Common Household Budgets Pros And Cons

Living by a household budget comes with several pros and cons. Exploring common household budget’s pros and cons can help individuals make informed decisions about their financial management. A budget, on the plus side, offers financial discipline and clarity. It enables individuals or families to keep track of their earnings and expenses to understand how much is spent on what. This can be useful for reaching financial objectives like saving for a home down payment, paying off debt, or creating an emergency fund. Additionally, budgets encourage smart spending by assisting in reducing impulsive purchases and unneeded expenses. They can also be used as a tool for long-term financial planning, enabling people to allocate funds for retirement, education, or other significant life costs.

But sticking to a budget can also provide some difficulties. It requires discipline and some sacrifice are two of its key drawbacks. Reducing discretionary spending to stay within a budget might be challenging for some people. Additionally, keeping track of costs and developing a thorough budget can take a lot of effort, which may put busy people off. Besides, unforeseen expenses can derail even the best-laid plans for a budget, resulting in anxiety and despair. Despite these difficulties, many people find budgeting helpful since it offers advantages, including financial security and the capacity to accomplish long-term goals.

Budgeting, like many other life facets, has advantages and disadvantages. An organized method of managing your finances is provided by budgeting, which is a positive. It offers a clear picture of your earnings and spending, which helps you reach financial objectives and preserve financial stability. You can control your spending and saving habits better if you know where your money goes. Budgeting can also help you spot areas where you could be overspending. It encourages fiscal accountability and responsibility in the end.

Cons, however, should also be taken into account. A time and effort commitment is necessary for both budget creation and adherence. It entails consistent expense tracking, which can be tiresome and time-consuming. Budgeting can sometimes feel constrictive because it frequently requires reducing discretionary expenditure to keep within your means. This can be difficult for people who like the spontaneity of impulsive purchasing. Furthermore, unforeseen costs can still occur and interfere with your spending plans, sometimes frustrating you. The discipline and financial knowledge that budgeting instills in people typically outweigh the negatives, assisting them in the long term in achieving their financial goals.

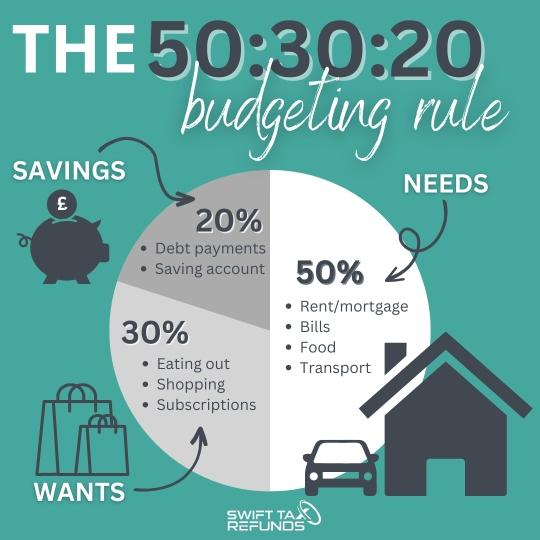

Each of the several home budgeting techniques has its benefits and drawbacks. For instance, a conventional line-item budget provides thorough control over expenditure categories, making it helpful in keeping track of expenses. However, maintaining it can take much work and might feel constricting. In contrast, a zero-based budget allots each dollar to a specific category, assuring practical resource usage but necessitating careful preparation. The simplicity of envelope budgeting is centered on cash, but it may not be for individuals who prefer digital transactions. The 50/30/20 budget allows for flexibility but may not provide for precise control. In the end, the technique of budgeting selected will rely on personal preferences, financial objectives, and the precision and discipline desired in money management.

The success of your budget is determined by the budget you select to use and your compliance with that budget. Planning on how to save money will get you to the door of debt and a stress-free life. One standard budget method that will be tackled is the =50/30/20 budget=, and many more budgeting techniques that will help you get the success you want. And if you’re asking yourself = Why do I need to save money=? Well, this article is for you! So continue your literary journey and unwind in the embrace of words!

Common Household Budgets Pros And Cons

Looking for the right budget isn’t as difficult as you might think.

