Debt-Free

Who doesn’t want to live debt free? For some, that may only be a dream. Others are willing to do what it takes to make it real.

For many people debt is a way of life. They begin their adult lives with the need to pay off student loans. Then, they tack on a car loan, some credit cards payments, and a mortgage. Some people see all this debt as an advantage: They get what they want NOW.

There are several big disadvantages though . . .

- You’ll pay for that immediacy for a very long time.

- You’ll pay a lot—A LOT—of money in interest.

- If you’re late or default on payments, they’ll get larger. It’s also possible you’ll risk losing whatever you purchased and the money you’ve already “invested” in it.

- You jeopardize your future.

Most people are at least somewhat aware of these consequences. They just don’t keep them in perspective. They’re huge. Yeah, the first one is a given: You want something—right now—you can’t fully afford right now, and you’re willing to pledge part of your paycheck to pay it off over time. (This is risky. You’re really trading part of your life.) As for the interest you’ll pay on your various loans, think of it this way: Someone is putting their money (essentially, part of their life) to work for you. And you know the old saying that goes, “Nobody works for free.” Interest is what you pay for the privilege (???) of using someone else’s money. Here’s the kicker: Your interest payments add nothing to the value of the item or service you purchased. To a very large extent, that means interest payments are wasted money. Since I’m a guy who tries to get a good return on the money I spend, that’s an affront to my principles; it’s not frugal.

When you borrow, you’re spending money you don’t have. People tend to “bank” on the idea that they’ll always have enough income to cover living expenses and repayment. Sometimes, life doesn’t deliver on that. Missed payments incur fees and can increase interest rates and minimum payments. Miss enough payments, and some things can be repossessed. Talk about wasted money… Owing money isn’t frugal at all. Money needs to be banked, not “banked on,” before it’s spent.

The above may be bad enough, but I think contemplating all the years of limited spending ability as you pay off the debt over a long period of time is worse. You don’t have the same spending options when someone else has a claim on your paycheck.

Being in debt can cause a lot of problems. Once they’re in debt, most people would prefer to be debt free. The problem is they don’t know how to overcome the challenge.

In this post, I’ll explain how to get out of debt. There are a few tools you’ll need. I’ll go into those, too. I’ll show you how you can live a debt-free lifestyle and give you a list of possible ways to cut expenses and save funds to help accelerate the progress toward your goal of debt-free living.

Lifestyle

Your lifestyle is your mindset in action. How you feel and think about something/anything, what’s important to you, your goals…your lifestyle habits  reflect those opinions and attitudes. How you handle your finances is an aspect of your lifestyle; your actions will be supported by your mindset on money.

reflect those opinions and attitudes. How you handle your finances is an aspect of your lifestyle; your actions will be supported by your mindset on money.

Debt As A Lifestyle

Many times, our indebtedness is a lifestyle choice; we want to do or to have something now even though we can’t afford it. If we look at the way we habitually handle money, there are likely to be indications we’d find debt acceptable (probably inevitable). For instance, do you spend all your money as it comes in? If you do, satisfying not only need, but also wants, is very important to you. Your mindset about money is that it’s important for what it can do for you now. If that’s the case, then it’s reasonable to predict that at some point (a lot more than one) you’ll need or want something that costs more than your cash in hand can cover. You’ll resolve that by going into debt.

Debt Free Is Also A Lifestyle

Do you save money? I mean, do you make it a regular practice (a habit) to put money into a savings account? If you do, preparing for future expense is (probably) very important to you. You may forego a considerable amount of immediate satisfaction to avoid debt, and you’re likely to have a financial plan with a timeline for meeting needs and wants. Your mindset promotes financial soundness

Changing Your Financial Lifestyle

Becoming debt free and staying debt free is a lifestyle choice. If you’re in debt and want to get out of it, you need to change your mindset. Getting out of debt is a process. Whether you have a large or small income, the process of achieving a debt-free lifestyle is essentially the same. The numbers may differ, but the steps are the same.

Being debt free means, of course, paying off your debts. But there’s more to it than that: You need to become money conscious and make your money work to provide for both the present and the future. To really be debt free, you must be able to afford to be debt free. As you pay off your debts, you’ll need to live below your means, avoid wasting money, and save for upcoming events. If you don’t, you’ll either never become debt free or you’ll find a “need” to borrow again sometime in the future. You need to adopt a frugal mindset.

Mindset And Tools

I’ve brought up your mindset several times. A lot of your work towards becoming debt free will be achieved by changing you attitude towards money, but not all the work is mental. There are some practices/habits—call them tools—that can reinforce a frugal mindset and enhance your rate of progress toward attaining your goal of becoming debt free.

Recommended reading How to buy a used car and save a bundle

Your Mindset

As I said above, how you view debt is of great importance. If you see debt as a norm, as OK, you’ll probably find it difficult to become debt free. People don’t tend to do what they think of as wrong. They do what they consider to be right–or at least ok.

