Do You Have An Earning Problem

Do you earn enough to live on? The answer can be very questionable. If you are looking for financial solutions, it’s an excellent place to start. Knowing if you earn enough money is the cornerstone to improving your financial status.

Let me ask the question. What’s the difference between having an earning problem and a spending problem?

If you have an earning problem, you don’t earn enough money to cover your living expenses, let alone get ahead one month on your bills.

If you have a spending problem, you may earn enough money to afford to live on, but you spend too much money. And you don’t have any money left to save or to get a month ahead of your bills.

If you are wondering, “Why can’t I get a month ahead of my bills,” this is an excellent place to start.

Do You Have An Earning Problem

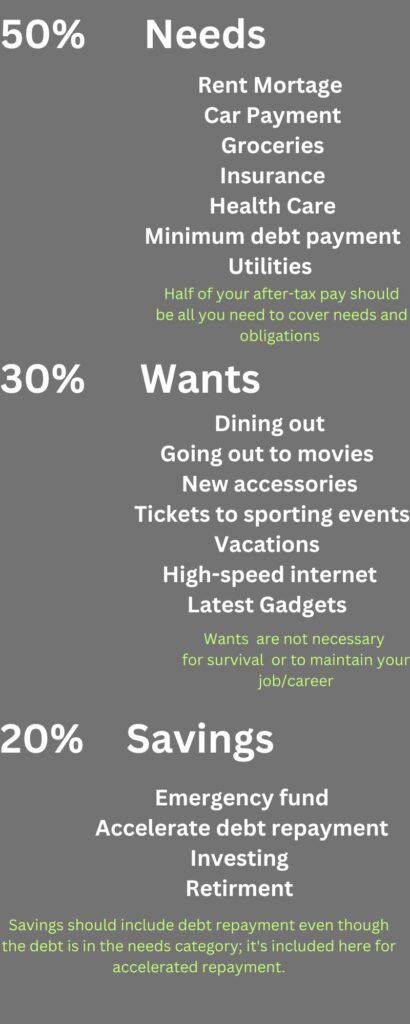

This chart shows you the breakdown of the 50 30 20 percent budget.

Your income will fit into one of the above categories.

For example, if you buy groceries, that would go to your needs category.

If you buy a cup of coffee from Starbucks, that would be wants.

Where is your money going? It’s easy to find out.

The Best Way To Learn Where Your Money Is Going

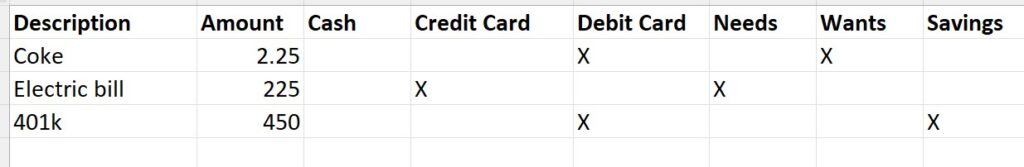

Use a spending journal. A spending journal is a diary of what you spend money on. It works best if you fill it out as you go. It’ll have columns for what you bought, how much it cost, the method of payment (cash, credit card, debit card), and the category the money came from.

As you spend money, log it in your spending journal. If you do this as you buy, you won’t forget the little things you spend money on. Your spending journal will be accurate.

If you overspend in a category, the difference will come from a different category, even if you use credit cards. Remember paying the minimum amount on debt comes from the Needs category.

If you use credit cards, you are only increasing your cost of living.

You will probably short your savings if you overspend in your other categories. Most people do. We don’t want to give up our wants.

If you need to spend more than 50% of your after-tax income on your needs, You have an earning problem.

Depending on the severity of your earning problem, you have several choices.

You could use money from your wants category to cover the deficit from your needs. Or you can do one or more of the below.

- Get a roommate

- Reduces your utility bills

- Get rid of your other car

- Audit your spending and find waste.

- Take your lunch to work

- Move to a cheaper place

Conclusion

Do you have a spending problem? If you do, there are ways to fix your spending problems. A second job or roommate will give you more money.

There are more choices to select from.