Solo Parenting On A Budget

Solo parenting on a budget is a challenging task, as lone parents shoulder a significant load of responsibilities. This includes covering expenses for their child’s essentials, such as food, clothing, medical care, and after-school programs, among other things. These financial obligations can be daunting, often requiring meticulous budgeting and resource management to make ends meet and avoid falling into the credit card debt trap.

While the challenges are substantial, it’s important to remember that solo parenting on a budget does not equate to impossibility. With determination and the adoption of smart financial strategies, solo parents can navigate these hurdles successfully, even planning for future expenses like college tuition and weddings. Solo parents can ensure their and their children’s well-being and prospects by carefully managing resources and seeking support where possible.

Learn some important financial moves for solo parenting on a budget

Saving money as a single mom is an important aspect of financial stability. One key area where budgeting becomes crucial is the single mom’s grocery budget. Single moms can stretch their grocery expenses further by carefully planning meals, making a shopping list, and opting for cost-effective ingredients. Utilizing vouchers, taking advantage of sales, and buying in bulk when possible are additional strategies to maximize savings in this essential area.

Creating an affordable single mom lifestyle goes beyond just grocery shopping. It involves making conscious choices in all aspects of life. This might mean finding free or low-cost entertainment options for the family, such as visiting local parks or exploring community events. It can also involve exploring discounts and assistance programs available for single parents, such as subsidized childcare or utility bill assistance. By embracing this mindset and seeking affordable alternatives, a single parent can provide for their families while maintaining financial stability and peace of mind.

Ultimately, saving money as a single parent and crafting an affordable lifestyle is about making well-informed choices. It’s about prioritizing needs over wants, setting financial goals, and sticking to a budget. Though it may require some creativity and discipline, the rewards include financial security, reduced stress, and the ability to build a better future for both the single parent and her children.

Solo Parenting On A Budget

Solo parenting on a budget can be challenging, but achieving financial stability with the right strategies is possible. One of the first steps in this journey is establishing a basic budget. This involves tracking your income and expenses, categorizing them, and identifying areas where you can cut back or save. Learning how to handle taxes, such as tax credits, deductions, and exemptions, will help you maximize tax refunds or minimize tax liability, putting more money back in your pocket.

Cutting debt is crucial for improving your financial health as a solo parent. High-interest debts like credit cards can eat away your income, so developing a plan to pay these debts efficiently is vital. Through these steps, solo parents can boost their financial well-being and provide a more stable future for themselves and their children.

Crunching the numbers and creating a budget

As a solo parent, crunching the numbers and creating a budget is fundamental in gaining control of your finances. To start, it’s necessary to figure out where you currently stand financially and make a monthly budget that aligns with your goals and needs. This process involves gathering financial statements from the past several months to gain insights into your spending habits and identify areas where you can improve.

Part of this budgeting process is determining your average monthly income. This includes income from working, child support, investments, or any other sources of income. It’s crucial to account for all sources of income to have a comprehensive understanding of your financial resources.

Once you have concrete income information, it’s time to categorize and quantify your expenses. List your fixed expenses, such as rent, mortgage, and car payments. These expenses remain constant each month—additionally, factor in your monthly bills to estimate your cost of living. Then, identify your variable expenses, which may vary, including categories like clothing, dining out or food delivery, entertainment, and gasoline for your car.

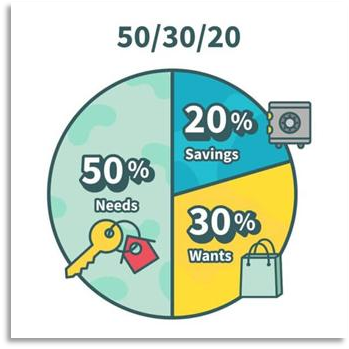

Used the smart techniques 50/30/20 rules

The 50/30/20 budget rule is a practical budgeting strategy for solo parents to manage their finances effectively. It involves dividing your income into three main categories. First, allocate 50% of your income to cover essential needs such as housing, utilities, groceries, and healthcare. This ensures that your basic requirements are met without straining your budget. Secondly, dedicate 30% of your income to wants, allowing for discretional spending on non-essential items like dining out, entertainment, and hobbies, enabling you to enjoy some of life’s pleasures responsibly. Lastly, committing 20% of your income to savings is important for building financial security. This portion can be directed toward emergency funds, retirement savings, or other long-term financial goals. Adhering to this 50/30/20 budget rule, solo parents can strike a balanced approach to budgeting, ensuring their financial stability and preparing for a more secure future.

Spending And Saving Plan That Works For You

Creating a spending and saving plan that truly works for you is essential. It tailors the plan to your unique financial situation, needs, and goals. Customizing your strategy accounting for your income, expenses, and financial objectives is crucial to ensure its effectiveness in helping you achieve financial stability and meet your aspirations.

Trimming Expenses

Trimming expenses is essential in managing your finances accurately as a solo parent. Living on a budget becomes essential, and this involves discovering ways to make do with less while maintaining a good quality of life. Exploring various methods to save money is vital in pursuing financial efficiency. These can include practical steps like switching to a more affordable cellphone plan, cutting out unnecessary expenses like cable subscriptions, preparing home-cooked meals instead of dining out, and taking advantage of coupons and discounts whenever possible. Trimming expenses can significantly contribute to a healthier financial situation, providing better for the family’s needs and working towards long-term financial goals.

