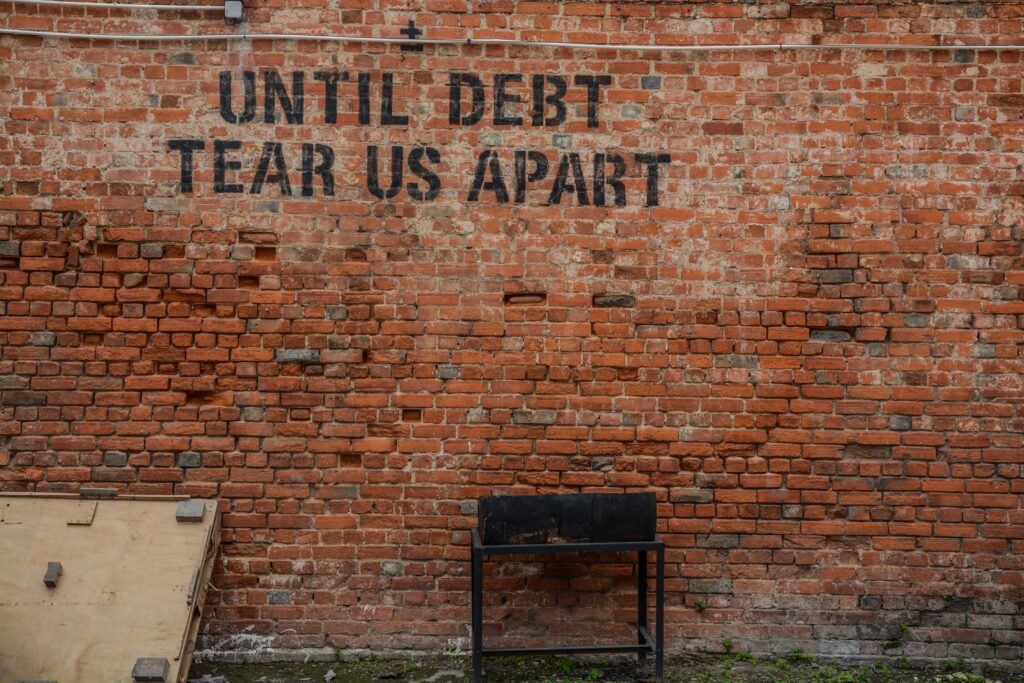

Debt Free

Achieving a state of being debt-free can have several positive outcomes:

Financial Freedom Achieved: Becoming debt-free means you no longer owe money to creditors or lenders. This can provide a sense of financial freedom as you have more control over your income and can allocate it towards your goals and priorities rather than paying off debts. You can build wealth, save for the future, invest, or pursue other financial endeavors.

Stress Relieved: Debt can be a significant source of Stress and anxiety for many people. The burden of monthly payments, high-interest rates, and the constant pressure to meet financial obligations can be overwhelming. By becoming debt-free, you can experience a significant reduction in stress levels, as you no longer have to worry about debt collectors, missed payments, or the negative impacts debt can have on your credit score.

Increased Disposable Income: When you no longer make monthly debt payments, you will have more money available at the end of each month. This additional disposable income can be used for various purposes, such as saving for emergencies, investing, pursuing personal interests or hobbies, traveling, or improving your quality of life. Having more money at your disposal provides greater financial flexibility and allows you to achieve your financial goals more quickly.

It’s important to note that becoming debt-free requires careful financial planning, budgeting, and disciplined spending habits. It may involve making sacrifices, adjusting your lifestyle, and implementing effective debt repayment strategies. Additionally, seeking professional financial advice or assistance can be beneficial in managing your finances effectively and achieving your goal of becoming debt-free.

How to save money as a single mother, how to save money can be challenging but it’s important to make emergency saving a priority to your financial well-being. Start by creating a budget to track your income and expenses, identifying areas where you can reduce unnecessary spending. Make saving an essential part of your budget by setting aside a specific monthly amount for emergency savings. Consider automating your savings by setting up automatic transfers from your paycheck or checking account to a separate savings account. Prioritize your expenses for you and your children while minimizing non-essential expenditures. Look for opportunities to save on everyday expenses, such as meal planning, shopping for discounts, or utilizing community resources for childcare and support. Remember, even small savings can add up over time and provide you with a financial safety net for unexpected expenses.

How To Become Debt Free:

Create a Budget: Start by assessing your income and expenses to create a realistic budget. Allocate enough funds for necessary expenses while setting aside a portion for debt repayment.

Cut Unnecessary Expenses: Review your spending habits and identify areas where you can cut back. Reduce discretionary expenses such as dining out, entertainment, or luxury items. Redirect those savings towards your debt payments.

Increase Income: Explore ways to increase your income, such as taking on a side job, freelancing, or asking for a raise at your current job. The extra income can be used to accelerate debt repayment.

Prioritize Debt Payments: List your debts and prioritize them based on interest rates or balances. Focus on paying off high-interest debts first while making minimum payments on other debts. Once one debt is paid off, redirect the funds toward the next.

