How To Use A Budget

You have a budget. Now what

I’ve noticed many blog posts telling us we need a budget. Some show us how to make a budget, but what then?

The answer is simple. You compare your spending to what you budgeted. This is where it can start to get messy. It starts to get messy unless you update your budget daily. You need to be consistent, and you need accurate information.

Suppose you know how to use a budget. You know you need to compare your budget to your actual spending. Some people hate this part because they spend so much time doing it. There is an easy way to do it, and it doesn’t take hours. I’m able to update my finances in fifteen minutes a day. I know others who spend less than two hours a week updating their finances because they’re organized. They know where everything is, and they know what to do. And they do it.

There are things you can do to streamline this process and make it easy.

Using a budget is simple. You compare the amounts of money you have designated to different categories to the amount you spent.

Read on to learn how to make budgeting easier and faster.

How To Use A Budget

I want to demystify budgeting. Have you worked a job that required you to do paperwork? Your employer gives you premade forms, and you complete them.

The reason for the premanufactured forms is it standardizes input and reports. In short, it makes the job easier for the next echelon, who will process the paperwork and later create reports.

View your budget the same way. What must I do to make this as easy as possible and have accurate information?

How To Budget For Beginners

If you are just starting your budgeting lifestyle, you need to read how to make a budget. This article will give you the nuts and bolts of creating a budget. I use the 50 30 20 budget in these articles because I think it’s the easiest one.

I have also written an article on how to simplify your budget.. It will show you some things you can do to make your job easier.

What Budgeting Forms Will You Need

- Budget

- Spending Journal

- Daily worksheet

The Budget.

A budget alone is a good start, but you need a way to monitor your performance before the end of the budgeting period.

If you think about it, it does no good to have a budget if you don’t know your status until it’s too late. That is why I encourage people to update their budgets daily.

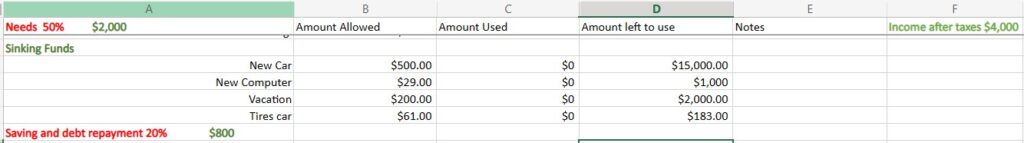

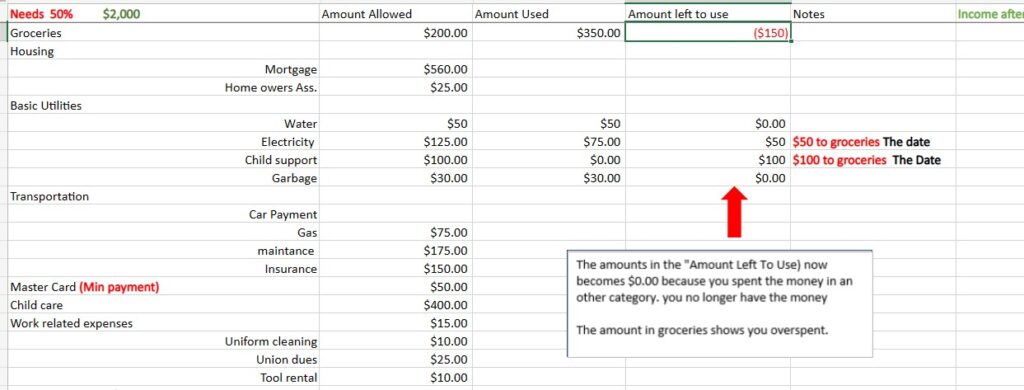

We’re going to use a 50 30 20 budget.

50% of your after-tax income goes to your needs.

30% of your after-tax income goes to your wants.

20% of your after-tax income goes to your savings and debt repayment.

Assuming your after-tax income is $4000 monthly, Your budget should look like the image below.

Notes

If you are paying child support, that amount should go in the needs section because you must pay it.

If your employer deducts health insurance, this should also go into the need section.

If you have an IRA and your boss withdrawals money from your pay to contribute to your retirement plan, that should be recorded in the savings and debt repayment.

