Why is A Spending Journal Important

A spending journal is an essential tool for managing personal finances effectively. It serves multiple purposes that contribute to financial health and discipline. With a spending journal, it can be easier for someone to accurately estimate his or her expenses and make informed decisions about how to save money. However, despite it being a powerful tool for managing finances, many people still think of a spending journal as a nuisance and not necessary. The frequent complaint whenever someone attempts to do it is that it’s time-consuming. Or that it is restrictive as it requires consistent effort and reduces financial flexibility. Some individuals perceive it as low or no value, which is invalid.

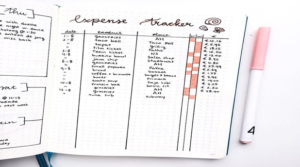

A spending journal is more important than you think. It will help you make a better budget, save money, and reach your goals. Additionally, by creating a spending journal, an individual can track his spending, providing a detailed account of where his money goes.

Why is a spending journal important to make a budget

Spending journals are essential for making a budget because they provide a clear and accurate picture of your financial habits and help you track your expenses. Using a spending journal to make a budget is an excellent strategy for gaining control over your finances. This information is crucial for creating an effective financial plan as it allows you to allocate your income towards different categories and prioritize your expenses accordingly. Here are a few key reasons why keeping a spending journal is crucial:

Visibility into Spending Habits

A spending journal provides a clear, comprehensive view of where your money is going. This awareness is critical as it allows you to identify patterns and pinpoint areas where you might overspend, enhancing your financial choices. With detailed insights from your spending journal, you can make informed decisions. Likewise, it helps you allocate your funds more effectively, and you can prioritize essential expenses, cutting back on non-essential spending.

One of the reasons keeping a spending journal is essential is goal setting. With a spending journal, you can track your spending, allowing you to set realistic financial goals. Whether you’re saving for a down payment on a home, retiring, taking that dream vacation, or anything else, understanding your actual spending can help you set more accurate and achievable budgeting goals.

When factoring in accountability, keeping a spending journal holds you accountable for every dollar you spend. This accountability can motivate you to stick to your budget and make more mindful spending choices. Similarly, a spending journal is a foundational tool for financial stress reduction. Knowing exactly where your money is going can significantly reduce financial stress. It provides a sense of control and empowerment because you actively manage your money rather than letting it manage you. By possessing it, you’re less likely to encounter surprises and more likely to have a buffer for unexpected expenses.

Over time, the data collected in your spending journal can reveal opportunities for savings, like spotting a redundant subscription or identifying less expensive alternatives for regular purchases. By meticulously recording all expenses, a spending journal increases awareness of where your money is going. This heightened awareness is often the first step towards changing spending behaviors, as it allows you to identify and evaluate each expense. Moreover, a spending journal is a fundamental tool for creating a budget that reflects their lifestyle and financial goals. By having a clear picture of your past and current spending through your spending journal, you can make informed decisions about how to allocate your funds in the future, ensuring that your budget is both realistic and achievable. A spending journal helps manage current expenses and paves the way for a more secure financial future.

A spending journal after the budget is built

Using a spending journal to balance a budget is an effective method for managing your finances. It involves regularly recording all your expenditures, which helps you understand your spending behavior. It adjusts your budget accordingly. It also provides a detailed account of where your money goes. Here’s how you can use a spending journal to balance your budget:

The first step towards better managing your finances is tracking every expense. Start by recording every single purchase and financial transaction. This includes everything from major bills, such as rent and utilities, to minor purchases like a coffee on your way to work. By recording all expenses, no matter how small, you can get a clear picture of your spending habits. Remember, the goal is to capture a complete picture of where your money is going and for what.

The next thing you have to do is to categorize expenses. Categorizing expenses is helpful when managing your finances and creating a budget. It allows you to understand where your money is being spent and helps you make informed decisions about your spending habits. In doing so, organize your expenses into categories such as groceries, entertainment, utilities, and dining out. This segmentation makes it easier to identify areas where you might be overspending and save money by determining where you can allocate more funds.

Another critical factor one must learn when having a spending journal is analyzing spending patterns. You might discover recurring expenses you hadn’t noticed before or realize you’re spending more in specific categories than you thought. This awareness can be eye-opening and is critical for making informed decisions about your budget. To analyze your spending patterns, you can review your spending journal to identify patterns at the end of each month.

Furthermore, adjusting budget categories to fit your specific needs and financial goals is essential in creating a budget that works for you. Based on your spending analysis, make the necessary adjustments to your budget. If you consistently overspending in one area, analyze your spending journal. Review and adjust your budget categories to align with your changing financial circumstances and goals. Life changes, such as a new job, a pay raise, or a significant expense, may require you to adjust your budget categories. Ask yourself, did you allocate enough money to that category? If not, maybe you should be more mindful of your spending as you could use the extra money in a different area. Also, if you are underspending in a category, it is crucial to find out why. This is because if you consistently underspend in a particular category, you can reallocate those funds to areas that require more financial attention. This ensures that your budget reflects your priorities and helps you maximize your available resources.

Setting spending limits is also helpful in managing your finances and ensuring you stay within your budget. Based on your budget and priorities, set specific spending limits for each category or subcategory. Consider factors such as your income, financial obligations, and savings goals. Be realistic and ensure that the limits you set are attainable and align with your financial situation. For categories where you tend to overspend, look for cheaper alternatives.

Continuously monitor your spending and update your journal daily. Updating your budget daily helps keep your budget balanced. Ultimately, the key is to find a balance that allows you to stay on top of your budget and make informed financial decisions. Reinforce good spending habits and financial discipline. Consistently and regularly review your journal, regardless of the specific frequency of updating your budget.

Lastly, reflect on your financial goals. Regularly revisit your financial goals, such as saving for a vacation, paying off debt, or building an emergency fund. Use insights from your spending journal to adjust your savings strategies and make your goals more attainable. If your current plan or methods are not yielding the desired results, consider changing your approach. Explore alternative methods or seek guidance from financial experts or resources to help you navigate obstacles and progress toward your goals.

Conclusion

To sum it all up, a spending journal is vital to personal finance management. It provides clarity and insight into your spending habits and empowers you to take control of your financial future through informed budgeting, saving, and spending decisions. It is a useful reference tool for future financial planning and allows you to reflect on your past spending habits or make informed decisions about your financial future. These reasons then conclude why spending journals are important.