Common household budgets’ pros and cons can offer insightful information on efficient money management. By keeping track of income and expenses, such budgets help people reach their financial objectives by promoting financial awareness and discipline. One drawback is that they can take much work to maintain and require meticulous spending tracking. Despite the effort, they continue to be crucial for obtaining financial stability and making wise financial decisions.

Finding the right budget for your financial needs and lifestyle might seem daunting, but it’s manageable with some thoughtful consideration. The key is to assess your individual goals, spending habits, and level of discipline. For example, a line-item budget might be suitable if you prefer a structured approach with detailed tracking. Conversely, a percentage-based budget like the 50/30/20 rule might work better if you value flexibility and simplicity. By understanding your financial objectives and personal preferences, you can choose a budgeting method that aligns with your needs and sets you on the path to financial success.

Indeed, choosing a budgeting method hinges on your specific financial goals and motivations. If you’re striving for strict control and precise tracking of expenses, a detailed line-item budget could be ideal. Ultimately, your budgeting choice should align with what you aim to achieve and why, making it a tailored tool to help you reach your unique financial objectives.

With a simple strategy, saving money for a trip may be a gratifying and attainable objective. Setting away a certain sum of money from each paycheck specifically for your vacation fund is useful. By doing this, you develop a dependable saving behavior that supports your desire to travel. This approach promotes fiscal responsibility without requiring radical lifestyle adjustments. It’s similar to gradually erecting a bridge to your ideal location, one paycheck at a time.

The secret to success is a basic budget that is matched to your vacation objective. Make a budget for your vacation by considering things like transport costs, lodging costs, activities costs, and any unforeseen charges. Then, divide this amount into more manageable portions based on how frequently you receive payments. Set aside money from each salary for your vacation fund, treating it as necessary. Using this strategy, you may watch your savings develop slowly and turn your dream vacation into a reality without putting a strain on your budget or sacrificing your daily needs. Ultimately, straightforward budgeting and diligent saving will turn your holiday plans from a wish to a well-realized strategy.

Reducing living expenses often necessitates a more detailed and sophisticated budgeting approach. It begins with tracking your spending meticulously. This means recording every expenditure, from daily coffee runs to monthly utility bills. By understanding where your money is going, you can identify patterns and areas where you might overspend. Numerous budgeting apps and tools can help streamline this process, making it easier to categorize and analyze your expenses.

Once you have a clear picture of your spending habits, it’s time to look for ways to cut expenses. Concentrating on the less expensive items in your budget can yield significant savings over time. Start by identifying discretionary expenses like dining out, entertainment, or subscription services that you can trim or eliminate. Additionally, scrutinize fixed costs such as insurance premiums or utility bills; there may be opportunities to shop around for better deals or negotiate lower rates. Focusing on smaller expenses will create more room for essential needs and savings in your budget.

Ultimately, successfully reducing living expenses requires a combination of diligence, strategic thinking, and a commitment to financial discipline. It’s an ongoing process that involves continual assessment and adjustment. As you identify areas to cut costs and reallocate funds, you’ll free up money for saving and investing and develop a heightened awareness of your financial habits, setting you toward greater financial stability and flexibility.

What Do You Need In A Budget

Before creating a budget, you must understand your financial objectives, income, and outgoings. This entails keeping track of your expenditures, classifying expenses, and separating discretionary wants from basic needs. After gathering this data, weigh the advantages and disadvantages of different budgeting strategies, such as the 50/30/20 rule, zero-based budgeting, and envelope budgeting, to determine which best suits your financial circumstances and objectives. Your perfect budget should balance practicality and effectiveness, assisting you in effectively managing your funds. At the same time, you work toward your financial goals, be they paying off debt, saving for a trip, or accumulating long-term wealth.

Differentiating between goals and wants is fundamental in budgeting. Your goals are financial objectives with a clear purpose, such as saving for retirement, an emergency fund, or a down payment on a home. Conversely, wants are desires that may not contribute directly to your long-term financial well-being, like luxury purchases or extravagant vacations. To budget effectively, it’s essential to prioritize your goals over your wants, allocating resources toward achieving those goals first. As for the time commitment required for budgeting, it varies from person to person. Setting up a budget may take a few hours to gather financial information and select a budgeting method. Afterward, regular monitoring and adjustments may take as little as 15-30 minutes weekly to ensure you stay on track. The key is to find a balance that works for you to manage your finances and work toward your goals consistently.

