How To Pay Off Student Loans

You’ve done your part. You went to school. You got a college degree. Hopefully, you’ve got a decent job. Now it’s time to pay off your college loans. Paying off accrued student loans is essential. The consequences of not paying them off can be very harsh. These may include losing a good credit score, being sued, and wage garnishing. Those are headaches no one wants to deal with. Your next task should be how to pay off student loans.

Einstein once said, “A clever man solves a problem. A wise man avoids the problem.”

How To Pay Off Student Loans

With proper planning, many problems are avoidable; defaulting on student loans is definitely a problem to avoid. Of course, to make a plan, you need to know what you’re dealing with. Here’s another quote (made famous in the ‘80s as the ending line of each episode of the G.I. Joe cartoon series), “Knowing is half the battle.”

Know Your Student Loans:

When you started applying for loans at eighteen(ish), you probably didn’t do a good job keeping track of where you applied. You may not even remember who granted you a loan and who didn’t. Of the loans you do have, you probably aren’t familiar with all the terms. After all, when you made the applications, the time for repayment seemed really far in the future (4, 5, 6 years—maybe more?) Can you even lay your hands on your original paperwork?

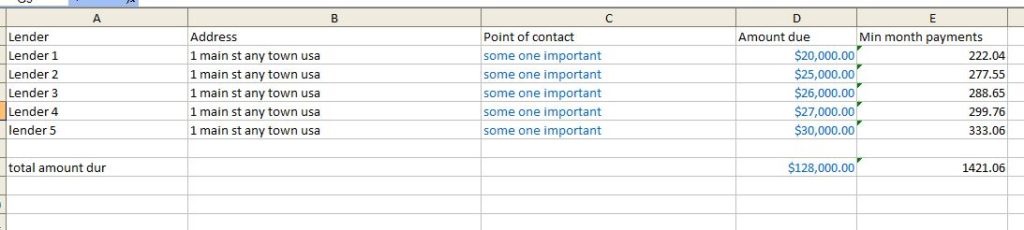

The first thing you need to do is learn where all of your loans are. Who are the lending institutions, what are the account numbers, the total amount due, the amount due each month, and the starting date for repayment?

If you don’t have good records, the easiest way to retrieve the information is to get a credit report. After that, you’ll probably need to contact each lending institution to update your contact information and maybe (and it’s a very iffy maybe) negotiate some lead time for the first payment. (If you continue taking classes, some lenders will suspend repayment, but you also need to have a job because (1) some won’t, and (2) you can’t put it off forever—start putting together a budget and a financial safety net.

Organize From Smallest To Largest Balance:

Assuming you need to begin repaying, list your college loans from the smallest to the largest balance. (I’ll tell you why later.) After you have your loans organized, post the minimum amount due next to the lending institution. You will have a page similar to the one below

Pay Off Smallest Balance First:

Now, here’s why l told you to list the balances from smallest to largest. You’re going to put emphasis on paying off the smallest balance first. This means you’re payments against this loan will consistently be greater than the required minimum. The larger loans will receive only minimum payments.

–Controversy–

Some people will tell you to pay off student loans that has the highest interest rate first, but I strongly urge you do almost the opposite. I’m saying that you should pay off the loan with the smallest balance first. By doing this you will free up money faster.

After you pay off your smallest student loan, you can do what you wish with the funds you’ve freed up. I recommend you immediately add that money to the monthly payments on your remaining loans—specifically, the loan that now has the smallest balance. Repeat this practice until you have paid off all your loans.

This loan repayment plan is known as a debt snowball. As you pay off each loan, you pack the freed up money onto the minimum payment of the next—just like adding another layer of snow to a snowball. Since it frees up money quickly, it’s a very effective way to pay off college loans.

–End of Controversy–

Do you know that it takes many people more than 20 years to pay off their under grad loans? Sure, some of them will say that they can put some money in the bank as long as they make only minimum payments against those loans. Great. Except any money they seem to be holding onto isn’t really theirs until all financial claims (loans) are paid off. It’s important to pay off debt quickly. Only after you get beyond debt can you seriously move towards financial security.

Just An Example

You owe $5,000. (Believe me. If you have student loans, you’ll likely owe a lot more than $5,000.) So, let’s say that one of your loans is for $5000. The interest rate on loan is 5%, and your required monthly payment is $100. If you make only that minimum payment, it will take you 56 months to pay off that loan. (That’s almost five years.) If you increased your monthly payments by $20 to $120 a month, it would take you 46 months to pay off the same loan. That’s ten months—almost a year—sooner, and you also avoid the interest payments on those ten months.

After you’ve paid off that $5000 loan, if you snowball the $120 onto the monthly payments of another loan, by how many months (or years) could the life of that loan be reduced?

The point is to apply all your money to your student loans to get out of debt as quickly as possible. In the beginning the debt may seem huge (and it usually is), but there are things you can do to bring it down quicker than the loan companies estimate.

Ways To Accelerate Debt Pay Off

Live cheaply:

As you put together your budget, cut as much waste as possible and apply the “found” money to your loans. I recommend applying it to the loan with the smallest balance. Get it paid off as quickly as possible, then snowball it.

Raises

When you get a raise, apply the new money to pay off your loan balance, but first, adjust the amount your employer holds towards your taxes. It makes no sense to pay down a loan if you need to take out one to cover the tax increase when you file.

Tax return

You probably already know if you’ll get your money back. When the expected windfall comes in apply it to your loans. By the way, I don’t think setting up your payroll tax deductions as a “savings account” is a good idea if you are paying off debt. The government doesn’t pay you interest on that money, but you continue paying interest on your loans monthly. It’s possible (and better) to have a smaller tax return and pay off your loans earlier.

Get a part-time job

Apply the amount you earn minus the taxes you will owe on those earnings to your loan. (Until it’s time to pay, bank the money that will go towards your taxes; you might earn a little interest.)

One More Thing

Look for other ways to secure funds that can be applied against your college loans.

For example, It never hurts to ask your employer if the company would be willing to pay off the loans (in part or in full). They may be willing to, especially if your degree is in a field that benefits them. Of course, if they invest in you, they’ll likely expect something in return—usually a formal commitment to remain employed for several years. (Note: If you are already working when you decide to go to college, check with your employer. Several companies have reimbursement programs for passing classes. Again, these classes usually have to be in the field in which the corporation does business, and they’ll probably require a commitment to remain in their employ for a while after graduation.)

Conclusion

Debt has to be repaid—and with interest. Because repayment prevents you from reaping the full benefit and enjoyment of money you earn, debt is inconvenient. When you were in college, you accumulated debt in the form of student loans. Now you’re out, and it’s time to pay off your student loans. It will be a long battle unless you put together a plan and take action to pay off college loans quickly.

knowing how to pay off student loans is essential.