Make debt wrong. Don’t think about using debt. Make it not an option. If you want or need something right now don’t borrow money to obtain it. Find another way. It’s amazing how creative we can be if the option of borrowing money isn’t available. Think about this: Borrow the item. Or, find others who desire it and pool your money—share. I know one person who canvases various markets to get “free stuff”. The stuff usually comes under the condition he promote it to people he knows. He becomes a de facto salesman. But hey, he has some cool things.

After you think about it, you may find your need is not as urgent as it first seemed. You may have time to save the money you need and buy it outright. By the way, people who borrow enough money often find that it becomes difficult to get more.

Strange as it seems, you can use your mind as a tool to train itself to think outside the box called “credit.”

According to Market watch, if you have a credit card that has a balance of $2,000 on it and you make minimum payments it will take you 370 months or over 30 year. While paying this credit card off paying the minimum payment you will pay almost $5,000 in interest.

Spending Log

A spending log, sometimes called a spending journal , is a tool you use while on the go.

Using a spending log, you’ll keep track of how much and when you spend money on any and every specific thing. This tool needs to be used early and consistently in as you pursue a debt-free lifestyle. Always and everywhere keep it available. Record expenditures as you make them. Your spending log will help you develop the expense categories that will make up your budget.

That last comment is important. You can try to keep your spending under control from the time you decide to become debt free, but until you really know what your spending money on—and how much your spending—it’s rather like punching at something in the dark. A spending journal can help you decide where you’re wasting money and how to pace your spending.

Here’s a quick example. (It’s certainly not going to be comprehensive): We’ll say you’ve been tracking your expenses for about a month. At the end of that time you go back through your spending log and see that you’ve been to the cinema three times; a cirque du soleil was in town one week, and you attended a performance; your sister came for a weekend visit, so you went to the museum. There a many other entries in your journal, some for groceries, auto expenses, and regular bills, and more. (As I said, this will not be comprehensive.) You also see in the course of thirty days you’ve purchased 20 venti lattes from your favorite coffeeshop. (That’s one a day, on your way to work.) With tax, those cost $4.57 each. (That’s $91.40).

What Does The Above Tell You?

- Entertainment is very important to you. Maybe too important?

- Is almost $100 a month on coffee too much to spend?

Both those things would be considerations as you begin to set up a budget. If these were initial entries in my spending log, I would know I needed an Entertainment category. (Also, I might think about whether I should include lattes in that category. Or should they go in Food? Or in a category of their own?) Also, looking at these particular expenses in light of fixed ones like housing, insurance, and monthly payments, I’d think about how to continue to enjoy them (perhaps at a lesser rate??) in order to have money to apply towards getting out of debt or towards savings.

Initially, a spending log can help you determine what spending categories you need in your budget. After you have a budget your spending log will make it easy to transfer figures into the appropriate categories. This is important. It allows you to see if you are overspending or developing a surfeit in any particular category. (That information can help you make adjustments to your spending habits or your budget.)

Ok. I’m going to address budgets shortly, but I want to finish up on spending logs. I think most people need to track their expenses for about 3 months before they begin to get an accurate idea of where their money goes. That doesn’t mean you wait that long to start compiling a budget. We all have fixed expenses that are repetitive. These may not be very flexible. Start your budget with categories and figures for those. That will help you know how much money you have to work with for other things. Also, you should realize you’ll always need a spending log. Over time your needs will change. That will change your spending patterns. You’ll will need that information to make adjustments to your budget.

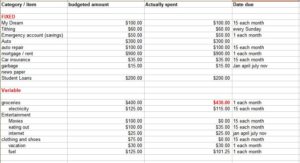

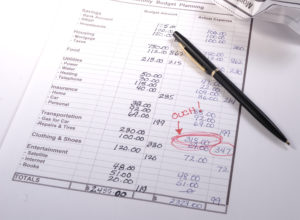

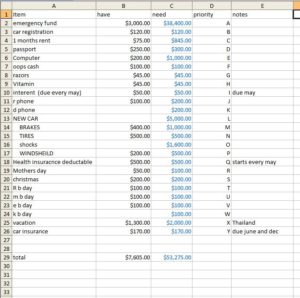

Budget

A budget is a spending plan you track on a spreadsheet. As a tool, a budget can help you make your money do more for you than just disappear as it’s blindly spent “on demand.” Your budget and spending log work together. As you keep your spending log, you’ll begin to see that there are some common categories. Each category will be made up of expenditures, needs (or wants), that you spend money on that you spend money on regularly such as groceries, housing, clothing, entertainment, etc. (There may be quite a few categories.) These categories will comprise your budget. Similar expenditures will need to belong to the same category in both your spending long and your budget.

