Teach Children Money Management

In an ever-evolving financial landscape, we need to equip children with the all-important art of money management.

Imagine young minds transformed into savvy money wizards, making financial decisions with wisdom beyond their years – now that’s a sight to behold!

This is not just for two-parent families but also for the remarkable single moms who navigate the financial maze with an extra touch of magic. Juggling the whirlwind of parenting, work, and finances might feel like taming a herd of wild unicorns, leaving little room for financial education.

Don’t worry, we see you.

As a single mom, navigating the realm of personal finance can be quite challenging. You might wonder how to save money effectively while juggling numerous responsibilities. Fortunately, exploring the benefits of having a roommate for single moms could be a game-changer, alleviating some financial burdens and making saving money as a single mom more feasible. Sharing expenses with a reliable roommate allows you to stretch your budget further and achieve greater financial stability. With this newfound financial flexibility, you can plan =affordable vacations= for you and your family, creating cherished memories without straining your finances.

Now, how do you teach children money management?

Teach Children Money Management

Children can learn money management by engaging in age-appropriate discussions about budgeting, saving, and responsible spending, using real-life scenarios to instill valuable financial skills.

Good money management skills will prevent many problems for your children in the future.

Read on to grasp essential insights that will help you reach this goal.

From budgeting basics to wise saving practices, this comprehensive guide aspires to nurture financial confidence and independence in the next generation, regardless of their family’s financial circumstances.

Buckle up, dear reader, for a spellbinding expedition into the realm of financial wisdom!

Assessing Your Own Financial Situation

Assessing your financial situation is the first step to achieving a stable and prosperous future.

How well do you understand your goals and priorities when it comes to financial matters?

Understanding your financial goals and priorities lays the foundation for a well-directed journey, ensuring your efforts align with what truly matters to you.

By meticulously analyzing your spending and budgeting habits, you gain valuable insights into where your money flows and how it can be optimized.

This powerful awareness empowers you to identify areas for improvement, guiding you toward making informed financial decisions that promote growth and security.

Embracing this comprehensive approach to self-assessment not only fosters financial discipline but also sets the stage for cultivating lasting financial well-being.

Building a Solid Financial Foundation

Building a solid financial foundation is the bedrock of a secure and prosperous future for you and your family.

How do I achieve that?

Start by creating a budget tailored to your unique needs and aspirations, allowing you to take charge of your finances confidently and clearly.

Alongside budgeting, establishing an emergency fund is crucial to shield against unexpected expenses that life may throw your way, providing a safety net during challenging times.

Additionally, reducing and managing debt is essential for long-term financial stability, freeing you from the shackles of debt and paving the way for greater financial freedom.

If you embrace these pillars of financial responsibility, you can build a resilient foundation that withstands economic uncertainties and unlocks the door to a brighter, more abundant tomorrow.

Introducing Basic Money Concepts To Children

Introducing basic money concepts to children is crucial in equipping them with vital life skills for a successful future.

Age-appropriate discussions about money foster an early understanding of its significance, laying the groundwork for responsible financial decision-making.

By teaching the value of money and the importance of hard work, children gain a profound appreciation for earning, saving, and investing wisely.

Furthermore, explaining the concept of savings and its benefits instills a sense of discipline, encouraging children to set aside money for future goals and unforeseen circumstances.

As we guide the younger generation through these fundamental money concepts, we empower them to navigate the complexities of personal finance confidently, ensuring a solid financial footing for their journey ahead.

As of now, how well have you equipped your children with the knowledge and skills they need to flourish in a world filled with financial opportunities and challenges?

Making Money Management Fun And Engaging

Did you know money management doesn’t have to feel like a chore?

Transforming money management into an enjoyable and engaging experience is the key to instilling lifelong financial literacy in children.

