ADJUST BUDGET REGULARLY

The adage “adjust your budget regularly “is a fundamental principle guiding prudent financial management in personal finance. Life is a journey marked by twists and turns, where unexpected events and transitions inevitably shape our financial landscape. From the joyous arrival of a new family member to the satisfying achievement of paying off a significant debt or the exhilarating boost of a salary raise, life changes necessitate corresponding adjustments to our budgets. Moreover, regularly reviewing and adapting our budgets is a linchpin in maintaining fiscal health and resilience. Through this proactive approach, individuals can effectively navigate the ebb and flow of their financial circumstances, ensuring that their budgets remain aligned with their evolving needs and aspirations.

To enhance budgetary efficacy and fortify financial stability, reduce unnecessary expenses is a strong strategy. This is how to improve your budget. By discerningly scrutinizing spending habits and identifying areas of potential savings, individuals can optimize their budgets to reflect their priorities and financial goals better. The =use of tools and resources =, ranging from budgeting apps and expense trackers to financial planning software, allows individuals to streamline their financial management processes and make informed decisions. Furthermore, the imperative of adjusting one’s budget regularly resonates as a proactive measure, empowering individuals to proactively respond to changes in their financial behaviors and circumstances, thus laying the groundwork for enduring financial well-being.

Adjust Your Budget Regularly

Managing personal finances efficiently entails more than just making a budget; it also entails constantly monitoring and adjusting that budget to guarantee financial goals are reached. Adjusting your budget regularly is an essential component of good money management, as it allows you to stay on track and make informed decisions about your spending and saving habits.

Adjusting your budget regularly will help you budget effectively and stay on pace to reach your goals in several ways. For starters, it allows you to assess your financial situation and make changes to guarantee that your spending corresponds to your income. Regular budget assessments help you identify areas where you may be overspending and adjust your spending habits accordingly.

Second, adjusting your budget enables you to prioritize your goals. As your financial circumstances and goals change over time, reviewing your budget regularly allows you to reassess and reallocate your resources to prioritize what is most important to you. This ensures that your money is spent in a way that aligns with your current priorities.

Furthermore, changing your budget allows you to anticipate and plan for unforeseen expenses or financial issues. Regularly reviewing your budget will enable you to accumulate emergency reserves and designate resources for unanticipated occurrences such as medical expenditures or car repairs. This proactive strategy will allow you to manage your finances better and avoid slipping into debt or financial stress. Regularly reviewing your budget will enable you to make more educated financial decisions, stay on track with your objectives, and adapt to changing circumstances. It is a crucial practice for good money management and long-term financial security.

Why Make Budget Adjustments?

Life is as predictable as the weather. For instance, a promotion, a new family member, or an unexpected repair can shift your financial priorities overnight. However, one must approach life with a similar level of analysis and understanding, accepting that while there may be unexpected storms, there are also periods of calm and sunshine. Just as we prepare for a rainy day with an umbrella or a winter storm with a warm coat, we can also equip ourselves with the tools and knowledge needed to navigate the uncertainties of life with confidence and resilience. Budget reviews also help you adapt to changes by comprehensively understanding your financial situation. They allow you to prioritize your financial goals, make necessary adjustments, and effectively handle unexpected expenses or new financial responsibilities.

Your financial goals today might not be the same six months from now because of meticulous planning, unforeseen circumstances such as market trends, personal life changes, or global events that can significantly impact one’s financial outlook. Therefore, it is crucial to regularly revisit your budget to allow you to adjust your budget and ensure that it remains relevant and achievable. We can make informed decisions and take proactive steps toward reaching our objectives by staying informed about current financial conditions and regularly evaluating our priorities. Whether that’s saving for a home, investing in education, or planning a dream vacation. Periodically revisiting your budget is essential because it enables you to adapt to changing priorities, accommodate lifestyle changes, adjust to income fluctuations, identify areas for improvement, and be prepared for unexpected expenses. It helps you stay proactive and in control of your finances, ensuring that your financial decisions align with your current circumstances and goals.

Find your money leaks.

