Decrease Your Cost Of Living

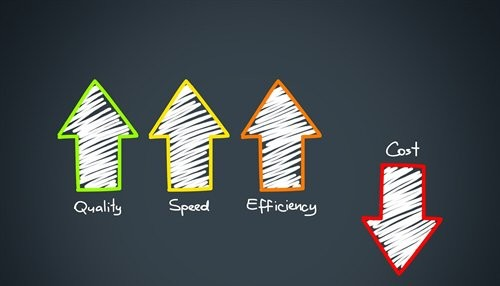

You’re seeking ingenious ways to improve your financial situation.

Navigating the world of personal finance involves mastering various strategies, including the art of knowing how to save money.

This skill becomes even more crucial in scenarios like frugal living as a single mom, where every penny counts.

One powerful tool that comes to the rescue is the spending journal. This nifty companion helps you track your expenses with a detective’s precision, unveiling patterns and areas for improvement.

But wait, there’s more – you can supercharge your financial game by exploring ways to earn additional income. These extra revenue streams can significantly bolster your financial stability, whether it’s a side hustle, freelancing, or investing.

And here’s a friendly tip: decrease your cost of living.

Now, what do we mean by that?

Embarking on the journey to slash your cost of living is like discovering the ultimate cheat code for life – it’s not just about saving bucks; it’s a thrilling quest to unlock your sustainability superpowers!

Minimizing expenditures helps individuals naturally require less to meet their daily needs, diminishing the necessity for a substantial emergency fund.

Achieving this can be approached through a series of steps.

First, thoroughly re-evaluating recurring bills helps identify areas where expenses can be trimmed.

Following this, cost-cutting measures can be strategically implemented to curtail unnecessary outflows.

The key lies in distinguishing between needs and wants; a self-assessment aids in understanding genuine requirements.

Unveiling the distinction empowers individuals to determine if their wants align with their priorities or if they have inadvertently become habitual expenses.

Through these steps, a conscious reduction in the cost of living paves the way for an enhanced financial future while encouraging intentional consumption.

Are you curious about learning specific strategies to lower your cost of living? Keep reading for some valuable insights.

Decrease your cost of living

Reducing your cost of living might seem challenging, especially in a world where the prices of everything keep climbing.

But fear not, for this financial puzzle has a silver lining.

It’s time to become a savvy detective of your expenses.

Take a closer look at what you’re shelling out for—yes, even those seemingly necessary expenses. Do they align with your needs, or is there room for a more innovative, cost-effective approach?

And let’s remember the wants that often sneak into our lives. Pause for a moment: Are they genuine desires or mere habits?

Delving into this introspection might unveil a treasure trove of opportunities to trim costs without sacrificing happiness.

Here is a list of ways to begin looking for ways to cut your cost of living

In a world where the cost of living keeps rising, finding ways to decrease expenses can be a game-changer.

Take a closer look at your spending habits and distinguish between needs and wants.

Remember, those might be habits in disguise!

Now, let’s dive into a treasure trove of money-saving tactics:

1. Lower your energy use: Unplug devices when not in use and switch to energy-efficient light bulbs.

2. Rent Out Space in Your Home: For extra income, list your spare room on home-sharing platforms.

3. Get Serious About Your Budget: Review your budget monthly to identify areas where you can cut back.

4. Shop Around for Insurance: Compare quotes from different insurance providers to find the best deal.

5. Re-evaluate Your Grocery Spending: Plan meals, create a shopping list, and avoid impulse purchases.

6. Buy Generic When Possible: Opt for store brands to save money without sacrificing quality.

7. Pay Off Debts: Prioritize paying off high-interest debts to free up more money over time.

8. Weatherproof Your Home: Seal gaps and insulate to reduce energy bills.

9. Public Transportation: Use buses or trains for daily commuting to save on fuel and parking.

10. Cheaper than driving: Consider walking or biking for short trips to cut transportation costs.

11. Carpool: Share rides with colleagues or neighbors to split gas and toll expenses.

12. Call your cell phone provider for a better deal: Negotiate a lower phone plan or ask for promotions.

13. Review your bank statement: Identify and cancel unnecessary fees or subscriptions.

14. Investment fees: Choose low-cost investment options to minimize fees over time.

15. Bulk Buying for you and your pets: Purchase items in bulk to save on essentials.

16. Check Facebook Marketplace first: Find secondhand items at lower prices before buying new ones.

17. Cancel your gym membership and workout from home: Follow online exercise routines to cut gym costs.

18. Do your grocery shopping once a week (and make a list): Minimize impulse buys by planning.

19. Meal prep instead of eating out: Cook meals in batches for convenient and cost-effective dining.

20. Cook more vegetarian meals: Plant-based options are often cheaper and healthier.

21. Split your bills fairly: Share expenses with roommates or family to ease financial burdens.

22. Take advantage of dinner deals and pick them up: Utilize takeout discounts to save on dining out.

23. Free activities to keep you entertained: Explore local parks, free events, and hobbies that don’t require spending.

24. Ditch the night out and host a night in: Host movie nights or game nights at home instead of costly outings.

25. Shop for quality, not quantity: Invest in durable items that save money in the long run.

26. Coupons, discounts, and deals: Look for coupons online or in newspapers before shopping.

27. The 24-hour rule: Wait a day before making non-essential purchases to avoid impulse buying.

28. Holiday with friends and save: Share accommodation costs and expenses with friends when traveling.

29. Be on a Strict Budget: Set clear spending limits for different categories and stick to them.

30. Take Better Care of Your Stuff: Proper maintenance extends the life of your belongings, saving you money.

31. Be Debt-Free: Focus on paying off debts to eliminate interest payments.

32. Eat at Home: Cooking at home is generally cheaper than eating out.

33. Eat Leftovers: Save and eat leftovers to reduce food waste and meal expenses.

34. Take Care of Yourself: Prioritize your health to avoid medical bills down the line.

35. Get Cheaper Car Insurance: Shop around for auto insurance to find a more affordable rate.

36. Don’t Upgrade Your Phone: Only replace your phone if it’s not functional anymore, not just to follow a “trend.”

37. Move to a Cheaper Place: Consider relocating to a more affordable area.

38. Cut Cable: Cancel cable TV and explore cheaper streaming options.

39. Use Cashback Credit Cards: Earn rewards for your purchases with cashback credit cards.

40. Buy Refurbished Instead of New: Opt for refurbished electronics to save money.

41. Go on a Financial Diet: Cut non-essential spending for a specific period to save more.

42. Get Term Life Insurance Instead of Whole Life: Choose term life insurance for lower premiums.

43. Get A Wholesale Club Membership: Buy bulk at wholesale clubs to save on everyday items.

44. Stop Leasing and Financing Cars: Purchase used cars outright to avoid monthly payments.

45. Reduce How Much You Spend on Alcohol: Reduce alcohol consumption to save money.

46. Spend Less on Gas: Avoid unnecessary travel and use apps to find the cheapest gas stations in your area.

47. Know the Difference Between Wants and Needs: Reflect on your purchases to distinguish between essential and non-essential items.

48. Get Better at Couponing: Learn effective couponing strategies to maximize savings.

49. Buy Groceries Online: Explore online grocery shopping for convenience and potential discounts.

50. Stay focused on the Prize: Saving money: Keep your financial goals in mind to stay motivated and committed to saving.

Remember, not every tip will fit your situation, but even incorporating a few can make a significant difference in your financial journey. So, roll up your sleeves and start embracing these creative ways to decrease your cost of living and secure a brighter financial future!

Conclusion

Discovering how to decrease your cost of living can be manageable.

It’s about cleverly saving a little here and there, which eventually adds up to a significant impact on your finances.

From energy-savvy habits to being a mindful shopper, these tactics empower you to navigate the escalating costs of today’s world.

You can uncover surprising ways to cut expenses without sacrificing satisfaction by differentiating between needs and wants.

Embracing this mindset allows you to redefine your financial landscape and embark on a journey where every minor adjustment contributes to a more stable and prosperous future.