Budget 50/30/20

- This budget has three categories

- 50 percent of the after-tax income is for your needs.

- Rent/mortgage

- Electricity

- Food

- Minimum payment for your debt (more about debt later)

- Utilities

- Insurances

- Health care

- 30 percent for wants

- Eating out

- Movies

- Vacation

- Tickets to sporting events and concerts, e. I’m sure you get the idea

- 20 percent for saving and debt repayment

- Retirement

- House

- Long term investing

- Debt repayment

- Earlier, I said more about debt repayment later. This is later.

- If you decide to accelerate your debt repayment, the money comes from here.

- You can use some or all the 20 percent.

- It’s not a good idea to not have any savings.

- Many people save half of their 20 percent.

- Pros of the 50/30/20 budget

- PRO: It’s simple

The 50/30/20 budgeting method offers several distinct advantages, making it a popular choice for individuals looking for a straightforward way to manage their finances. Firstly, its simplicity is a key pro. With only three categories to consider—50% for needs, 30% for wants, and 20% for savings and debt repayment—it’s easy to grasp and implement. This simplicity can benefit those new to budgeting or who find complex financial planning overwhelming. With clear-cut categories, you can quickly determine whether you’re overspending on essentials or discretionary items, clearly showing your financial habits.

Another notable advantage is that the 50/30/20 budget encourages you to lower your fixed costs. Since the needs category encompasses essentials like housing, utilities, and groceries, it pushes individuals to seek ways to reduce these fixed expenses. This can lead to cost-cutting strategies such as refinancing mortgages, negotiating utility bills, or finding more budget-friendly housing options. By focusing on this aspect, the budgeting method promotes financial stability. It helps individuals take control of their finances by making necessary adjustments to their spending patterns, ultimately working towards long-term financial goals.

One of the key advantages of the 50/30/20 budget is that it provides a granular insight into where your money is allocated each month. By breaking down the “needs” category into subcategories like groceries, electricity, and car payments, individuals can clearly understand how much they spend on each essential aspect of their lives. This level of detail empowers better financial awareness and decision-making. It enables you to identify areas where you might be overspending or areas where you could potentially cut costs, thus helping you make more informed choices about your finances and allocate your resources more effectively to meet your financial goals.

Housing often represents the single largest expense in a person’s budget, and it’s not uncommon for individuals to exceed the recommended 50 percent allocation for needs, mainly if they live in high-cost areas. However, one of the flexible aspects of the 50/30/20 budgeting method is that it allows for adjustments when necessary. If you overspend in one category, such as housing, you can make temporary shifts by reallocating funds from another category, like wants or savings. This adaptability can help you manage unexpected financial challenges or fluctuations while maintaining a structured approach to your finances.

Most people who use budgets do so with the intention of improving their financial condition, whether that involves eliminating debt, setting aside money for significant expenses, or reaching long-term financial security. It’s critical to acknowledge that your housing expenses are taking up a sizable chunk of your budget and to take aggressive measures to rectify this situation. In theory, staying within your means and spending categories is the best strategy, but doing so may necessitate changing your way of life, such as downsizing your home or looking for more affordable housing options. You can strive toward a better financial future and guarantee that your financial goals are attainable by recognizing the issue early on and being willing to make the required modifications.

The 50/30/20 budgeting method’s focus on fixed costs, such as housing and car payments, is a powerful motivator for individuals striving to live within their budgetary constraints. When someone is genuinely committed to adhering to their budget, they are encouraged to scrutinize their fixed costs closely. If they identify an item, like housing or a car payment, consuming an excessive portion of their budget, they are prompted to consider making substantial changes. This might involve getting a roommate to share housing expenses or selling a too-costly car, thus enabling them to live comfortably within their means.

Taking these steps can have a profound impact on one’s financial health. By reducing fixed costs, individuals not only free up more money to allocate to other budget categories, such as savings or discretionary spending but also minimize financial stress and create a stronger foundation for their financial future. Living within your means, as advocated by the 50/30/20 budget, ultimately fosters financial stability and paves the way for achieving financial goals, whether paying off debt, building an emergency fund, or saving for important milestones like homeownership or retirement.

