No Spend Days Or Weeks

Are you familiar with the No Spend Days (or Week) concept? The idea is to spend no money during a specified period of time. Most people who write

about the No Spend Plan claim to save money.

There doesn’t seem to be a set of rules for implementing a No Spend Plan. Instead, everyone develops their own parameters. I’ve read posts promoting (1) spend no money, (2) spend no money, except on fuel, (3) allow for food and fuel, and (4) don’t spend any money unnecessarily. (That last one gives me a chuckle. It brings to mind Monopoly’s “Get Out of Jail Free” card.) And, the duration is arbitrary. Everybody gets to decide how and how long they’ll operate in their No Spend Period.

While the arbitrary nature of this plan may not necessarily be bad, you know that I promote the idea of living according to a budget made up of funded categories. In my budget plan each of those categories requires a definition of its scope. Those funds are based on positive (in the sense of real) numbers—dedicated divisions of a whole income based on definite life (or lifestyle) needs. It seems to me that a No Spend Plan is the exact opposite. You start with nothing and add in funds as need occurs. (And, you can believe me, without a plan—a budget—unexpected “needs” tend to occur with great frequency.)

There are certain things required in order to live—food, housing, and a whole lot more. When I talk to (or read the account of) someone who has experimented with a No Spend Period, what I hear them say is “I spent no money today, or last week.” That is an accomplishment. But, if it seemed profitable, by the time they finish explaining, I realize what really happened is they prepared ahead of time. They went shopping and stocked up on the consumables they would need for that period of time. Alternatively, they deferred the expenses until later. My point is they did spend money—an amount close to the same they would spend in that same length of time. It just didn’t exchange hands during the No Spend Period. (That is, if they were not confronted with an unexpected “need.”)

If income, expenses, and savings were averaged over time—say several months—it’s likely they would see that their No Spend Period made very little difference. In that aspect, even a person who is an impulse buyer or someone who doesn’t routinely stick to their budget can “save” money by—occasionally—not giving into habit. But, people tend to return to their usual behavior patterns. Because those funds were not accumulated as part of a long-term plan, they will eventually fall to a spending whim. Not much is really “saved” by exercising restraint any one time.

The typical person who practices a No Spend Period will also find his “savings” averaged back into his normal spending (and—maybe—savings pattern.) Still, I’m intrigued by the idea of a No Spend Period. I’m all for saving money. I’m just not sure how effective the usual strategies for this plan are.

I’m intrigued by the idea of a No Spend Period

After thinking about it for a while, I came up with my own plan for a No Spend Week. Since I get paid weekly, the idea would be to save an entire paycheck.

Getting ready for a No Spend Week would take some preparation—in other words, time (and money). I live on a budget of regularly funded categories (which includes savings). It’s my paycheck that provides the funds. So, in order to really “save” a whole paycheck, I’d need some extra money prior to the No Spend Week to cover those contributions. (I’ll share some my ideas on extra money shortly.) Along with covering the obligations to my budget, I’d also want to be sure I had sufficiently stocked my pantry, fueled up, paid any bills that were coming due that week, and also arranged my social schedule to avoid a cash output.

I’ve already said it’s hard to find a No Spend Plan that isn’t paid in advance or by deferment. I’d choose to pay in advance.

Ok. Like most people, my paycheck is automatically deposited to my checking account. So, after my finances were arranged for the No Spend Week, instead of divvying it into categories, I’d transfer it to my long-term savings, live the week conservatively, and when the next paycheck was deposited, I’d resume “business as usual.”

To me, a No Spend Period seems like a lot of work with no great yield. I prefer the consistency of a budget. But, regardless your savings plan, contributing extra money to it is worthwhile. (I said I’d get back to this.) I’ve written an article “extra-money”. It addresses the use of funds leftover at the end of a pay period. I wrote this article because so many people are robbing Peter to pay Paul. Nobody will ever get ahead doing that.

At the end of any pay period,

you should have money left over

Using my plan, that’s very feasible. You will have money left over, because you will be looking for ways to make the funds in each category of your (realistic) budget go even farther.

For example: I know I need $50 a week for groceries. I can always get what I need for $50. Often, I can get what I need for less than $50—if I use coupons. So, I use coupons and other in-store discounts to lower my grocery bill. I have money left over, and I save it.

