control is crucial in managing your spending habits. Remind yourself of your financial goals and the bigger picture, and make conscious choices that align with your priorities.

Tracking your spending is a powerful tool in managing your finances effectively.

By keeping track of your expenses, you become more aware of how much money you have to spend. This awareness helps you make informed decisions and reduces the likelihood of overspending.

When making purchases, it’s important to check your budget or spending limits for the specific category. This allows you to stay within your allocated funds and avoid overspending.

Being mindful of your spending and regularly tracking your expenses helps you avoid wasting money by overspending. It allows you to see how much you have already spent in a particular category and how much is left, providing a clear picture of your financial situation.

Conclusion

In conclusion, adopting proactive strategies to stop wasting money is essential for improving your financial well-being. By resisting sales, swearing off debt, delaying self-gratification, stopping overspending, and implementing other effective techniques, you can make significant progress toward your financial goals.

Remember to know your why and set goals that align with it. Create and follow a budget, make a shopping list, resist temptation, and track your spending. These actions will help you make informed and intentional decisions about your money, ultimately leading to increased savings and financial stability.

By taking control of your finances and making conscious choices, you can avoid wasting money and achieve a healthier financial future.