Once you know what you’re spending your money on you can start analyzing the value of each expenditure. You can decide how much of your income to allocate to any particular category. In order to have adequate funds to live on and pay down debt, you’ll probably need to cut back on or eliminate some expense (like too many lattes).

The idea behind a budget is to plan your spending, to allocate funds to categories in accordance to that plan, and to avoid an outlay of money from any category that exceeds the amount designated to it. A budget is essential to living a debt-free lifestyle.

As you develop your budget, it’s important to be realistic. The funds you allocate to your various categories should be sufficient and not excessive. That means the amount of money you allow is enough for the task but won’t leave much in the category between periods of allocation (and those periods should occur at regular intervals—usually paydays).

Putting a good budget together takes time, maybe several months. That’s because it takes time to recognize spending patterns and break financially wasteful habits. Even then, as I’ve already said, we have to realize that budgets are organic. They have to change as needs change. Here, we have to be careful . . . Budgets are tools, not toys. Changes shouldn’t be capricious or based solely on desire, but as you pay off your debts, you’re going to have more funds you can put to use. I advocate against using these as money to play with. It’s money that can really work for you.

If you think about needs the categories in your budget are based on, you’ll find there are any number to things that could use their own funding. For example, instead of have a general category for all automobile expenses, make some specialized subcategories such as fuel, oil changes, new tires, a new car, etc. These subcategories are called sinking funds. (I’ll talk about sinking funds in the next section.)

Another factor that many of us don’t taking into account when we budget is seasons. Whether they are seasons of life or seasons of the year, there are times we don’t spend as much money on some things as we do at other times. Take Spring and Fall, many of us don’t spend as much in heating/cooling our homes during those seasons as we do in Winter or Summer. During these times we may find the category that covers this expense has some excess funds. When you spend less than what you’ve allocated, you’ve found extra money. Extra money can be used to pay down debt more quickly or (temporarily) assigned to some sinking fund. If you find you have a category in your budget that regularly has a considerable amount of extra money, you should reduce the amount allocate to it and find a more productive place to put it—another category (a debt payment, a sinking fund, an emergence or savings fund???).

For more information read my article how to make a budget and save money.

Sinking Funds

A sinking fund is money set aside for a specific purpose, perhaps a vacation, a new computer, your wedding, or any number of other things. You may not know when the money for these things will be needed, but you’ll have a dollar figure you’re aiming to reach before that time comes. In a broad

Sinking funds is saving money for items and events. It’s almost like have a savings account for everything

sense, every category in your budget could be considered a sinking fund. I mean, you will have assigned a specific amount to money for every recurring bill you pay, but here we’re more concerned with events that will occur in a less regular or in an uncertain timeframe. Sinking funds help keep your budget on track through saving. Rather than impulsively spending any money not designated for immediate or short-term use, give it purpose. Put it into a sinking fund. Sinking funds are a tool that help you prepare for the future.

Over the years, my budget has become increasingly comprised of sinking funds. As an example, I’ll use funds I spend on my car. (You’ve probably noticed I use car examples a lot; with cars there are quite a variety of issues that can be addressed.)

When I began budgeting, I had a category for auto expenses. It was intended to cover everything that had to do with my car. My plan was that fuel, maintenance, repair, insurance, replacement…anything that had to do with the car was to be paid for out of money set aside in that general category. As I became more aware of what my money could do for me, I discovered that knowing how close I was to being able to cover individual expenses would help me better determine the true state of my finances. I started breaking the general auto expense category into sinking funds such as fuel, oil changes, tires, insurance, and replacement… I did this for other categories, too.

The list of sinking funds for any budget category can get as specific as you wish, but in order to build any sinking fund you need to have a good idea about how much money you’ll need to fully fund it and when you’ll need it. (That’s the only way to figure out how much to regularly dedicate to it.) Consider car insurance. I pay my car insurance every six months. Every payday, I add a predetermined amount of money to that sinking fund. When the car insurance is due I have the money to pay it, and I don’t have to worry about having enough money to pay for the fuel I’ll need the week I make the payment.

There is one more thing (and it’s a “no duh”) you need to consider when you use sinking funds. Most of them need to be replenished after you’ve used the money in them. That’s how you will have the cash to cover the cost when the expense comes due again. (Exceptions might be something like “the vacation of a lifetime”. After all, how many of those does a person usually get?)

You can probably tell I’m very enthusiastic about sinking funds. As often as I can I move individual expenses out of general categories and designate them as sinking funds. They’ve become the backbone of my budget.

There is one category in my budget I consider most important. It’s my emergency fund, and guess what? It’s also a sinking fund. What’s really exciting to me is that as I’ve built my budget into sinking funds, I’ve needed to use my emergency fund less and less frequently. That’s a good thing! Sinking funds are under used. Too many people don’t see their potential. Why not save for everything ahead of time and avoid debt? This is a major thing you can do to avoid debt and enjoy the debt-free lifestyle.

