Increase your income

Ever find yourself trimming your budget to the bare bones, only to discover that the financial puzzle still needs to include a piece?

Despite your best efforts, the numbers don’t add up, and that bank balance seems to be playing hard to get.

Well, my friend, what if the key to your financial puzzle lies not in cutting back further but in exploring ways to increase your income?

Sometimes, the solution is managing what you have and finding creative ways to welcome more into your financial fold.

As a bonus tip, whether you’re saving money as a single mom or part of any other demographic, try to automate your finances to make this process smoother and more efficient.

Are you eager to unlock some valuable insights on supercharging your income? Dive in for a compelling journey ahead!

Increase your income

Increase your income without chaining yourself to perpetual work commitments. The idea is to avoid toiling endlessly but to bridge the gap temporarily.

Consider it a short sprint to get caught up, and you can pivot whenever you please.

However, before immersing yourself in additional tasks, always keep your purpose in sharp focus.

Whether settling bills, building savings, or chasing personal goals, align your efforts with your ‘why.’ Ensuring that each step is goal-oriented is crucial, bringing tangible accomplishments.

As you step into this expedition, remember to work within the contours of your lifestyle.

Not every money-making opportunity fits everyone, so choose ventures that resonate with your values and circumstances.

Your journey to increased income should be as unique as you are.

Go back to school.

In tandem with augmenting your income through strategic efforts, another avenue worth exploring is furthering your education.

The correlation between higher education and increased earning potential is undeniable.

College graduates tend to command higher salaries compared to their non-college-educated counterparts.

To put it in perspective, an individual with a Bachelor’s degree typically earns a whopping 65% more than someone with only a high school diploma.

So, while navigating the terrain of income enhancement, consider the long-term benefits of investing in education.

It’s a means to boost your current earnings and a strategic move to fortify your financial future.

Create a passive income source.

Venturing into passive income offers a strategic avenue for bolstering your financial portfolio.

One option is to invest in dividend stocks or Exchange-Traded Funds (ETFs), allowing your money to work for you while you focus on other pursuits.

Through mechanisms like Real Estate Investment Trusts (REITs), real estate stands as another lucrative avenue, providing a steady income stream.

For those with a flair for creativity, consider launching a blog or a YouTube channel—yes, people genuinely make a living through these platforms.

Peer-to-peer lending platforms like LendingClub or Prosper open up opportunities to lend money online and earn returns.

If you possess artistic talents, licensing your photography or art can turn your passion into a passive income source.

Creating a mobile app adorned with Google ads is another tech-savvy way to generate earnings.

Renting out your property, be it through Airbnb or other platforms, offers an additional income stream.

Lastly, explore the stability of high-yield savings accounts or Certificates of Deposit (CDs) for a secure and passive financial boost.

The beauty of passive income lies in its potential to provide financial returns with less hands-on involvement, affording you the flexibility to diversify and secure your financial future.

Look into your current employee benefits.

Say, when was the last time you took a closer look into your current employee benefits?

Unearth the hidden gems that might be slipping through the cracks—benefits you’re paying for but not fully collecting.

It’s worth assessing whether discontinuing or optimizing these offerings aligns with your current needs.

From wellness programs to professional development opportunities and retirement benefits, untapped resources could be waiting for you to unlock their full potential.

Don’t let these benefits linger in the shadows.

Instead, consider how leveraging them could enhance your financial well-being and overall job satisfaction.

Take a proactive step towards maximizing your compensation and putting more money back into your pocket.

Modify your tax withholdings.

Explore the potential benefits of modifying your tax withholdings as a savvy strategy to optimize your financial situation.

In many cases, you have the opportunity to claim more, ultimately resulting in a reduction of your tax burden.

It’s a tactical approach that allows you to retain more of your hard-earned money throughout the year rather than waiting for a tax refund.

By adjusting your withholdings, you gain more control over your cash flow, enabling you to allocate funds toward your immediate needs, savings, or investments.