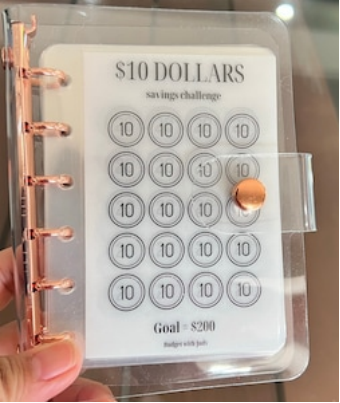

For young children, setting up a “money jar” system can make saving fun, allowing them to see their savings grow and understand the value of money.

With teenagers, designing financial challenges and offering rewards create a sense of accomplishment, fostering responsible financial habits.

Additionally, involving children in family financial decisions imparts real-world lessons, teaching them about budgeting and the importance of thoughtful financial planning.

Infusing these interactive approaches can spark curiosity and enthusiasm in our children, paving the way for a future where they confidently navigate the complexities of money management.

Cultivating Smart Spending Habits

Cultivating smart spending habits is a vital aspect of financial education for children.

It starts with teaching them to distinguish between needs and wants, helping them understand the importance of prioritizing necessities over frivolous desires.

By empowering children to compare prices and seek out deals, they develop a keen eye for making informed purchasing decisions, ensuring they get the most value for their money.

Also, fostering responsible spending choices instills a sense of financial prudence, guiding them to save for future goals and make wise investments.

Through these valuable lessons, we equip our children with the tools to become financially savvy individuals, prepared to navigate the world of consumerism with confidence and foresight.

Sow the seeds of smart spending habits that will bear fruit for a lifetime of financial success.

When we teach children money management, we give them the knowledge they need to make financially responsible decisions.

Introducing Banking And Saving Accounts

Have you ever considered elevating your children’s saving practices beyond the realm of piggy banks and taking them to the next level?

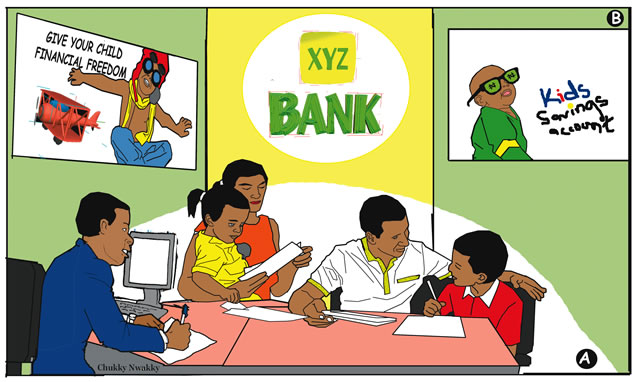

Introducing children to banking and saving accounts is another crucial step in their financial journey.

Explain how banks work and their significance in our daily lives, showcasing how they safeguard our money and offer valuable financial services.

As part of this process, consider opening savings accounts for children, encouraging them to actively participate in managing their money, and witnessing the power of saving.

Furthermore, demonstrate the magic of compound interest, illustrating how their money can grow over time through responsible saving practices.

Acquainting our children with these foundational concepts helps us empower them to forge a strong relationship with money, cultivate healthy saving habits, and lay the groundwork for a bright financial future.

Teaching The Basics Of Investing

Teaching the basics of investing to children is a valuable life lesson that can set them on a path of financial responsibility and prosperity.

Introducing the concept of investing and its potential benefits early on helps them understand the importance of making money work for them.

It is essential to explain different investment options, such as stocks and bonds, in a simplified manner suitable for their age and comprehension level, giving them a foundational understanding of these financial instruments.

First, starting with small, safe investment activities for children, like opening a savings account (as we’ve discussed before) or investing in a low-risk mutual fund, can instill confidence and excitement about the possibilities of growing their money over time.

This education equips them with essential skills that can lead to financial independence and secure their future financial well-being.

Nurturing an Entrepreneurial Spirit

Nurturing an entrepreneurial spirit in children is a powerful way to foster creativity, innovation, and self-reliance.

Encouraging children to explore their passions and talents early is crucial, as this helps them discover their unique interests and strengths.

By doing so, they develop a sense of purpose and direction that can drive them toward entrepreneurial endeavors aligned with their passions.