Also, getting a roommate and selling an expensive car are practical steps to align your lifestyle with your budget and live within your means. These actions reduce the financial burden of housing and transportation and provide an opportunity to allocate those freed-up funds toward savings or debt repayment, fostering greater financial stability and long-term financial success.

If simplicity is your aim, you can allocate predetermined amounts to the three main categories of needs, wants, and savings/debt repayment without meticulously tracking each purchase. On the other hand, for those who prefer a more detailed approach, it’s possible to break down spending further, monitoring how much is spent on specific items within each category. This adaptability ensures that the budget can cater to those seeking a quick and easy financial overview and those who want a more granular understanding of their expenditures, making it accessible to various financial management styles.

The 50/30/20 budgeting method, while straightforward, has its drawbacks. It needs more flexibility to adapt to individual circumstances, as it rigidly allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment, regardless of your unique financial situation. This means it doesn’t address concerns where someone might be burdened by excessive debt or facing substantial medical bills, as these critical factors are not explicitly considered. The focus is solely on dollar amounts, which can lead to financial strain for those with unique financial challenges, potentially making it less effective for managing their specific financial needs and goals.

One significant limitation of the 50/30/20 budgeting method is its need for more emphasis on debt repayment. Debt can be incredibly costly due to interest payments, and this budgeting approach doesn’t prioritize aggressively tackling debt. If you allocate more than 50% of your income to necessary expenses and then add substantial debt payments on top of that, you might exceed the recommended 50% limit for needs. Consequently, you could live on money that could otherwise be directed towards savings or wants, making it challenging to break free from the debt cycle and potentially hindering your long-term financial stability. This budgeting method may not be the most effective choice for individuals with significant debt burdens.

Distinguishing between needs and wants can be challenging, and the example of a car illustrates this complexity well. In many cases, having a car is essential for daily life, especially if it’s the primary means of commuting to work or ensuring the safety and convenience of your family. However, your specific car type can blur the line between needs and wants. While a reliable and trustworthy car is crucial, opting for a more expensive or brand-new vehicle that stretches your budget might be considered a want. In such situations, the budget calls for compromise. An older, less expensive car in good enough shape to meet your needs might be the practical choice, even though there are better or more luxurious options. Buying a better car could be leaning more towards a want unless there are exceptional circumstances, like a long commute through challenging weather conditions, that genuinely require a higher-end vehicle for safety and reliability.

Ultimately, determining whether buying a better car is a need or a want depends on your circumstances and priorities. It’s essential to balance meeting your essential transportation needs and avoiding unnecessary financial strain. Careful consideration of your budget, financial goals, and specific requirements should guide your decision in choosing a car that aligns with your overall financial well-being.

The 50/30/20 budgeting method’s allocation of 30% of your income to wants can be generous, potentially leading to excessive spending on non-essential items. To achieve a more balanced and tailored budget, it’s crucial to consider your individual financial goals and priorities. Adjusting the percentages based on your specific needs, such as increasing the allocation to short- and long-term savings, can be a more prudent approach. This customization allows you to allocate your resources to align better with your financial aspirations, whether reducing the portion allocated to wants or increasing the allocation to savings and investments to secure your financial future more effectively. Finding the right balance within a budgeting framework is key to achieving your unique financial goals and ensuring that your money works for you best.

The 20% savings allocation in the 50/30/20 budget is a guideline, not an inflexible rule. The beauty of budgeting is that it can be customized to suit individual financial goals and circumstances. If someone has more ambitious savings objectives or needs to prioritize debt repayment, they can certainly adjust the percentages accordingly. Budgeting is a personal tool; the key is to make it work for you and your unique financial situation. Whether it means saving more than 20% or reallocating funds to address specific needs or goals, the flexibility to adapt your budget to your preferences is a valuable aspect of financial planning. Ultimately, the goal is financial stability and achieving your financial objectives, and your budget should be a day.

