WHO IS LIVING PAYCHECK TO PAYCHECK

The question Who is living paycheck to paycheck?

Recent statistics reveal that 63 percent of Americans are in the precarious position of relying on each paycheck to meet their financial obligations. This underscores the widespread challenge many individuals face as they navigate the delicate balance between income and expenses, prompting a closer examination of the factors contributing to this prevalent phenomenon.

Determining the exact number of individuals living the lifestyle of living paycheck to paycheck proves to be challenging, given the intricacies involved in defining and quantifying this financial status. The dynamic nature of personal finances, influenced by diverse income sources, fluctuating living costs, and individual financial management styles, contributes to the complexity of arriving at a precise count. However, a close approximation places the figure at 125 million people, highlighting this financial challenge’s pervasive nature across a broad population.

Living paycheck to paycheck is more than a financial predicament; it embodies a lifestyle characterized by constant financial tension and a perpetual balancing act between income and expenses. This way of life often needs to be noticed or underestimated in its prevalence, emphasizing the need to dive deeper into the nuances of calculating these figures. Recognizing = the problems of living paycheck to paycheck= becomes essential in unraveling the layers of challenges inherent in this lifestyle, urging a thoughtful examination of the factors that perpetuate this cycle.

In the face of these considerations, it’s reassuring to acknowledge that How to stop living paycheck to paycheck is not just a theoretical concept but a tangible pursuit. Realizing that one doesn’t have to be bound by the constraints of living paycheck to paycheck opens avenues for proactive steps and informed decision-making. This awareness empowers individuals to explore solutions to the =problems of living paycheck to paycheck=, ultimately steering them towards a more secure and stable financial future.

Unlock the secrets to financial freedom as we delve into the staggering reality of living paycheck to paycheck.

Who Is Living Paycheck To Paycheck?

A person who is living paycheck to paycheck, once synonymous with the plight of the working poor, has undergone a transformation that includes all income levels. What was once perceived as a struggle unique to a specific socioeconomic group has now become a pervasive challenge affecting individuals across many financial brackets. The evolution of this financial predicament prompts a critical examination of its root causes, inviting us to question the factors contributing to its widespread prevalence.

The shift in perspective raises the crucial question: why has living paycheck to paycheck expanded beyond its traditional association with low-income earners? While reports and discussions often attribute this phenomenon to factors such as inflation and low income, a deeper analysis is necessary to ascertain whether these commonly cited causes truly encapsulate the complexities at play. It beckons us to explore beyond the surface-level explanations and dive into an intricate web of economic dynamics, individual financial choices, and societal structures that may contribute to the enduring challenge of living paycheck to paycheck.

The Stats

Overview of American Financial Behavior

In 2023, 63% of Americans live paycheck to paycheck, affecting about 125 million people across various income levels.

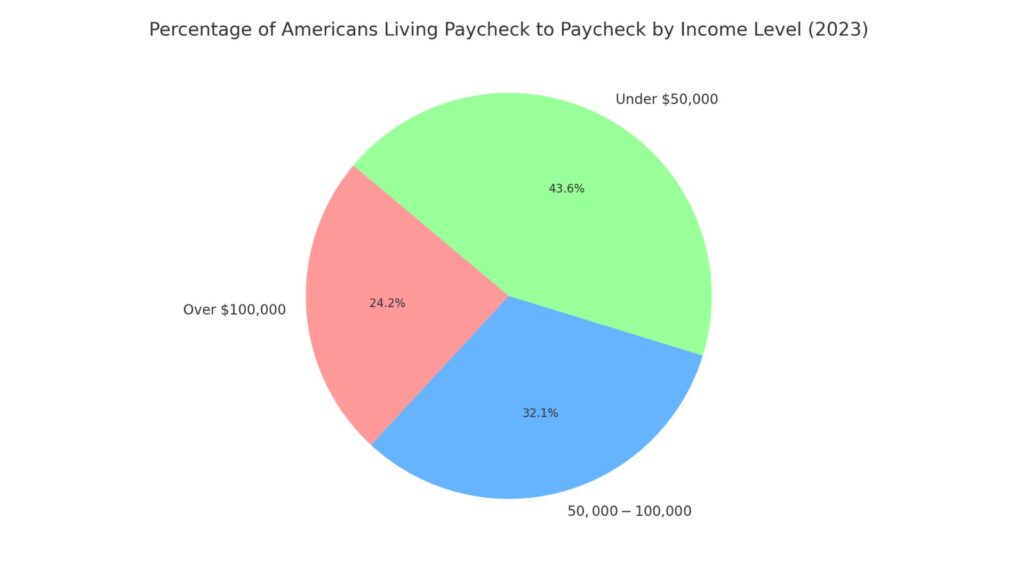

Income Breakdown

The phenomenon spans across income brackets:

- 40% of those earning over $100,000

- 53% with incomes between $50,000 and $100,000

- 72% earning under $50,000

Beyond Necessity: A Choice

For many, this lifestyle is a choice influenced by personal values and spending habits rather than just income constraints.

High-Income Group

Among the high earners, lifestyle inflation plays a key role. Increased earnings often lead to higher spending on non-essentials, compromising savings and investments.

Middle-Income Group

Middle-income earners often juggle current needs and future security, sometimes prioritizing immediate expenses over long-term savings.

Lower-Income Group

While the lower-income group faces more financial challenges, choices around budgeting and spending priorities significantly affect their financial state.