In the needs section, you will notice a category for Master Card. You will also see it’s marked min payment. That’s because this is a required amount to pay. Any extra money you pay to Master Card should come from the “savings and debt repayment” category.

In the saving and debt repayment, you will also notice Master card again because if you choose to pay more against the amount due than required. The funds will come from savings and debt repayment, not needs or wants.

All deductions except taxes from your paycheck should be accounted for in one of the categories.

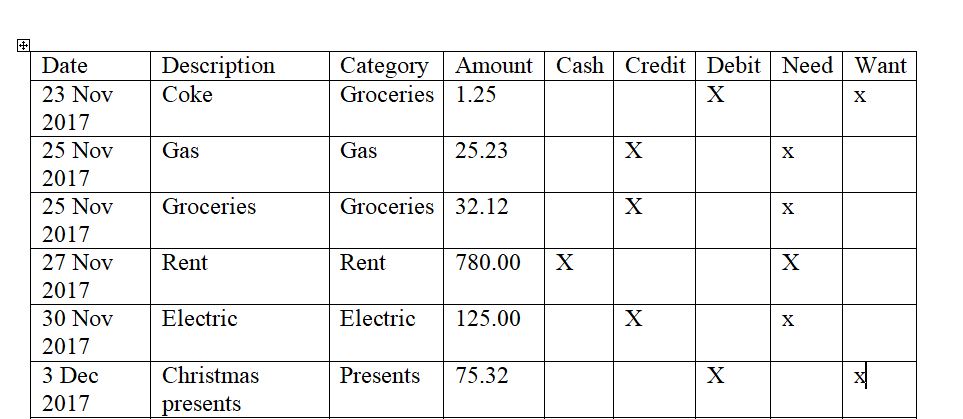

Spending Journal

A spending journal is a log that tracks your spending.

Everything you spent today, including automated bill pay, retirement contributions, and child support, should be logged.

You will need the following information.

- Date

- Description

- category/subcategory

- amount,

- Payment type

- Cash

- credit card

- debit card

- Automated payments.

Daily Worksheet

Use a daily worksheet to help track your spending and to keep your records correct. A spending journal is carried in the car purse or back pocket. It’s subject to being ruined by the rain, lost or stolen.

A daily worksheet should be kept at home or in a safe place, so you still have the information you need to check your budget if your spending journal becomes unusable.

Also, if your spending journal is unusable or lost, you won’t need to recreate your spending because you have already completed your daily worksheet.

I keep things simple. My daily worksheet resembles my budget.

How To Use Sinking Funds

Sinking funds are saving up for something. Usually, people save up for things like tires for the car, vacations, a new computer, and college money for their children. Sinking funds should become an intricate part of your budget.

There’s no limit to the number of sinking funds you can have.

Sinking funds are an easy way to avoid debt.

I have a sinking fund for tires. I usually have the money Io buy new tires before I need them. I can afford to buy tires without using credit. I’m not in debt because I pay cash 2. Because I’m not in debt, I have a lower cost of living.

I keep my sinking funds in one savings account and use my budget to know the totals for each item.

Notice I have $1,000 saved for a new computer. After I bought the computer, I had $100. In the “amount left to be used column,” I put the price of the computer and subtract that from the “amount used column.”

Bringing It All Together

You have your budget, your spending journal, and your daily worksheet.

Your budget is completed. And this is the first day of the new budgeting period.

During the day, you have made several purchases. You enter your spending to include automatic transactions.

First, enter into your spending journal than at the end of the day or whenever you decide to update your daily worksheet, put the appropriate amounts in the appropriate box.

If you have two or more entries for the same subcategory for a day, add them together before and put them in the appropriate box,

All transactions should be entered in your spending journal and your daily worksheet. And eventually, your budget.

I Needed To Borrow From Another Category

Suppose you need money from another category. You should subtract it from the category you are taking the money from and add it to the amount used a column in the category in which you are using the money.

Make a note as to where the money went in the notes column. If this happens too often, you may need to adjust your budget.

What If I Have Money Left Over In A Category At The End Of A Budget Period?

You can leave it there and have more money than you usually budget for that category or move it to a different category that needs funding now or later. It’s up to you.

I usually have a surplus in my gas fund because you never know what the gas price will do. Better safe than sorry.

Conclusion

Having a budget is essential, but knowing how to use a budget will put you in charge of your money.

Take the time to learn how to use a budget.