The envelope system is a budgeting method that uses physical envelopes to allocate and manage your money for different categories and subcategories of expenses. Each envelope represents a specific spending category, such as groceries, entertainment, or transportation. Within these envelopes, you set a predetermined amount of cash for each category based on your budget. Once the money in an envelope is spent, you can only spend more in that category during the next budgeting period, typically a month. This system helps you stay disciplined with your spending, prioritize your financial goals, and avoid overspending in any particular area, as it enforces strict limits on discretionary spending.

In the envelope system, you allocate a specific amount of money to each envelope based on your budget and financial priorities before any spending occurs. It’s important to note that not all categories will have the same amount of money in them. This differentiation is essential to reflect the varying importance and size of different expenses. For example, your car payment will likely be larger than your grocery bill because it’s a fixed and substantial monthly obligation. By tailoring the envelope amounts to match the specific financial needs of each category, the system allows you to manage your finances effectively, ensuring that you prioritize important expenses while keeping discretionary spending in check.

In the envelope system, you pay cash for everything, using physical cash from the respective envelopes to cover your expenses. This cash-based approach helps you stay accountable to your budget because once the money in an envelope is gone, you can only spend more in that category during the next budgeting period. It promotes better financial discipline by making you more conscious of your spending, reducing the reliance on credit cards, and preventing overspending since you’re limited to the cash in each envelope.

One of the key pros of using the envelope system is that it necessitates proactive financial planning. When you receive your income, you must allocate it to specific envelopes for various spending categories before purchasing. This deliberate budgeting process forces you to think ahead and make conscious decisions about where your money should go, which can lead to better financial control. Dividing your money into envelopes ensures you have funds set aside for essential expenses and helps prevent impulse spending since you’re limited by the cash available in each envelope. Ultimately, this structured approach promotes responsible money management and can lead to improved savings and reduced financial stress.

Discretionary spending refers to the portion of your budget where you can decide how to allocate your funds. In this category, you can choose what you will and won’t spend your money on, as opposed to mandatory expenses like rent or utilities. This discretionary spending flexibility provides ample opportunities for saving and financial planning. It allows you to prioritize your financial goals, whether building an emergency fund, investing, or treating yourself to occasional luxuries, all while maintaining control over your financial decisions. By exercising prudence and making thoughtful choices within your discretionary spending, you can balance enjoying life’s pleasures and securing your financial future.

Saving becomes easier when you avoid using credit cards because it promotes responsible spending. By relying on cash or debit transactions, you have a more tangible sense of the money leaving your account, making it easier to track expenses and resist impulse purchases. This heightened awareness of your spending habits can help you budget effectively and save more consistently.

Cons Of Using The Envelope System

While effective for managing discretionary spending, the envelope system has some cons when paying bills. Since it typically involves physically allocating cash into envelopes for various spending categories, it makes paying bills more challenging. Most bill payments today are made electronically, either through online banking or automatic deductions, and these methods often require digital transactions rather than physical cash. This means that you might need to visit physical locations, like your bank or biller’s office, to make payments in cash, which can be less convenient and more time-consuming than digital methods. However, some hybrid approaches can be used to mitigate this challenge, like withdrawing money to deposit into a bank account for online bill payments.

Carrying around envelopes of cash as part of the envelope system can pose safety and security concerns. Firstly, having a significant amount of money on hand makes you vulnerable to theft or loss. It’s riskier than carrying a debit or credit card, which can be easily canceled or replaced if lost or stolen. Secondly, if the envelopes containing your budgeted cash are misplaced or stolen, you might lose the money and disrupt your entire budgeting system. This lack of physical security can be a drawback for those who value the safety and convenience offered by digital payment methods or traditional banking, where funds are stored electronically and protected by various security measures.

Dividing your money into envelopes before you start spending, as required by the envelope system, can be time-consuming, particularly if you have numerous envelopes representing different spending categories. It demands careful planning and cash allocation to ensure you have enough for each expense category. This task may become cumbersome, especially for those with busy schedules or those who prefer the convenience of digital transactions, where money is readily available for various purposes without the need for physical division. However, proponents argue that this initial time investment can lead to better financial discipline and awareness, ultimately helping individuals stay on budget and save more effectively.