It’s a simple yet effective maneuver that ensures you’re not overpaying in taxes and, instead, making the most of your income.

Start a side business.

Embarking on a side business can be a game-changing move in the quest to bolster your income.

Fortunately, there’s a myriad of easily accessible business gigs to consider.

Whether it’s window cleaning to provide a crystal-clear view, car detailing for that showroom shine, lawn care to enhance curb appeal, or house painting to breathe new life into homes—the opportunities are diverse.

Starting a side business injects additional funds into your financial landscape and opens doors to new skills and entrepreneurial experiences.

The beauty lies in the simplicity of these ventures, making it feasible for anyone to dip their toes into the world of entrepreneurship and reap the rewards of their efforts.

Earn a certification

Investing in certifications can be a powerful strategy to increase your value in the job market.

The premise is simple: the more you know, the more valuable you become.

Consider certifications in specialized areas such as heating and air conditioning, welding, or bookkeeping, to name a few.

These certifications enhance your skill set and make you a sought-after professional in your field.

Whether you want to advance in your current job or explore new opportunities, earning a certification demonstrates your commitment to continuous learning and mastery.

It’s a strategic move that boosts your earning potential and opens doors to various career paths.

Ask for a raise or promotion.

If you consistently contribute value to your company, consider asking for that well-deserved raise or promotion.

Articulate why you merit such recognition, highlighting specific accomplishments, contributions, or additional responsibilities you’ve taken on.

It’s crucial to convey why you deserve the raise based on your performance and impact rather than requesting it solely because you desire one.

By presenting a compelling case grounded in your contributions and achievements, you advocate for yourself and showcase your dedication to the organization’s success.

Remember, the key is demonstrating your value proposition and the positive influence you bring.

Open an online store.

Venturing into the world of e-commerce by opening an online store can be a lucrative avenue to augment your income.

Numerous platforms make it accessible for aspiring entrepreneurs to establish their digital storefronts.

Consider platforms like eBay, Shopee, Temu, or Shopify to kickstart your online business journey.

These platforms provide a marketplace for you to showcase and sell your products, reaching a vast audience without needing a physical storefront.

Whether you’re selling handmade crafts, vintage finds, or innovative creations, the online marketplace offers diverse opportunities.

With the potential for global reach, opening an online store allows you to turn your passion into profit and explore the dynamic landscape of digital entrepreneurship.

Drive for a rideshare or delivery company.

Transform your car into a part-time source of income by exploring opportunities with rideshare or delivery companies.

Many individuals successfully earn their living by driving for ride-sharing services, with Uber leading the pack as one of the most popular platforms.

Additionally, Lyft offers a reputable alternative for those looking to leverage their vehicle for profit.

Whether you’re interested in shuttling passengers or delivering goods, these flexible and accessible opportunities can be a game-changer for your financial goals.

By turning your vehicle into a money-making asset, you not only navigate to extra income but also enjoy the flexibility to choose your working hours.

It’s a modern approach to part-time work that aligns with the ever-evolving gig economy.

Sell your gently used items.

Clearing out your clutter can be a surprisingly effective way to boost your income.

Consider parting ways with your gently used items through various channels.

Hosting a yard sale allows you to engage with your local community while giving your items a second life.

If you prefer a more hands-off approach, consignment shops provide a convenient option to sell your items and share the profits.

Embrace the digital age by exploring online platforms where you can reach a broader audience.

Whether through websites like eBay, Craigslist, or dedicated selling apps, your gently used items can find new homes while putting some extra cash in your pocket.

It’s a win-win solution that declutters your space and boosts your budget financially.

Top of Form

Teach a course

Monetize your skills or hobbies by sharing your expertise through teaching a course.

Platforms like YouTube provide an accessible and expansive space for you to impart your knowledge to a global audience.