Additionally, teaching the basics of starting a small business, such as creating a business plan, understanding finances, and marketing their products or services, equips them with practical skills to turn their ideas into reality.

Alongside this, instilling the value of perseverance and risk-taking helps children embrace challenges and learn from failures, which are inherent aspects of entrepreneurship.

By nurturing an entrepreneurial mindset, children can develop resilience, adaptability, and a lifelong drive to explore new opportunities and positively impact the world.

Being A Role Model For Financial Responsibility

Are you confident you can be a good role model for your children? If not, you need to step up your game, mate!

Being a role model for financial responsibility is a powerful way to impart valuable lessons to children about money management.

Firstly, demonstrating responsible financial behavior through budgeting, saving, and making informed investment decisions teaches them the importance of thoughtful financial choices.

Also, being open about financial challenges and sharing how to overcome them helps children understand that financial setbacks are a part of life and can be addressed with resilience and determination.

By being transparent about successes and failures, children learn that financial responsibility is a journey with ups and downs.

Lastly, highlighting the importance of continuous learning about money management reinforces that you can hone your knowledge and skills in this area.

As a role model, showing a commitment to ongoing financial education sets an example for children to adopt a lifelong approach to improving their financial literacy and securing their financial well-being in the future.

If you Teach Children Money Management, you are setting them up for a better life.

Overcoming Challenges As A Single Mom

As a single mom, overcoming challenges requires resilience and resourcefulness, especially regarding financial matters.

Dealing with limited resources can be daunting, but creating a budget and prioritizing expenses is crucial to ensure financial stability.

Seeking community and support for financial education is essential in this journey. Joining local support groups or online communities can provide valuable insights, tips, and advice on managing finances effectively.

Moreover, contacting financial counselors or attending workshops can offer guidance and strategies for improving financial literacy.

Being adaptable and flexible in teaching money management to children is also crucial since each family’s situation is unique.

Finding creative ways to teach children about money, like using real-life examples and involving them in age-appropriate financial decisions, can foster a positive and practical understanding of money management.

Facing challenges head-on, seeking support, and embracing flexibility enable single moms to navigate their financial journey confidently and set a strong example of resilience for their children.

Empowering Your Children for Financial Independence

The fact that you’ve made it this far shows your dedication to exploring the intricacies of teaching children about money management. That’s a good sign! Now, let’s dive into our next key point.

Empowering children for financial independence is a transformative process that equips them with the necessary skills and mindset to take charge of their financial future.

To begin with, setting long-term financial goals together as a family encourages open communication and a sense of shared responsibility.

Involving children in goal-setting helps them develop a vision for their financial future and understand the importance of planning and saving.

In addition, allowing children to manage their money and learn from their mistakes fosters financial responsibility and accountability.

Providing them with opportunities to make financial decisions, even if they make mistakes along the way, helps them learn valuable lessons about budgeting, saving, and making thoughtful choices.

Furthermore, celebrating financial milestones and achievements, no matter how small, reinforces positive financial habits and motivates children to continue their journey toward independence.

Parents nurture their children’s confidence and competence in handling money by acknowledging their efforts and successes.

Empowering children for financial independence sets them up for a more secure future. It instills in them a sense of empowerment and self-reliance that extends far beyond their financial lives.

Conclusion

As parents, including remarkable single moms, we should be the first to teach children about money management.

By imparting knowledge about budgeting, saving, and responsible spending, we lay the foundation for a secure and prosperous future.

Through age-appropriate discussions and interactive approaches, we make money management enjoyable and engaging for them, fostering lasting financial literacy.

Moreover, introducing basic money concepts, banking, and saving accounts empower them to make wise financial decisions from a young age.

As we lead by example, being role models of financial responsibility, we encourage our children to embrace resilience, adaptability, and the entrepreneurial spirit, preparing them for a lifetime of financial success and independence.

The lasting impact of teaching financial literacy to the next generation extends far beyond their wallets, empowering them with the knowledge and skills to make informed decisions, shape their destinies, and build a brighter and more secure financial future for themselves and their communities.

Take the time to teach children money management and watch them flourish financially.