Running out of money before the end of the month can be a significant problem, especially when it comes to essential expenses like groceries or fuel for your car. These are often recurring, non-negotiable costs that you need to cover to maintain your daily life. Exhausting your budget for these necessities early in the month can lead to financial stress and difficulties meeting other obligations or emergencies that may arise later. It underscores the importance of effective budgeting and the need to prioritize essential expenses to ensure that your financial resources are appropriately allocated throughout the month, reducing the risk of financial difficulties.

Zero Sum

Zero-sum budgeting is where you allocate every dollar of your income to specific categories or expenses, ensuring that your total income equals your total expenses. This approach acknowledges that not all categories will receive the same amount of money because it prioritizes allocating funds according to needs and financial goals. It’s about giving every dollar a job and ensuring that your money works for you most effectively.

When you zero-sum budget, you assess your income and prioritize your expenses accordingly. Categories like housing, utilities, groceries, and debt payments usually receive higher allocations because they are essential for your basic needs and financial obligations. Discretionary spending categories, such as entertainment or dining out, receive smaller allocations based on what’s left after essential expenses are covered. By aligning your budget with your financial priorities and needs, zero-sum budgeting helps you make deliberate and informed decisions about your spending, savings, and financial goals, ensuring that every dollar you earn is put to its best use to achieve your financial objectives.

In zero-sum budgeting, the core principle is that every dollar you earn is assigned a specific purpose or category within your budget. This means you allocate your entire income to various expense categories, savings goals, debt payments, and other financial priorities until you’ve accounted for every dollar. Doing so ensures that you’re making conscious and deliberate choices with your money, preventing any funds from going unaccounted for or being spent frivolously. This meticulous approach to budgeting provides a clear financial roadmap and helps you achieve greater control over your finances, making it a valuable tool for effective money management.

When you have money left over in certain categories at the end of a budgeting cycle in zero-sum budgeting, the recommended practice is to allocate these surplus funds in your next budgeting cycle. By adding these amounts to your next paycheck, you’re starting with a slightly larger pool of funds to distribute among your various categories. This ensures that you continue to give every dollar a purpose and avoid unnecessary accumulation of unallocated funds. It allows flexibility in adapting your budget to changing circumstances or priorities while maintaining the core principle of allocating all your income to manage your finances effectively.

The zero-sum budgeting system offers several advantages, and one of the key benefits is that it makes tracking your spending significantly easier. By assigning specific amounts of money to each category and subcategory, you have a clear, predetermined guideline for your expenses. This ensures that you’re always aware of how much you’ve allocated and how much you have left to spend in each category, which simplifies the tracking process. It promotes a high level of transparency in your financial management, reducing the likelihood of overspending or losing track of your budget. Ultimately, this meticulous approach to budgeting enhances your financial awareness and discipline, helping you achieve your financial goals more effectively.

One of the great strengths of the zero-sum budgeting system is its high customization and flexibility. Your budget can be tailored to meet your specific financial needs and goals. Whether you prefer a straightforward budget with just a few significant categories or a more detailed one with numerous subcategories, zero-sum budgeting accommodates your preferences. Additionally, you can easily add, modify, or delete categories as your financial situation changes. This adaptability makes it a versatile budgeting method that can evolve with your life circumstances, ensuring that your budget remains a valuable tool for managing your finances effectively.

Cons Of Using Zero-Sum Budgeting

One of the drawbacks of using a zero-sum budgeting system is that it can demand a significant time commitment, mainly if your budget is complex or involves numerous categories and subcategories. Creating and maintaining a detailed budget may require more effort than straightforward budgeting methods. Carefully allocating every dollar of your income, tracking expenses, and making adjustments as needed can be time-consuming. This can be a challenge for individuals with busy schedules or those seeking a more streamlined approach to financial management. However, proponents argue that the time invested often outweighs the financial discipline and control gained through zero-sum budgeting.

Zero-sum budgeting may only be suitable for individuals with regular income or expenditures. It relies on a consistent and predictable income stream to effectively allocate funds to various categories. If your income fluctuates significantly from month to month or if you have irregular expenses, such as occasional large medical bills or car repairs, it can be challenging to fit these into a fixed budget without constantly adjusting it. However, for those with stable incomes, like salaried employees, where the paychecks are relatively consistent, zero-sum budgeting can work effectively, providing a structured way to manage their finances and prioritize spending according to their needs and goals.

