Keeping a spending journal

Keeping a spending journal involves more than simply jotting down numbers and expenses. It is a dynamic, running record of your financial transactions and decisions. By documenting your spending regularly, you create a comprehensive picture of your financial habits and patterns over time.

Will clarify where you spend your money. It shows you your spending habits

Maintaining a spending journal helps clarify your financial situation by revealing exactly where your money goes. By categorizing and tracking your expenditures, you gain insight into your spending habits, enabling you to identify trends and patterns that may not have been apparent otherwise. This heightened awareness allows you to make more informed decisions about your finances.

One of the key benefits of keeping a spending journal is pinpointing areas of unnecessary or excessive spending. This newfound awareness empowers you to identify potential waste and redirect those funds toward the things that truly matter to you, such as savings, investments, or personal goals. By actively managing your spending, you can align your financial resources with your values and priorities.

Contrary to what some believe, maintaining a spending journal can be manageable. With the availability of digital tools and apps, recording your expenses and income can be a quick and straightforward process. By dedicating just a few minutes daily to updating your spending journal, you can gain valuable insights into your financial behavior without becoming burdensome.

Ultimately, the benefits of keeping a spending journal are indeed overwhelming. From gaining a clearer understanding of your spending patterns to identifying opportunities for improvement, the insights provided by a spending journal can profoundly impact your financial well-being. By leveraging this tool effectively, you can take greater control of your finances, reduce waste, and work towards achieving your financial goals.

How to stop living paycheck to paycheck, individuals must address the problems associated with this cycle by understanding the importance of a budget. =Problems of living paycheck to paycheck= are financial stress, limited savings, and the inability to handle unexpected expenses, creating a cycle that perpetuates financial instability. By recognizing the =importance of a budget=

In managing income and expenses, individuals can gain control over their financial situation, allocate funds strategically to cover necessities, build an emergency fund, and work toward breaking free from the paycheck-to-paycheck cycle.

What is a spending journal?

A spending journal, also known as an expense tracker, is a record-keeping tool that allows individuals to monitor and analyze their daily expenditures. Individuals create a comprehensive log of their spending habits by documenting each expense, providing valuable insight into their financial behaviors and patterns over time.

All financial transactions should be recorded. Whether cash, checks, debit cards, or credit cards should be annotated.

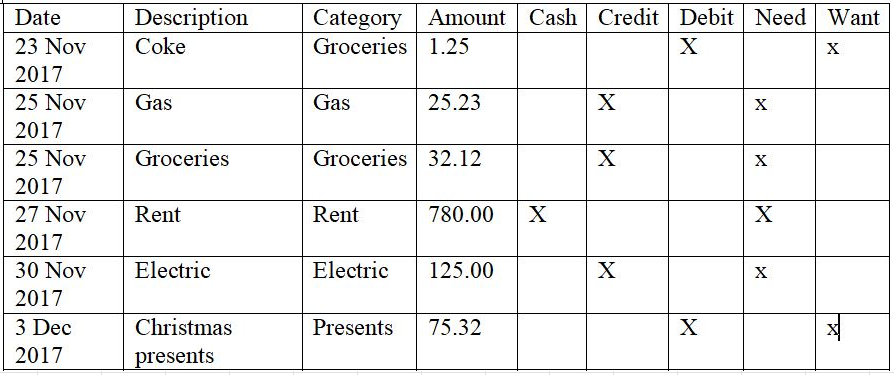

In a spending journal, it’s essential to include key details such as the amount spent, a description of the item or expense, the date of the transaction, and the category from which the money was drawn. Categorizing expenses (e.g., groceries, utilities, entertainment) enables individuals to understand their spending patterns and identify areas for adjustments. By meticulously recording these details, individuals can understand their financial activities, facilitating informed decision-making and pursuing financial goals.

At the end of each month, you must thoroughly analyze your spending by comparing it to the budget you’ve set. This side-by-side comparison allows you to assess how closely your expenditures align with your planned expenses, providing valuable insights into areas where adjustments may be necessary.

During the analysis, it’s crucial to identify any instances of overspending within specific categories. By pinpointing areas where expenditures exceeded the budgeted amounts, you can clearly understand potential financial pitfalls and take proactive measures to reallocate resources appropriately in the future.

Look for waste. Spending that isn’t essential brings you joy or closer to your goals; this is a waste. Save the money you would usually waste

Another important aspect of analyzing your spending is to identify instances of waste. By scrutinizing your expenses, you can distinguish between essential spending that aligns with your values and goals and non-essential expenditures that add little value to your life. By recognizing and reducing such waste, you can redirect those funds toward more meaningful purposes, such as savings, investments, or experiences that truly enrich your life.

Finally, assessing how well you adhered to your budget is important. Reflecting on your spending patterns about your budget enables you to gauge your financial discipline and identify areas for improvement, ultimately reinforcing the importance of actively using your budget as a guiding tool for financial decision-making.

It is essential to recognize that a budget holds only inherent value if it is actively utilized as a framework for managing your finances. More than merely creating a budget is required; it must be regularly referenced and adjusted based on your spending habits and financial goals to be effective.