Making A Debt Free Lifestyle

Mini Recap

- Change your mind about debt. Make debt unacceptable. Take steps to get out of debt and live debt-free in the future.

- Live within your means. Develop a budget that uses your money efficiently.

- Use a spending journal and a spreadsheet to track your expenditures and help keep them in line.

- Make use of sinking funds to provide money to cover future expenditures.

Also…I’ve mentioned extra money a few times in thus post. Finding extra money, or generating it, can go a long way towards helping you reach your goal of being debt free. Use it to pay down debt or apply it to a sinking fund.

Places To Look For Extra Money

Just Say No

Impulse buying can be the nemesis to achieving the debt free lifestyle. We all need to learn to say “No” to ourselves.

About That Fancier Cup Of Coffee

I hear you. I love my coffee too. In general, I make coffee at home and take it to work or where ever I’m going. That’s the least expensive way to have coffee. There are times, however, when I need a great cup of coffee. For those times, I have money set aside in a sinking fund.

Eating Out Is Expensive

A great way to save money is to avoid eating out. You can (almost always) make a meal at home—even a special meal—for much less.

Couponing

I know…you’re thinking, this is all I need—one more thing to do. Now, think about this: realistically, most people don’t need a lot more money. They need just a little bit more. Finding a little bit more money doesn’t have to be hard, but if your choices are getting a part-time job or couponing, which is likely to take more of your time?

Shop At Goodwill And The Salvation Army

You can buy almost anything at a thrift store. Check out consignment shops too. I’ll make this a little broader and include yard sales, garage sales, and the local newspaper. All these are sources for finding used clothing and other items. You know, in most cases “new” doesn’t count. Getting what you need is what counts. I buy all of my clothes, from goodwill. My youngest son is getting married in February 2020 and I have a new suit of clothes to wear … That’s right, I got my “new” suit from a consignment shop.

the local newspaper. All these are sources for finding used clothing and other items. You know, in most cases “new” doesn’t count. Getting what you need is what counts. I buy all of my clothes, from goodwill. My youngest son is getting married in February 2020 and I have a new suit of clothes to wear … That’s right, I got my “new” suit from a consignment shop.

Cable

It seems like everyone is saying you can save money by cutting cable service. If you need more money, you should think about it. You can have it turned back on when your finances are on track.

Gym Memberships

Going to the gym to become physically fit is a good idea. We all know the merits of being in shape. It makes you look good and feel good. If you’re struggling with money and unable to save, you may need to cut gym membership from your budget. There are alternatives: Take up running or walking. Do aerobics at home. Find furniture and household stapes you have on hand to replace the sophisticated machines at the gym.

Generate Extra Money

If you already work full time, you may not want another job, but applying the money it brings to paying down your debt can help you become debt free more quickly. It could also give you more money to save. (Think about sinking funds. Think about saving for retirement.) Before you say no, think about the years you could knock off of debt repayment by working a part-time job or side hustle.

Sell Stuff

Most of us have more “stuff” than we need.

Have you ever noticed that after we buy some things we really want, such as expensive sporting gear or the basics for some gaming systems, those items start gathering dust fairly quickly? One reason that happens is that after the initial investment we can’t afford to participate or update them sufficiently to maintain the level of fun/excitement/entertainment we had anticipated—especially if it’s going to take a while to pay for them. Sell what you don’t need/can’t use. If you really want it, you can replace it later when you’re debt free and can afford both the equipment and the experience.

How Many Cars Do You Have?

By nature, most of us don’t want to give up anything, but in order to become debt free, you may need to sell a car. In fact, you may not need a car. Owning a car is very expensive, even if you don’t owe any money for it; insurance and upkeep aren’t cheap. You may want to think about selling your car and using an alternative form of transportation. Walking, bicycling, or the bus are possibilities that could keep your cost of living down. If you’re in debt and have more than one vehicle, you might find quite a generate quite a bit of extra money buy selling one or more and you may find extra money because you no longer have to maintain them.

Investing

Investing is a great idea, and everyone should invest, if for no other reason than one day you’ll need to live on in retirement. That said, as the old

saying goes, first things first. If you’re struggling with debt, it may be to your advantage to stop investing for now and use that money to pay off debt and fund an emergency account. Do this with idea of making investments a priority as soon as you stabilize your finances.

Conclusion

Living debt free is a lifestyle. In order to enjoy this life style, there are certain things you need to do such as living by a budget to secure a sound financial platform now and save for the future. It goes without saying, you need to pay off old debt and avoid incurring new. Take advantage spending logs, budget spreadsheets, and sinking funds to track and maximize what your money can do. Be creative in finding extra money by reprioritizing expenses or using economical alternatives. Also, be open to generating extra money. You’ll find that eliminating debt will free your finances to work for you.