Opening An Interest-Bearing Account

Opening an interest-bearing account is considered a smart move when managing your finances as a solo parent. Consider options like a high-yield savings account offering competitive interest rates to help money grow over time. Alternatively, online savings account provides convenience and often higher yields than traditional brick-and-mortar banks. Some individuals also find it beneficial to maintain a combination of checking and savings accounts, allowing easy access to funds while earning interest. Look for financial institutions that do not impose monthly fees and other account charges, as this ensures that one’s hard-earned money continues to work for you without unnecessary deductions. By carefully selecting the right interest-bearing account, one can enhance its financial stability and take steps toward securing a better future for himself and his family.

Prioritizing Emergency Savings

Emergency savings are funds set aside expressly for unexpected financial crises or emergencies. Prioritizing emergency savings is a critical aspect of financial planning for solo parents. These funds act as a safety net for unforeseen circumstances such as car or home repairs, unexpected medical expenses like taking a child to urgent care, or sudden loss of income. Aim for at least 3 to 6 months’ worth of living expenses in your emergency savings fund to ensure adequate emergency savings. This financial shield provides peace of mind and safeguards one’s family’s well-being during unexpected financial strain, allowing one to navigate challenging situations with greater confidence and stability.

Planning For The Future

Formulating one’s future is fundamental to securing one’s financial well-being as a solo parent. This involves considering two vital aspects: retirement and your children’s college education. Prioritizing retirement savings is essential to ensure financial independence during your later years. Additionally, planning for children’s college education helps alleviate the financial burden that higher education can bring. Through thorough budgeting and investing in these two areas, you can work towards a more stable and prosperous future for yourself and your children.

Automating Your Finances

Automating finances is setting up systems and processes that automatically handle various aspects of your financial management, such as bill payments, savings contributions, and investments. Automating finances can be a powerful strategy for managing your money as a solo parent. It simplifies your budgeting process by automatically allocating funds to different accounts or expenses, reducing the risk of oversights or missed payments. Moreover, it helps ensure you don’t incur expensive fees, as bills and savings contributions are paid on time. Careful setting up of automatic transfers and payments can smoothen your financial management, saving time and promoting greater financial stability for you and your family. Before opening a financial account, conducting thorough research and understanding the associated fees and charges is crucial. This knowledge empowers you to make informed decisions and prevents overspending by being aware of potential costs and expenses that may arise with the account.

Increasing Your Income

Increasing income isn’t just about making more money; it’s about improving financial well-being, reducing stress, and creating opportunities for a brighter future. Increasing your income is crucial to bolster your financial stability as a solo parent. Consider asking for a raise in salary if you have been performing well in your job. Demonstrating your value and contributions can make a compelling case for a salary increase, providing you with additional financial resources.

Additionally, exploring side hustles that align with your skills and interests allows you to earn extra money outside your primary job. Freelancing is another avenue to explore, especially if you have writing, design, or programming skills. Freelance work can provide flexibility and additional income. Consider selling your crafts or artwork if you’re crafty or have a creative talent. Online platforms and local markets can provide a marketplace for your creations, generating income from your hobbies. These opportunities can be pursued outside your regular job, allowing you to earn extra money for savings, investments, or meeting your family’s needs. By diversifying your income sources, you can better secure your financial future and provide for your children more quickly.

Taking Advantage Of Tax Breaks

Tax breaks, also known as tax deductions or tax credits, are incentives or reductions in the amount of income subject to taxation. Taking advantage of tax breaks is a smart financial strategy for solo parents to maximize their savings and reduce tax liability. Here are some strategies to take advantage of tax breaks. Firstly, consider filing as the head of the household instead of a solo taxpayer, as it often results in more favorable tax rates and deductions, ultimately putting more money back in your pocket.

Secondly, explore tax credits designed to benefit families with children. The child tax credit can significantly reduce your tax bill by providing a credit for each qualifying child. The child and dependent care credit can help offset childcare costs, allowing you to deduct a portion of your eligible expenses. On the contrary, it is advisable to consult a tax professional or use tax preparation software to ensure you maximize these opportunities. In the long run, leveraging these tax breaks can help solo parents optimize their tax returns and keep more of their well-earned money, contributing to improved financial stability for themselves and their families.

Conclusion

Solo parenting on a budget presents unique challenges but also an opportunity to prioritize financial discipline and strategic planning. It demands a multifaceted approach to financial management. It encompasses creating an allocation tailored to your income and expenses, embracing the 50/30/20 budget rule, trimming unnecessary costs, opening interest-bearing accounts, building emergency savings, and automating your finances. Furthermore, it involves planning for the future, whether saving for retirement or your children’s education. Taking advantage of tax breaks can also significantly enhance your financial situation.

Effective financial planning involves setting a mix of both short-term and long-term goals. Short-term goals help you manage your day-to-day finances, address immediate needs, and stay on track. Long-term goals guide your financial future, ensuring you work towards a secure and fulfilling life in the coming years.

These strategies, when combined, empower solo parents to navigate the challenges of single-handedly managing finances while striving to achieve both short-term and long-term financial goals. It may require diligence and adaptability, but with careful planning and prudent financial decisions, solo parents can secure a stable financial foundation and provide for their family’s well-being. By carefully managing your expenses, seeking out savings opportunities, and setting clear financial goals, you can work towards both short-term and long-term objectives while providing for your family’s well-being. It may require dedication and resourcefulness, but saving money and achieving your financial aspirations is within reach with the right approach.