Imagine a water tank you fill to the brim, ready to be consumed at the end of the month. When that day comes, you check the water tank and find almost no more water left! All that effort to fill it up and waiting for the perfect time to finally use what you worked hard for, just for nothing? That’s why reviewing your budget helps identify areas where you might need to spend more money or utilize resources. Regular adjustments can plug these leaks, optimizing your financial flow by tracking expenses, analyzing budget variances, identifying unnecessary expenses, aligning spending with financial goals, and making regular adjustments. By addressing these areas, you can optimize your financial flow, maximize the value of your resources, and ensure that your money is working towards achieving your financial objectives.

What does it mean to adjust your budget?

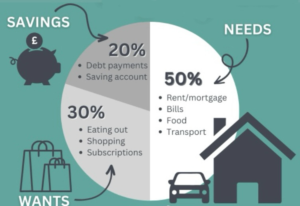

Adjusting your budget means reviewing and modifying your spending plan. How to Adjust Your Budget Effectively: This method necessitates a thorough analysis of your spending habits, revenue sources, and financial objectives. Adjusting your budget will help you live within your means, save for the future, and avoid excessive debt. It could entail reducing non-essential expenses, increasing your income, or restructuring your financial goals to fit your present financial status better.

Furthermore, modifying your budget necessitates continual monitoring and evaluation. It is not a one-time exercise but rather an ongoing endeavor to guarantee that your financial resources are appropriately spent and economically. You may need to track your expenses, save money for emergencies, and reassess your financial goals frequently to keep on track. Adjusting your budget regularly allows you to react to changes in your financial status and make educated decisions, improving your overall financial health.

Set a Regular Review Schedule

Set some time each month to review your finances. And, with a thorough assessment every three to six months, you can keep on top of your finances and achieve your financial goals more easily. By reviewing your income, expenses, and savings each month, you can find areas where you may be overspending or falling short. This approach enables you to make required changes, prioritize where your money should be spent, and guarantee that you live within your means. Furthermore, evaluating your budget every three to six months allows you to assess your progress toward debt repayment, saving for significant expenditures, or creating an emergency fund. Finally, having a clear awareness of your financial condition allows you to make informed decisions about managing your money and attaining long-term financial security. Mark it on your calendar. Schedule a budget review day on your calendar to preserve financial stability and achieve your financial goals. Make it a regular occurrence to guarantee it becomes a habit. By reviewing your finances properly, you can track your spending, find areas where you may be overspending or underspending, and make necessary adjustments to stay on track with your budget. Furthermore, designating a specific date for budget reviews helps build a habit of financial discipline and responsibility, encouraging sound money management practices that contribute to overall financial health and success.

Track your spending religiously. Tracking your expenditures can help you manage your money effectively and progress toward your goals. You can track where each dollar goes using apps or a spreadsheet. Knowing where each dollar goes gives you more control over your cash flow. You’ll also have a solid idea of how much you can save for new financial goals. Understanding your spending patterns is also critical since it allows you to manage your finances better and make informed decisions. Without understanding your spending habits, you will likely continue doing what you have done. That is why it is beneficial to conduct a money personality exam. Like any personality test, it’s useful because it allows you to view the big picture rather than just the details. It makes it easier to set goals. Tracking your spending and knowing your spending patterns is critical for making educated decisions since it raises awareness of specific traps, problems, and vulnerabilities you may be unaware of. It is a simple money move, but the consequences can be far-reaching.

Prioritize flexibility when it comes to budgeting to react to constantly changing company circumstances. Organizations can respond rapidly to unanticipated difficulties or opportunities while maintaining financial stability by allowing funds to be adjusted and reallocated as needed. Flexibility also fosters more efficient resource allocation since you can transfer cash to high-priority projects or initiatives without being restricted by strict budgets. Furthermore, a flexible budgeting strategy promotes organizational innovation and creativity, allowing for exploring new ideas and tactics without concern for financial consequences. One cooperative approach is to create budget categories with considerable wiggle room; this will be useful in financial planning. Individuals can better manage their spending habits and find areas for improvement by categorizing expenses such as food, entertainment, and utilities.