Living in alignment with a budget is key to achieving financial stability and pursuing your long-term objectives. By integrating your budget into your daily life and consistently analyzing your spending against it, you can make informed financial decisions, prioritize your resources, and work toward a more secure financial future.

How do you make a spending journal?

Creating a spending journal is a straightforward process that can be tailored to individual preferences. Whether using a traditional pencil and paper format or a digital solution such as a spreadsheet or dedicated budgeting app, the key is to select a method that aligns with your habits and preferences. Both analog and digital formats offer advantages, so choosing the one that suits your lifestyle can make the process more convenient and sustainable.

Make a row for each item with a description of the item, date, and category the money came from. Also notice weather it’s cash, debit card, or credit card.

When constructing your spending journal, it’s essential to establish a clear, structured layout. Each entry should include a row that records necessary details such as the item or expense description, the transaction date, and the specific category from which the money was spent. This systematic approach allows for organized, comprehensive tracking of expenditures, facilitating later analysis and insights into your spending habits.

Why is a spending journal important?

A spending journal is crucial as it enables individuals to monitor their actual spending against their budgeted amounts, clearly indicating whether they are adhering to their financial plan. This monitoring process empowers individuals to make timely adjustments and maintain financial discipline, ultimately contributing to effectively managing their resources.

By meticulously tracking expenses, a spending journal serves as a tool for identifying unnecessary or non-essential spending, commonly called “waste.” Recognizing and minimizing waste allows individuals to reallocate those funds toward more meaningful purposes, such as savings, investments, or experiences that align with their long-term goals.

You may be on budget, but you may be able to lower your cost of living

While individuals may be within their budget, a spending journal facilitates identifying opportunities to reduce the overall cost of living. By scrutinizing expenses, individuals can uncover potential areas for cost savings, allowing them to optimize their financial resources and achieve greater financial stability.

Specifically, a spending journal can shed light on excessive spending, such as high car insurance premiums. By closely examining insurance costs, individuals can explore opportunities to lower their premiums through comparison shopping, adjusting coverage, or seeking discounts, ultimately contributing to overall financial efficiency.

Similarly, the examination of the electric bill within a spending journal can reveal opportunities for energy conservation and potential cost-saving measures. By identifying patterns of excessive energy usage, individuals can take steps to reduce consumption and, in turn, lower their monthly expenses.

For renters, a spending journal can help evaluate the portion of income allocated to rent payments. By assessing rental costs in the context of overall financial health, individuals can consider alternative living arrangements or negotiate with landlords to reduce this significant expense.

Ultimately, a spending journal prompts individuals to scrutinize every expense, regardless of size, fostering a heightened awareness and understanding of their financial habits. This comprehensive examination empowers individuals to make informed decisions and take proactive steps toward financial well-being.

Keeping a spending journal

The ease of maintaining a spending journal is essential to ensure its consistent use. Individuals are less likely to engage in this beneficial practice if the process is overly complicated or time-consuming. Therefore, simplicity and user-friendliness are key considerations when establishing a spending journal routine.

Saving receipts and updating the spending journal at home is a practical approach to tracking expenses. Individuals can ensure accurate and comprehensive documentation of their expenditures by collecting receipts throughout the day and then allocating time to update the spending journal at home.

Alternatively, updating the spending journal in real-time as expenses occur is another effective method. This approach provides:

- Immediate and accurate record-keeping.

- Reducing the likelihood of overlooking or forgetting expenses.

- Enabling individuals to maintain a clear picture of their spending habits.

A dedicated phone app, such as “spending tracker,” offers a convenient and accessible way to maintain a spending journal. With this app readily available on Google Play, individuals can leverage its user-friendly interface and features to streamline the process of tracking expenses, ultimately promoting consistent and effective financial record-keeping.

Benefits of using a spending journal

One of the primary benefits of using a spending journal is the enhanced awareness it provides regarding allocating financial resources. By diligently tracking expenses, individuals gain a comprehensive understanding of their spending habits, allowing for informed decision-making and identifying potential areas for improvement.

You can determine the accuracy of your budget by doing a side-by-side analysis with your spending journal

Regularly comparing your actual spending with your budget through a side-by-side analysis enables you to gauge the effectiveness of your financial plan. This process facilitates adjustments and refinements, ensuring that your budget accurately reflects your financial reality and guiding you toward improved financial management.

You can find where you are spending money that isn’t for essentials, things that don’t bring you joy, things that don’t get you closer to your goals

By maintaining a spending journal, individuals can identify non-essential expenses that do not align with their values, joy, or long-term goals. This heightened awareness allows for recognizing and reducing wasteful spending, redirecting resources toward more meaningful and impactful uses.

Conclusion

The benefits of using a spending journal are multifaceted and substantial. By leveraging this tool, individuals gain valuable insights into their financial behaviors, allowing for a clear understanding of where their money is going. Additionally, comparing actual spending with budgeted amounts facilitates financial accuracy and empowers individuals to make necessary adjustments. Most importantly, a spending journal identifies non-essential expenses, fostering a more purposeful allocation of resources toward endeavors that align with personal values and long-term aspirations. Using a spending journal is a proactive and empowering approach to financial management, facilitating greater control, informed decision-making, and progress toward overarching financial objectives.