Predicting and managing variable expenses can be challenging, and zero-sum budgeting can add a layer of complexity to this task. With this budgeting method, you allocate specific dollar amounts to each category and subcategory before you have a precise idea of what those expenses will be, which can be difficult when dealing with fluctuating costs like utility bills or medical expenses. Additionally, because every dollar needs to be accounted for in advance, you may frequently adjust your budget to accommodate unexpected expenses or shift funds from one category to another, which can feel like twice the work compared to a more flexible budgeting approach.

However, it’s worth noting that the meticulous nature of zero-sum budgeting can also help you become more proactive in anticipating and planning for variable expenses. While it may seem like extra effort upfront, it can lead to better financial discipline and a deeper understanding of your spending patterns over time. Plus, it can be particularly effective for smoothing out variable expenses by allowing you to set aside funds during months when costs are lower to cover those months when they are higher. It all comes down to personal preference and how comfortable you are with this level of detail and planning in your budgeting process.

Reverse Budgeting, Also Known As Paying Yourself First

Reverse budgeting, often referred to as “pay yourself first,” is a budgeting approach that prioritizes savings over expenditures. The fundamental principle is to allocate a portion of your income for savings or investments before considering other expenses. Doing this ensures that your financial goals, such as building an emergency fund, saving for retirement, or investing in long-term objectives, take precedence over discretionary spending. This approach encourages disciplined saving habits and helps individuals secure their financial future by making savings a non-negotiable part of their budget, ensuring that money is set aside for their goals before it can be spent elsewhere.

In reverse budgeting, when you receive your paycheck, you proactively allocate a predetermined amount for savings or investments as a top priority. This means that you’re essentially making savings a non-negotiable expense, treating it as an essential “bill” that must be paid before considering any other spending categories. After setting aside this savings amount, you then adjust your expenditures and lifestyle based on what remains in your budget. This approach shifts the focus from spending to saving first, encouraging responsible financial habits and ensuring that you consistently work towards your financial goals by making saving a primary consideration in your budgeting process.

The Pros Of Reverse Budgeting

One of the key advantages of reverse budgeting is its minimal effort requirement. Since you prioritize savings by allocating a predetermined amount first, you don’t need to track every expense or constantly adjust your budget meticulously. This simplicity reduces the administrative burden of budgeting, making it an accessible and sustainable approach for those who prefer a more hands-off financial management style while ensuring that you consistently save towards your financial goals.

Reverse budgeting excels at concentrating on savings by addressing a common issue: the challenge of saving money after paying all of one’s bills. This budgeting method puts saves first, ensuring that before you engage in any discretionary expenditure, you’ve already designated a portion of your income for your financial objectives. By being proactive, you may eliminate the chance of overspending and turn saving into an essential part of your everyday financial activity. It promotes a healthier and more predictable saving pattern that can significantly boost your financial stability and help you achieve your long-term goals by eliminating the desire to spend all your money.

One of the remarkable aspects of reverse budgeting is its adaptability to automation, which makes saving money easier. By setting up automatic transfers from your income to your savings or investment accounts, you ensure that the allocated savings amount is consistently put aside without any manual effort. This simplifies the process and reduces the temptation to spend what you’ve earmarked for savings. It transforms saving from an active, often challenging task into a passive, seamless routine, allowing you to effortlessly build your financial reserves and work towards your goals while minimizing the risk of forgetting or neglecting to save.

The primary drawback of reverse budgeting is its limited focus on expenses. By prioritizing savings first and not actively tracking how you spend your money, you miss valuable insights into your spending habits and financial behaviors. Tracking expenses provides essential data that can inform smarter financial decisions, helping you identify areas where you can cut costs, optimize your budget, and make more informed choices. While reverse budgeting simplifies the savings aspect, it’s still essential to have a comprehensive understanding of your spending patterns to maximize the efficiency of your financial plan. Tracking your expenses can lead to a more holistic approach to managing your money and ultimately help you get more value out of your finances.

