Cutting cost, not quality of life

In financial wisdom, cutting cost, not quality of life, resonates as a guiding principle, challenging the conventional notion that frugality is synonymous with sacrifice. In pursuing fiscal prosperity, the question arises: Can embracing a frugal lifestyle pave the way to riches? This inquiry underscores the essence of will be frugal make me rich. Contrary to a feeling of deprivation, =frugal living investment= in a sustainable future that not only preserves financial resources but also enriches the tapestry of one’s life. This introduction sets the stage for an engaging exploration of the symbiotic relationship between frugality and wealth, delving into the notion that being frugal is not just a means of cutting costs but a strategic investment in a more fulfilling and prosperous life.

Cutting cost, not quality of life

Achieving financial success hinges on cutting costs rather than quality of life. It’s a nuanced balance that requires careful consideration and strategic choices. By discerning between essential and discretionary expenses, individuals and organizations can reach financial efficiency while preserving a high standard of living. This approach prioritizes long-term prosperity, ensuring that frugality complements, rather than compromises, a fulfilling quality of life.

Financial Assessment

In the pursuit of fiscal prudence, the first step towards achieving a harmonious balance between frugality and financial prosperity involves a comprehensive financial assessment. This pivotal process serves as the bedrock for informed decision-making and strategic planning.

Find areas of overspending: Begin by scrutinizing expenditures with a discerning eye. Pinpointing areas of overspending is a crucial aspect of the assessment, shedding light on potential leaks in the financial ship. A meticulous examination will reveal the culprits hindering your path to financial stability, whether it’s discretionary spending, recurring subscriptions, or impulsive purchases.

Evaluate the current budget and expenses: Take a closer look at your existing budget and day-to-day expenses. Assess whether your financial allocations align with your priorities and long-term goals. This step supplies clarity on your financial standing and serves as a foundation for crafting a more sustainable and effective budget that accommodates your needs while fostering a frugal mindset.

This financial assessment forms the groundwork for the later strategies, ensuring that the pursuit of financial stability is rooted in a deep understanding of your current financial landscape.

Prioritization of Expenses

Once the financial assessment lays bare the landscape of your expenditures, the next crucial step involves meticulously categorizing expenses based on their necessity and importance. This process is a strategic guide for distributing resources more effectively, fostering a balanced and sustainable financial life.

Essential Expenses: The foundation of any well-considered budget lies in prioritizing essential needs. Categorize these expenses to ensure that the core elements of your life are adequately addressed.

Housing: Your home is not just a physical space but the cornerstone of stability. Prioritize mortgage or rent payments to keep a secure and comfortable living environment.

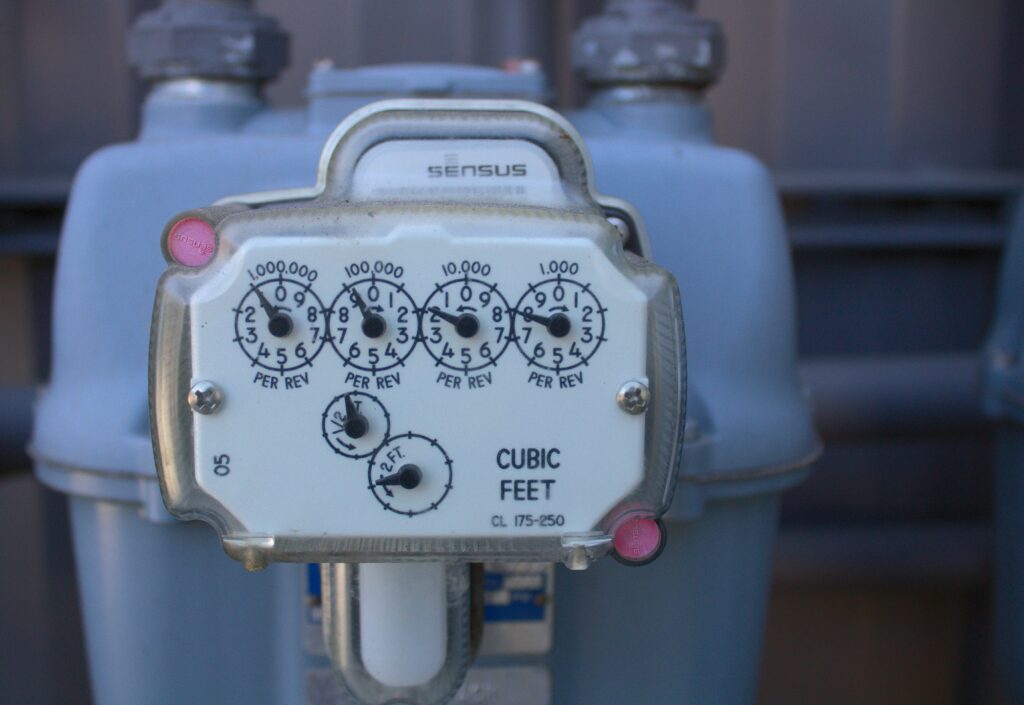

Utilities: Essential services such as electricity, water, and gas are non-negotiable.

Ensuring these essential utilities are covered guarantees a functional and comfortable daily life.

Healthcare: Prioritize health and well-being by distributing resources to healthcare needs. This includes insurance premiums, necessary medications, and regular check-ups.

Non-essential Expenses: While necessary for a well-rounded life, non-essential expenses should be discerned. By categorizing them separately, you gain clarity on where discretionary spending occurs.

Entertainment: While leisure activities are vital for quality of life, evaluating and potentially trimming entertainment expenses ensures a balance between recreation and fiscal responsibility.

Dining Out: Dining out, though enjoyable, can significantly contribute to overspending. Prioritize this as a non-essential expense, allowing for moderation and conscious decision-making.