The same is true when I buy fuel. Based on consumption history, I have a set amount of money I use to purchase gasoline on a weekly basis. But, I don’t necessarily have to spend all of it. I try to buy gas when it’s cheapest, and save any leftover funds. (By the way, if you read my articles, you’ll see that while I’m conservative with my funds, I’m not miserly.)

I’m sure you’ve already realized that, individually, none is these savings are large… Given time, all the small savings you make will add up to a lot.

If you save $2 a day for a year how much money will you have?

$2 is not much money???

—-Note—-

Here’s something I think I should address before I go any further: A budget is a financial guide. Sometimes changes are needed. But… if you make a change to your budget, it needs to be because there has been a (semi)permanent change in your finances or lifestyle. While a budget is not a static policy, it’s not meant to be flexible to the point of ineffectiveness.

Soon, I’ll be making a change to my budget. The last time I purchased tires for my car, I started a fund for the next set. I don’t need new tires yet, but I’ll have the money for them in a few weeks. At that time the category in my budget for tires will be fully funded. When this point is reached, I will stop adding money to it and begin adding that amount into my savings. After I buy a new set of tires, I’ll reopen the category in preparation for the next set. There’s one caveat. Until I need to buy tires, I will stay informed as to how much I’ll need to spend—and keep the tire fund current.)

—-END OF NOTE—-

As I said earlier, I live by a budget of funded categories. This means I save for everything. I know that sometime in the future I will need a new(er) car, a computer, a vacation, a trip to the dentist, and, and, and… I set aside a little bit each week in each of these categories. I save the money to avoid debt. I hate debt. So, yes, I save for what I need—the car, the tires, vacation, and, and, and. I only access and apply the funds to the need for which they were put aside. When I need to make the purchase, I have the money, and I don’t need credit.

I’ve found the best only way to save money is to set it aside in a savings account and use a spread sheet to track the status of the various categories.

My method is fairly simple:

After my weekly pay is automatically deposited into my checking account, I figure the total amount of money I need to cover contributions to the categories that require long-term savings. (Funds I need to live on for the week stay in my checking account.) Then, I update the numbers in my Excel spreadsheet to reflect the allocations. I do this to know exactly how much money I have available for various purposes (categories). Should I need to apply funds, I make a withdrawal from my savings account and update the spreadsheet. Keeping the spreadsheet current is imperative. It’s my means of knowing the funding status of each category and my overall financial condition.

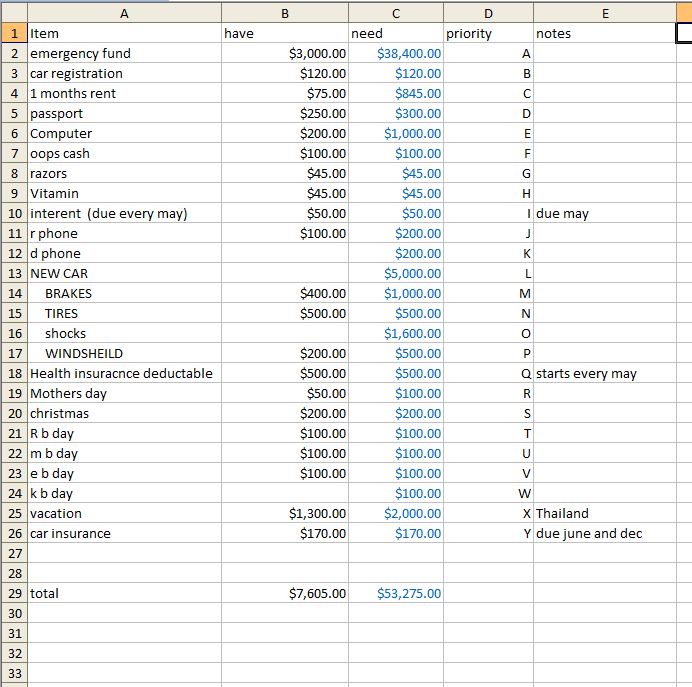

Here is a representation typical of my Excel spreadsheet entries:

Explanation:

Read the chart from left to right. Each entry in the first column on the left designates a category and the weekly contribution assigned to it.

Across the top of the spreadsheet I have vertical columns titled “Have,” “Need,” “Short,” and “Priority.”

The “Have” column is a number that shows how much money I (currently) have dedicated to any particular category.