Consider Consolidation or Negotiation Options: Explore debt consolidation options such as balance transfers or personal loans with lower interest rates. Negotiate with creditors to lower interest rates, settle for a reduced amount, or establish a more manageable payment plan.

Cash Flow and Savings to Fall Back On:

Maintain Healthy Cash Flow: Regularly monitor your income and expenses to ensure positive cash flow. Adjust your budget as needed to avoid overspending and maintain a surplus that can be used for savings and emergencies.

Build Sufficient Savings: Make saving a priority by setting aside a portion of your income each month. Aim to build an emergency fund covering at least three to six months’ living expenses. Savings provide a reliable financial safety net in case of unexpected expenses or income disruptions.

Tracking Every Dollar Earned And Spent:

Track Income and Expenses: Keep a detailed record of every dollar earned and spent. Use personal finance software, apps, or spreadsheets to accurately track and categorize your income and expenses.

Financial Inflows and Outflows: By tracking your finances, you gain a comprehensive understanding of how money flows in and out of your accounts. This knowledge helps you identify areas where you can save, cut back, or allocate more funds towards debt repayment.

Effective Money Management: Regularly reviewing your income and expenses lets you make informed decisions about your financial priorities. It helps you stay accountable, adjust your budget, and ensure you are on track to becoming debt-free while building a stronger financial foundation.

Prioritizing Savings and trading luxuries for future needs and wants

Making conscious choices to forego luxuries for needs and wants tomorrow: Prioritizing savings means being mindful of your spending habits and making intentional decisions to limit your indulgence in luxuries. It involves distinguishing between what you truly need and what you merely want and being willing to forgo immediate gratification in favor of long-term financial stability.

Prioritizing long-term financial security: Saving money is not just about accumulating wealth for the sake of it. It’s about ensuring a secure financial future. Prioritizing long-term financial security involves setting goals, creating a budget, and allocating some of your income toward savings and investments. It may also include making wise decisions such as contributing to retirement accounts, building an emergency fund, and considering insurance options to protect yourself and your assets.

Self-Reflection

Debt-free empowers you: Being free from debt can have a significant positive impact on your life. It gives you a sense of empowerment and control over your finances. Debt freedom means allocating your income towards your goals rather than paying off debts and interest. It allows you to choose based on what you truly want and need rather than being constrained by financial obligations.

Relieved financial Stress: Debt and financial obligations can cause significant Stress and anxiety. When you prioritize saving and minimize your reliance on credit and loans, you reduce the financial burden and alleviate Stress. Having savings provides a safety net and peace of mind, knowing you have a cushion to fall back on in emergencies or unexpected expenses.

Allowed for savings: By prioritizing savings over indulging in luxuries, you create the opportunity to build a financial safety net for the future. Saving money enables you to have funds available for emergencies, major life events, or long-term goals such as buying a house, starting a business, or retiring comfortably. It provides financial flexibility and the ability to pursue your dreams and aspirations.

Fostered financial independence: Prioritizing savings and trading luxuries for future needs and wants is a step towards achieving financial independence. Financial independence means having enough resources and assets to support your desired lifestyle without relying on others or being limited by financial constraints. By saving and investing wisely, you can build wealth, create passive income streams, and gain the freedom to make choices based on your values and goals rather than financial limitations.

Reward System

Reward yourself but not too much: While prioritizing savings and trading luxuries for future needs and wants, it’s important to incorporate a reward system. Celebrate your progress and achievements along the way. However, it’s crucial to strike a balance and avoid excessive indulgence that could hinder your debt-free journey.

Celebration: When you reach milestones in your financial journey, take the time to celebrate your accomplishments. Recognize your hard work and sacrifices to prioritize savings and become debt-free. Celebrating your successes can motivate you to continue and reinforce positive financial habits.

Freedom to pursue dreams: Prioritizing savings and becoming debt-free grants you the freedom to pursue your goals and aspirations. By eliminating debt, you free up resources that can be redirected towards the things that truly matter to you. Whether it’s starting a business, traveling, furthering your education, or supporting a cause you believe in, being debt-free opens up a world of possibilities.

And a brighter future: Prioritizing savings and trading luxuries for future needs and wants sets the stage for a brighter future. Focusing on long-term financial security creates a solid foundation for yourself and your loved ones. Being debt-free empowers you to navigate life’s uncertainties confidently and provides stability and peace of mind.

Conclusion

Focus on debt-free: Prioritizing savings and trading luxuries for future needs and wants is crucial to achieving financial freedom. By consciously choosing to be debt-free, you can overcome financial Stress, build savings, foster independence, and create opportunities for a brighter future. Keep your focus on becoming debt-free, and the rewards of financial stability and freedom will follow.

By prioritizing savings and making conscious choices to forgo luxuries today while focusing on long-term financial security, you can achieve the freedom and flexibility to pursue your dreams and create a brighter future. So, stay committed to becoming debt-free and enjoy the rewards that come with it.