The need for more flexibility in reverse budgeting, particularly when prioritizing significant savings, can have downsides. When you allocate a substantial portion of your income to savings as a non-negotiable priority, it might lead to a scarcity of discretionary funds for unexpected expenses or opportunities that arise. This rigid approach can leave you financially strained in the short term, especially if you encounter unexpected medical bills, home repairs, or other urgent financial needs. Additionally, it may limit your ability to take advantage of investment opportunities that require immediate capital or seize spontaneous opportunities for personal enjoyment, like an impromptu vacation or a special treat, as your budget could be more balanced towards savings.

Furthermore, by concentrating too heavily on savings within the reverse budgeting framework, you may miss opportunities for other forms of investment that could yield higher returns or diversify your financial portfolio. While saving is crucial, exploring investment options that align with your financial goals is equally important. Achieving a balanced approach that allows for savings, investments, and enjoying life’s pleasures requires careful consideration and, at times, a degree of flexibility that reverse budgeting may not readily provide, making it essential to assess your specific financial needs and goals when adopting this budgeting method.

The risk of overspending is a notable concern in reverse budgeting, mainly since it doesn’t impose strict limits on individual spending categories. While it prioritizes saving first, it relies on your discipline to manage your remaining funds effectively. Without predefined limits for various expense categories, there’s a higher likelihood of overspending in areas like entertainment, dining out, or shopping. This can lead to budget imbalances and potentially jeopardize your financial goals if not carefully monitored.

Individuals practicing reverse budgeting should still set limits or guidelines for their spending categories to mitigate this risk. While the primary focus is on saving, it’s crucial to establish boundaries to ensure responsible spending within your means. Use historical spending data or benchmarks to set these limits, enabling you to enjoy some discretion while staying on track with your financial objectives. Additionally, ongoing monitoring and periodic adjustments to your budget can help you avoid overspending and adapt to changing financial circumstances, providing a more holistic approach to managing your finances effectively.

Reverse budgeting may need to be better suited for individuals living paycheck to paycheck. The fundamental premise of this budgeting method is to prioritize savings by allocating a portion of your income for future goals before considering other expenses. However, when you’re barely making ends meet and don’t have any discretionary funds, it becomes challenging to allocate money for savings without compromising essential living expenses like rent, groceries, or utilities. In such cases, focusing on covering immediate needs and avoiding debt might be the top priority, making “paying yourself first” less feasible.

Moreover, living paycheck to paycheck often implies limited financial flexibility, and adhering to a strict savings-first approach can exacerbate financial stress. Individuals in this situation must address their immediate financial concerns, create a solid budget that covers essential expenses, and gradually work toward building a financial safety net when their financial situation improves. Prioritizing financial stability and debt reduction should take precedence over aggressive savings to ensure financial well-being and avoid additional financial strain.

Debt repayment is a significant financial priority, especially for individuals burdened with various forms of debt, such as credit card debt, student loans, or personal loans. Getting out of debt often requires a concerted and focused effort, as carrying high-interest debt can be financially debilitating. While saving is essential for financial security, more emphasis on saving at the expense of debt repayment is needed to ensure your progress. High-interest debt can accumulate quickly, making it costlier in the long run. Therefore, balancing saving and debt repayment is crucial, ensuring that you allocate enough resources to tackle your outstanding debts while setting aside some funds for emergencies and future goals. Achieving this equilibrium is key to achieving financial stability and peace of mind.

Reverse budgeting or “pay yourself first” is most effective when you have a regular and predictable income stream. This reliability allows you to confidently allocate a portion of your earnings towards savings or investments, assuring you’ll consistently have the funds available for your financial goals. Having a steady income also simplifies the process of determining the amount you can comfortably allocate for savings, making it a more seamless and sustainable budgeting approach.

Conclusion

Finally, setting a budget is of utmost significance to our financial lives. It acts as a compass to guide us through the murky waters of income and expenses. By carefully managing our finances, we can keep tabs on our spending and ensure our financial objectives are accomplished and ready for unanticipated situations.

Common household budgets’ pros and cons remind us that, despite the time and effort budgeting may demand, the rewards for our financial security and peace of mind far surpass the difficulties. It allows us to make well-informed decisions, set aside money for the future, and finally achieve the financial freedom we strive for.