Moreover, having wiggle room within these categories allows for unforeseen spending or price variations without putting the overall budget off track. This flexibility cushions unexpected events while still meeting overall financial objectives. It also fosters prudent financial decision-making by encouraging people to plan for anticipated changes in spending and adapt their budgets accordingly. As we all know, life is unpredictable. Having flexible spending areas can assist in covering unforeseen expenses. Whether natural calamities, home repairs, medical problems, or insurance. Having flexible spending areas allows individuals and organizations to respond rapidly to changing circumstances and seize new opportunities as they occur. If you allocate resources flexibly and agilely, you can respond more effectively to changes in technological developments or unexpected problems.

This approach improves an organization’s capacity to remain competitive and stimulates innovation and creativity by allowing staff to experiment with new ideas without being bound by strict financial limits.

Embrace technology using apps and internet tools to plan the most efficient path. Using financial applications and tools for real-time budget tracking and analysis is vital for making informed decisions about our financial health. They can provide insights and alerts to help you stay on track, allowing you to easily monitor your income, expenses, and overall spending patterns. Using these apps, we can gain invaluable insights into our financial habits, identify areas where we can cut costs or increase savings, and ultimately achieve our long-term financial objectives. Furthermore, real-time budget tracking allows us to be more accountable and proactive in managing our finances, preventing us from overspending or going into debt. With the convenience of these digital tools at our disposal, we can gain control of our finances like never before, paving the road for a safe financial future.

Involve household members. Make budget discussions a family affair. Budget discussions must be a collaborative effort involving all home members to develop financial literacy and prudent money management within the family unit. Families can achieve financial stability and long-term security by openly and transparently discussing their income, costs, savings objectives, and spending habits. Include your children in budget conversations from a young age to instill a sense of duty and accountability while helping them build critical money management skills that will serve them well throughout their lives. This promotes accountability and responsibility in the family unit. Individuals are more likely to appreciate the necessity of sticking to a budget and making educated spending decisions when everyone is involved in financial talks and decision-making. This collaborative approach encourages open communication and ensures that everyone’s goals and wants are addressed. The financial planning process provides a road map for individuals or businesses to attain their financial objectives. It entails reviewing the financial situation, establishing realistic goals, and devising tactics to achieve them. A financial plan that examines income, expenses, assets, and liabilities can assist in finding methods to improve savings, reduce debt, and mitigate risk. It also allows individuals and organizations to make informed decisions about investments, retirement plans, insurance coverage, tax strategies, and estate planning. Following a well-structured financial plan allows one to track progress toward their long-term financial goals better and make modifications to keep on track. Finally, the overarching purpose of financial planning is to ensure a solid financial future and peace of mind during times of uncertainty.

Celebrate success and learn from oversights. Recognizing your achievements enhances your mood and motivation and emphasizes the value of hard work and devotion. Furthermore, rewarding triumphs helps you witness the direct impact of your efforts while encouraging an internal culture of excellence. Conversely, studying oversights gives great learning opportunities for growth and improvement. By analyzing where mistakes were made and understanding how to avoid them in the future, you may improve your skills and prevent similar occurrences from happening again. Accepting successes and failures promotes a balanced approach to professional growth and ensures ongoing progress toward corporate goals. Recognizing and celebrating small accomplishments reinforces positive habits and behavior, which can lead to long-term success. These rewards serve as incentives that help keep you focused on the big picture and provide a sense of accomplishment that boosts morale.

Additionally, rewarding yourself for completing your objectives can minimize fatigue and make budgeting more pleasurable. It also teaches discipline and self-control by allowing you to consume in moderation without jeopardizing your financial security. It is also critical to reflect on areas where you deviated off course to retain financial stability and attain long-term objectives. Examining past mistakes and spotting patterns of overspending or underestimating expenses allows you to improve your budgeting tactics in the future. This technique enables adopting a more accurate and realistic financial plan, resulting in superior decision-making and money management skills.