The Role of Financial Decisions

These trends suggest that financial security is not solely about earning more but also about making informed spending and saving decisions.

Take away

The 2023 data highlights the importance of financial literacy and strategic financial planning across all income levels, emphasizing the need to balance present spending and future financial security.

Living Paycheck To Paycheck Is A Decision

Living paycheck to paycheck emerges as more than a mere consequence of financial circumstances; it is, in essence, a decision shaped by individual choices and attitudes toward money. Contrary to the notion that income level alone dictates this predicament, I’ve encountered numerous instances where individuals earning modest incomes successfully avoided the cycle of living paycheck to paycheck. These individuals exemplify the impact of intentional financial choices that transcend income brackets, proving that deciding to live within or beyond one’s means is pivotal.

Some individuals took on part-time jobs and engaged in various gigs to supplement their income. They diversified their income streams from seasonal lawn work and snow removal to selling items on platforms like eBay and undertaking odd jobs. This resourcefulness demonstrated that living paycheck to paycheck can be mitigated through proactive efforts to increase earnings, even without a conventional full-time job. Furthermore, I’ve witnessed cases where individuals actively invested in personal development, acquiring new skills that translated into promotions and higher-paying opportunities. For instance, I know someone who earned an engineering degree online, showcasing how self-improvement can be a catalyst for breaking free from the constraints of paycheck-to-paycheck living.

In all the instances I’m familiar with, a common thread was the disciplined adherence to a budget. These individuals recognized the significance of financial planning and allocation, ensuring their spending aligned with their priorities and goals. One notable example involved a family’s decision to move to a more affordable living arrangement, underscoring the importance of strategic lifestyle choices in achieving financial stability. Living paycheck to paycheck is not a foregone conclusion but a result of choices in managing income, expenses, and overall finances.

We Are Not Trapped In The Paycheck-To-Paycheck Life

The belief that we are inevitably trapped in the paycheck-to-paycheck life is dispelled by the realization that our choices and actions significantly shape our circumstances. The key lies in a willingness to explore alternative paths and make proactive decisions. Are you open to furthering your education, acquiring new skills, or considering a career change? Taking the initiative to attend school or engage in continuous learning can broaden opportunities and pave the way toward a more financially secure future. Similarly, embracing part-time employment or side gigs can supplement income, providing a means to break free from the constraints of living paycheck to paycheck.

Effective money management is another pivotal factor in steering away from the paycheck-to-paycheck life. While working more hours might be unappealing to many, learning to manage existing resources efficiently becomes a worthy endeavor. Contrary to the misconception that financial management is a daunting task, the reality is that it’s not that hard to do. Individuals can exert control over their financial trajectory by creating and adhering to a budget, making informed spending decisions, and saving strategically. This empowerment through financial literacy opens avenues for greater financial stability, challenging the notion that living paycheck to paycheck is an inescapable fate.

Tips For Living Below Your Means

Living below your means is a strategic financial approach that empowers individuals to cultivate financial stability and build a more secure future. Cutting your cost of living is a fundamental step in this endeavor. By scrutinizing and reducing utility expenses, individuals can significantly reduce their overall monthly expenditures. Considerations like consolidating living spaces, opting for a single vehicle, or even relocating to a more affordable residence minimize the financial burden. Embracing a deliberate approach to saving money, whether through budgeting techniques or creating an emergency fund, further reinforces the capacity to live comfortably within one’s means.

Equally vital is the pursuit of avenues to increase income. Returning to school to enhance qualifications and promotability presents a long-term investment in career advancement. Moreover, engaging in odd jobs and side gigs can provide supplementary income streams, allowing for greater financial flexibility. For those seeking entrepreneurial opportunities, starting an Internet business has become an accessible option in the digital age, offering the potential for additional income and financial independence. By combining prudent cost-cutting measures with strategic income growth, individuals can navigate the terrain of living below their means, fostering financial resilience and creating a pathway to a more prosperous and sustainable lifestyle.

It Will Take Planning

Embarking on the journey of living below your means requires meticulous planning and recognizing the inherent diversity among individuals and the unique nature of their financial circumstances. While our solutions may vary, the foundational principles of living below your means prove universally effective. Crafting a personalized plan is paramount, considering each individual’s distinctive needs and priorities in the financial landscape. The key lies in developing a strategy that aligns with your goals, lifestyle, and aspirations. Although there is no one-size-fits-all solution to financial management, the overarching principles of minimizing expenses, maximizing savings, and seeking avenues for income growth serve as a universal guide. It is essential to tailor your plan, incorporating strategies that work with your unique challenges and objectives through cutting unnecessary costs, implementing budgeting techniques, or exploring opportunities for income augmentation. In doing so, you seize control of your financial narrative, forging a path toward a more secure, resilient, and sustainable future.

Conclusion

In conclusion, the deliberate choice to focus on living below your means emerges as a pivotal decision with far-reaching implications for personal finance. This intentional approach to managing expenses fosters a sense of financial stability and acts as a shield against the uncertainties of an ever-changing economic landscape. In a world where the cost of living continues to escalate, adopting a lifestyle characterized by financial prudence becomes an invaluable asset.

Breaking free from the cycle of living paycheck to paycheck requires a shift towards financial mindfulness, leading to transformative changes in managing financial strain. By living below one’s means, individuals break free from the shackles of constant financial pressure, paving the way for a future marked by resilience and sustainable financial well-being.