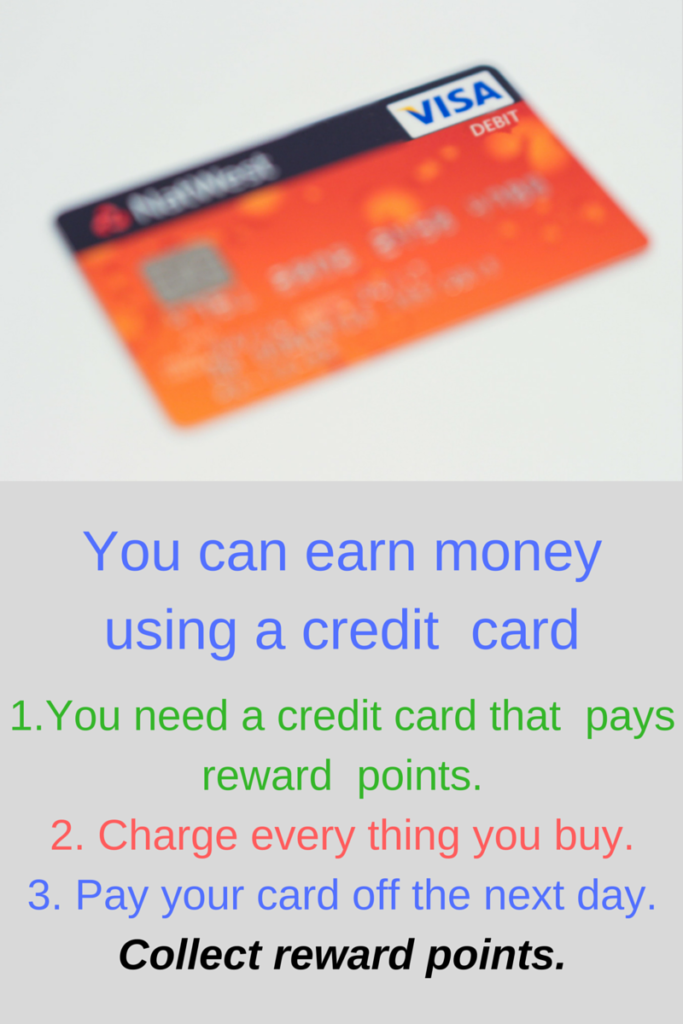

How To Make Money With Credit Cards

It almost seems to be too good to be true. You can make money using your credit card!

Warning

A word of caution before I go any farther: Many people get in trouble using credit cards. They don’t understand the impact of interest or the long term effect of what could turn into another monthly bill on their disposable income. If you choose to use this strategy, it is important imperative you use it correctly or you will find yourself losing—instead of making—money. The point in this is to make money using your rewards credit card.

How to make money with your credit card

To implement this plan you will need a credit card that pays points. Most credit cards paying reward points do so by refunding between 1% & 2% of qualified purchases. Mine pays 1.5% on all transactions. In order to get terms best suited to your circumstances, it’s a good idea to do some research before applying for any credit card: Not all credit cards are created equal.

Note: If you already have a credit card that you want to use to make money, it’s important that you owe nothing on it. You do not want the card you use for this plan to carry a balance due. The interest you will pay for carrying a balance will be greater than any money you would earn.

Essentially, this plan employs a cash-in-hand policy. You are going to use your credit card to charge items for which you already have the funds and could pay for at the time of purchase. Then, you will pay off those purchases—before interest charges have time to accrue, but with the reward points (this means money) already accredited to you.

Planning And Discipline Are The Keys To Making This Work

Planning and discipline are the keys to making this work. Plan your purchases in advance: Know exactly what you are going to charge and how much you are going to spend. Discipline is required to avoid charging items for which you do not have ready funds. Don’t cheat yourself: Make your purchases as if you were going to pay with cash from your pocket.

Go shopping. Or, pay bills. Keep in mind that these are to be planned transactions. You are going to charge no more than an amount equivalent to what you would be able and willing to pay out of your available cash. That given, use your credit card for everything you can. Then, when you get home (or more practically, once a week) pay it off. Yes, it is that simple.

I use my card to pay for fuel, groceries, entertainment, some recurring bills, etc. Now, look at the numbers: I make about $500-worth of charges a week; that’s $26,000 a year. My credit card pays me 1.5%. So, in a year’s time I make about $390. That’s considerably more than half a week’s regular expenses, and I think that’s pretty sweet.

I’ve said some research needs to be done to find the card with terms best suited for you. I picked my card for that reason. Mine works for me. But, there is one provision I keep in mind: I can’t make a payment if I have a payment pending; it takes about 2 days for my payments to post. That means I schedule the use of my credit card. I plan my spending campaign from Saturday morning thru Friday. I make it a point to pay off my weekly charges every Friday evening. By doing this there will be no pending payment transactions when I pay again on the following Friday.

The above is just an issue I deal with. Everyone needs to know and be comfortable with the terms of their own card. There are other issues. For example: What is the dollar limit on charges? And, how do pending payments (payments made, but not yet posted) affect your prerogative to make transactions? I think the almost universal question would be: When and how do I get paid? You can probably guess the answer: It varies from company to company. So, research will give you your answer. Some of the payment procedures I’ve come across are automatic credit to the card when a certain dollar amount is reached, automatic credit to the card on a weekly/monthly/quarterly basis, a check to the cardholder, a “savings” account with funds to be issued at the cardholder’s request… I’m sure there are others. The point is to find a card that works for you.

I feel the need to emphasize (again) that all charges I make on my credit card are planned and could be cash or debit transactions. I will not carry a negative balance on this card. The companies issuing these reward points cards are banking on the cardholder carrying a balance. If you do carry a balance, the interest rate they charge will, certainly, be much higher than the 1% to 2% reward points they pay. By paying off your balance—weekly—you win on two levels: You don’t pay to use someone else’s money: You get paid for using your own.