Furthermore, the review provides valuable lessons for future financial planning, essential for professional development and success. Individuals can recognize triumphs and failures in their financial strategy by reviewing previous actions and outcomes, allowing them to make informed modifications in the future. This reflection process assists individuals in understanding their spending habits, investment decisions, and general financial management strategy, allowing them to create a more effective and sustainable plan for reaching their long-term financial objectives. Furthermore, analyzing previous decisions enables professionals to learn from their mistakes, avoid doing them again in the future, and eventually enhance their financial literacy and decision-making abilities. Finally, by reviewing previous actions and outcomes, individuals can gather essential insights that will serve as a road map for making better financial decisions in the future.

Turning Challenges into Triumphs

Adjusting your budget entails crunching statistics and analyzing financial data, adopting a continual improvement mindset, and recognizing the underlying reasons that drive your spending habits. To make significant changes in your financial habits, you must develop high self-awareness and discipline. Furthermore, changing your budget is not a one-time activity; it involves ongoing monitoring and modifications as variables such as income, expenses, and unexpected charges change. Aside from simply balancing the books, reasonable budget adjustment entails creating realistic financial goals, allocating expenses based on values and priorities, and developing long-term financial plans. Individuals can take more control of their finances and work toward their financial objectives. It is well-accepted that the path to financial freedom is fraught with challenges, learning, and development. It entails taking charge of your finances, creating objectives, and making sound decisions about spending, saving, and investing. It may include changing your spending patterns, choosing needs above wants, and adopting a frugal lifestyle. Learning about personal money, budgeting, and investing is critical for sound financial decisions. As you gain knowledge and experience, you can increase your wealth and strive for financial independence. Remember, this trip will demand patience, discipline, and tenacity. Each review is an opportunity to enhance your financial skills. By examining your budget regularly, you can identify areas where you are overspending or where you can cut costs. It enables you to track your expenses, analyze your spending habits, and make informed decisions about where your money should be spent. This technique allows you to uncover wasteful expenses, find cost-cutting opportunities, and dedicate more dollars to your financial goals, such as debt repayment or future savings. Additionally, monitoring your budget allows you to keep accountable and make necessary modifications to guarantee you are on pace to meet your financial goals. It’s a beneficial practice that can lead to better financial management and, ultimately, help you meet your financial objectives.

CONCLUSION

The importance of budget adjustments

Budget adjustments are essential to financial management in both personal and business contexts. Individuals and organizations can ensure that their financial resources are used effectively and efficiently by making necessary budget adjustments. Budget adjustments are crucial because they allow for better resource allocation, which leads to increased financial stability and growth.

One of the primary reasons for budget changes is that they enable individuals and organizations to adapt to changing conditions. Financial situations can be unpredictable, and unexpected spending or revenue shifts can greatly impact your overall financial health. Individuals and organizations can guarantee they can effectively respond to these developments while mitigating any negative impacts.

Budget modifications can also help individuals and organizations meet their financial goals. Regularly evaluating and amending the budget makes it easier to discover areas where spending might be cut, or resources moved to areas better aligned with strategic priorities. This enables more efficient use of financial resources, eventually leading to better financial outcomes.

How often and when.

Budget adjustments are an important part of financial management for both people and companies. Budgets should be reviewed regularly and adjusted as necessary to guarantee that financial goals are accomplished. This provides greater flexibility and agility in response to changing financial conditions. The frequency of budget modifications will vary based on the conditions. However, it is typically advised that budgets be reviewed and adjusted periodically, if not weekly. This enables a more proactive approach to financial management rather than waiting until a crisis occurs to implement essential changes. Budget adjustments are especially important during periods of economic uncertainty or financial instability. In such cases, it is critical to regularly monitor and alter budgets to ensure financial stability and reduce potential hazards. Individuals and organizations who make frequent budget adjustments are better equipped to detect areas of overspending or underspending and make the required modifications to stay on track toward financial goals. This can help to avoid financial catastrophes and maintain long-term financial health.

External circumstances must also be considered when deciding how frequently and when to make budget modifications. Changes in interest rates, inflation, or market conditions may need more frequent budget revisions to account for these external issues. By staying informed and proactive in making budget adjustments, individuals and organizations can make wise financial decisions by being educated and proactive in making budget adjustments.