By strategically categorizing expenses based on their significance, you lay the groundwork for a budget that aligns with your financial goals, emphasizing the importance of cutting costs without compromising the quality of life.

Energy Efficiency Measures

In the pursuit of both environmental sustainability and financial prudence, implementing energy-saving initiatives stands as a critical strategy. By focusing on energy efficiency, not only do you contribute to a greener planet, but you also unlock potential cost savings eventually

Upgrade to energy-efficient appliances: The appliances we use daily can significantly affect both energy consumption and utility bills. Consider investing in energy-efficient alternatives for major appliances such as refrigerators, washing machines, and air conditioning units. While the first cost may be higher, the long-term savings in energy expenses make these upgrades financially astute decisions.

Improve insulation and seal drafts in the home: A well-insulated home is not only comfortable but also cost-effective. Assess the insulation in your residence and find areas where currents are present. Sealing these gaps and improving insulation, particularly in doors and windows, helps keep a consistent internal temperature. This reduces the strain on heating and cooling systems, lowering energy bills.

By adopting these energy efficiency measures, you contribute to a sustainable future and create tangible financial benefits. The constructive interaction between environmental responsibility and financial prudence is evident in these initiatives, reinforcing the overarching theme of cutting costs without compromising the quality of life.

Healthcare Cost Reduction

In the realm of personal and organizational financial strategies, healthcare costs often are a massive part of expenditures. Exploring avenues for cost-effective healthcare is paramount to ensure fiscal prudence without compromising health and well-being.

Explore cost-effective health insurance options: Thoroughly evaluate available health insurance plans. Research and compare options to find cost-effective programs that still supply comprehensive coverage. Consider factors such as premiums, deductibles, and coverage scope to balance affordability and protection against unexpected medical expenses.

Promote preventive healthcare to reduce long-term costs: Emphasizing preventive healthcare measures benefits individuals and contributes to long-term cost reduction. Encourage regular health check-ups, screenings, and a healthy lifestyle to mitigate the risk of chronic illnesses. Preventive measures not only improve overall health but can also lead to significant savings by avoiding expensive medical treatments in the future.

Consider wellness programs for employees: In a workplace setting, implementing wellness programs can effectively reduce healthcare costs. These programs may include fitness initiatives, stress management activities, and health education. A healthier and more engaged workforce will likely experience fewer medical issues, reducing healthcare expenses for employers and employees.

By proactively addressing healthcare costs through strategic measures, individuals and organizations can navigate the complexities of the healthcare landscape while adhering to the overarching principle of cutting costs without sacrificing the quality of life. Prioritizing cost-effective options and preventive care safeguards financial resources and fosters a culture of well-being.

Waste Reduction and Sustainability

As global awareness grows about the environmental impact of consumption, integrating waste reduction and sustainability practices becomes imperative. By adopting eco-friendly initiatives, individuals and organizations contribute to a healthier planet and often discover cost-effective solutions that align with the overarching theme of cutting costs without compromising the quality of life.

Encourage recycling and responsible resource use: Foster a culture of responsible waste management by encouraging recycling practices. Implement clearly labeled recycling bins and educate stakeholders on proper disposal methods. By reducing waste sent to landfills, environmental benefits are realized, and potential cost savings may arise through streamlined waste disposal processes.

Evaluate sustainable alternatives for products and services: Explore sustainable options for the products and services used. Whether opting for reusable materials, sourcing from environmentally conscious suppliers, or choosing energy-efficient options, these choices can reduce waste and often result in long-term cost savings. Sustainable practices align with ethical considerations and position individuals and organizations as responsible stewards of the environment.

By embracing waste reduction and sustainability, the pursuit of financial prudence intertwines with a commitment to environmental well-being. This comprehensive approach aligns with the ethos of responsible living and underscores the potential for sustainable practices to yield both ecological and economic benefits.

Continuous Monitoring and Adaptation

A. Recognizing the dynamic nature of financial landscapes and the evolving needs of individuals or organizations, implementing a cost-cutting strategy requires not just a one-time overhaul but a continuous process of monitoring and adaptation.

Stay informed about industry best practices: Regularly review industry trends and best practices in cost management. The financial landscape is ever-changing, and staying abreast of innovations and strategies within your sector can supply valuable insights. By adopting or adapting industry best practices, you ensure that your cost-cutting plan stays relevant and effective in the face of evolving economic conditions.

Solicit feedback from employees and stakeholders: The perspectives of those directly affected by cost-cutting measures are invaluable. Regularly seek feedback from employees and stakeholders to gauge the practical implications of the strategy. Their insights can unveil areas needing adjustment or supply suggestions for alternative approaches. Fostering open communication channels ensures that the cost-cutting plan stays effective and considerate of the needs and concerns of those involved.

The cost-cutting strategy becomes a flexible and responsive framework by instilling a continuous monitoring and adaptation culture. This approach allows for swift adjustments in response to changing circumstances and reinforces the commitment to cutting costs without compromising the quality of life. In the ever-evolving financial landscape, adaptability is key to ensuring the longevity and effectiveness of cost-saving initiatives.

Conclusion

It is imperative to underscore the significance of prioritizing “cutting cost, not quality of life.” Pursuing financial efficiency should not be synonymous with a diminished standard of living. By carefully managing expenses and making strategic financial decisions, individuals and organizations can achieve a harmonious balance that streamlines costs and enhances overall well-being. Emphasizing the long-term benefits of this balanced economic approach is crucial, as it promotes sustained success and stability. A conscientious effort to trim unnecessary expenditures and prudent investments in areas that contribute positively to quality of life can pave the way for a prosperous future. Striking this delicate equilibrium ensures that financial decisions do not merely focus on short-term gains but contribute to a sustainable and fulfilling lifestyle over time.