The “Need” column shows the total amount I need to fully fund each category

The Priority column is an “A thru Z” rating with “A” being most important. When I first started funding, rating was very necessary. Back then, with a much smaller paycheck, I sometimes had to fund categories in rotation rather than every week, but due to urgency, there were always some that took precedence.

If you’re familiar with formulas in Excel, you know you can change a numerical entry and associated sums will self-correct. If you change the figure in any particular column, it will update the category, and you will know how close you are to having that category fully funded.

When a category is fully funded

You’ve budgeted and saved for something. You’ve got the money you need to make the purchase or payment. (In my case, it would be a set of tires.) But, you don’t need to use those funds just yet… When a category is fully funded, you have choices. The money usually designated for that fund could be reassigned to another specific category, it could be transferred to long-term savings, or if you’re planning a No Spend Period, it could be distributed among your categories as “prepayments” against the paycheck you intend to save. At times I’ve used it for a treat—perhaps a movie. This extra money can be used any way you wish. (And that presents a challenge—to choose wisely.)

You may be thinking, “How do you handle emergencies?” One of the categories in my budget is an emergency account. Not long ago I had to get the breaks replaced on my car on my car. This was not a planned event, but I was prepared.

Working money

Not only does my paycheck fund the various categories in my budget, it has to cover my weekly living expenses. I touched on this earlier when I said my weekly grocery allotment was $50. This is working money, and this is one place I can find extra money.

As with funds from a fully funded category, I can use this extra money as I choose. I might put a week’s extra money into a category that was lacking. I might put it into savings. I might spend it. And should I decide to do a No Spend Period, I could use it to cover the obligations of the paycheck I plan to save.

The following are some ways I manufacture extra money.

Fuel Allowance: I’ve already explained how I use the fluctuation in gas prices to cut fuel costs. In addition, I’ll sometimes walk to the store, the movies, etc. I save fuel and, therefore, money (not so many fill ups). For that same reason, I never idle my car. If I stop at a store, I turn the car off. Cutting fuel consumption gives me extra money.

Groceries: When I shop, I (usually) try to find the least expensive version of the product I want to buy. However, there are some things on which I just can’t compromise quality (toilet paper). And that’s ok; comparison shopping has proven that cheaper versions of many other items are very good. Sales, coupons and other discounts help with leaving me a decent amount of extra money at the end of most weeks.

Taking care of the “foodie” in me: If you read my posts, you know I allow myself an occasional meal out. When I eat out, I drink water instead of coke or coffee and pocket the price difference. Often, I do the same with the cost of an appetizer or desert. Also, you may qualify for the discounts many restaurants offer. (I’m veteran and a senior citizen.) And, yes, I count all those savings as extra money.

Power Bill: You should know about how much you spend on power during each season. Much of that cost is for heating and air conditioning. Setting my thermostat a couple of degrees higher in summer and lower in winter usually yields some extra money. Also, I turn off lights I’m not using and run full loads in the washer, dryer, and dishwasher. That cuts down on the number of loads I do and equals extra money.

Really, it’s not hard to find a number of ways that each yield a little extra money. (Essentially, you are lowering your cost of living.) Add all those amounts together, and the total can be significant.

Also, if we really want to, most of us can find ways to earn extra money.

There is one more topic I want to (briefly) address: Debt

Debt repayment is expensive. The cost is huge: We spend so much money in interest. If you are in debt, you have no extra money. One sure way to lower your cost of living is to become debt free.

Conclusion:

No spend days or weeks are becoming a popular savings event. I’m not sure they are as effective as many believe. All the usual bills and needs for a living still exist, and the standard methods to cover them are to prepay or defer payments. If money from a paycheck is used for either practice most of the so-called “savings” are negated.

I do think that—with a tweak—a prepayment plan could have some possibility. I surely can’t get out of paying my usual costs for living. And, why would I want to compromise one or more paychecks preparing or repairing for a saving period that at its best will have minimum yield? To make my prepayment plan work, I need extra money.

I’ve written about extra money before: Ways to bolster your income, and stretch your paycheck. I’ve included some of those suggestions in this article. There’s no reason not to use the same ideas to fund a No Spend Period. If I’m going to have a No Spend Week (or any variable thereof), I want to keep my paycheck—all of it. I can do that, if I finance a No Spend Period with extra money.

Never miss another post follow me on Facebook