Whether you’re a master chef, a coding enthusiast, or an art aficionado, there’s an audience eager to learn from you.

Create engaging and informative content, and you will make an impact and generate income through ad revenue, sponsorships, or direct course sales.

Teaching online courses allows you to showcase your passion and opens up new opportunities for personal and financial growth.

If you have a skill worth sharing, consider stepping into the world of online education and turning your expertise into a rewarding source of income.

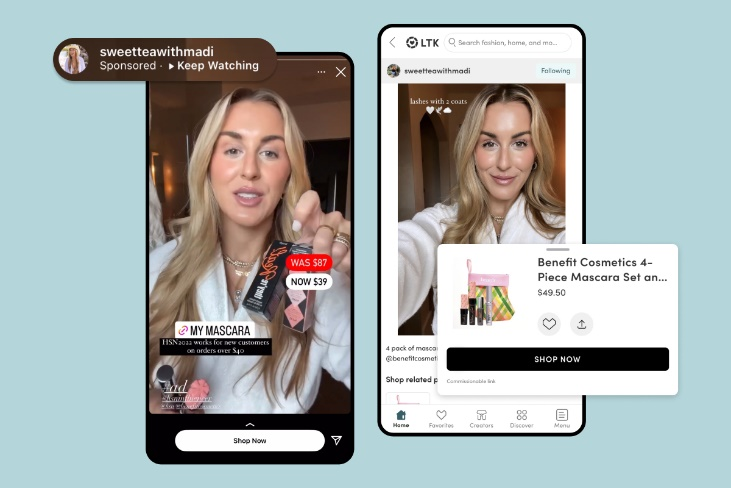

Advertise on social media.

Do you possess a substantial social media following and an engaging theme?

If so, you could be on the path to transforming your online presence into a lucrative opportunity through advertising.

Brands actively seek individuals with a significant following to showcase their products or services.

A focused theme—whether centered around women’s wear, home projects, or fitness—can heighten your appeal to potential advertisers.

If you’ve cultivated a sizable and engaged audience, consider leveraging your influence to generate income through sponsored posts and collaborations.

Explore the exciting possibilities that advertising on social media can bring your way.

Rent out your property

Are you open to the idea of moving to a more affordable location?

Consider maximizing the potential of your property by exploring the option of renting it out.

Consultation with a real estate agent can provide valuable insights into the rental market, helping you determine the optimal rental strategy for your property.

This approach allows you to generate additional income and offers a strategic way to make the most of your real estate assets.

Explore the possibilities, weigh the pros and cons, and embark on a journey that turns your property into a valuable income stream.

Volunteer for extra shifts

Have you ever thought about volunteering for extra shifts or working overtime?

I get it—initially, the idea might not sound too appealing. However, taking on additional hours can be a short-term sacrifice for long-term gain.

Not only does it boost your income, but it also showcases your dedication and work ethic to your employer.

So, while the notion of extra shifts may not be the most enticing, the potential financial rewards and professional recognition might make it worth considering.

Claim business expenses on your taxes

You might be eligible to claim business expenses on your taxes if you have a legitimate part-time business.

Taking advantage of tax deductions can significantly impact your overall financial situation.

Keep meticulous records of your business-related expenses, such as supplies, equipment, or home office expenses.

It’s a proactive way to optimize your tax situation and ensure you take advantage of potential savings.

Exploring these tax benefits could be brilliant for your financial well-being if you’re engaged in a part-time business.

Conclusion

Enhancing your financial well-being doesn’t have to be a daunting task.

The strategies mentioned here highlight the ease with which you can increase your income.

Whether starting a side business, teaching a course, or even claiming business expenses on your taxes, these steps are accessible to everyone.

Embrace the simplicity of these approaches, and you’ll find that even with minor adjustments, you can significantly impact your financial well-being.

By exploring these avenues, you’re not just increasing your income – you’re taking tangible steps toward a more secure and prosperous future.