The role of insurance

Insurance is a financial arrangement where individuals or entities pay premiums to an insurer in exchange for protection against specified risks, with the insurer providing compensation for covered losses.

Insurance in the United States has roots dating back to the late 17th century.

The first insurance company established in the colonies was the Insurance Company of North America in 1792, operating in Philadelphia.

Over the 19th century, insurance evolved with the growth of commerce and industry.

The 20th century saw the establishment of regulatory frameworks, such as the creation of state insurance departments, to oversee and standardize insurance practices.

The Great Depression prompted further regulatory changes with the passage of the Securities Act of 1933 and the Securities Exchange Act of 1934.

Social Security and Medicare, introduced in the mid-20th century, expanded the scope of insurance-like protections.

In recent decades, the industry has faced challenges and changes, including the growth of health insurance and debates over reforming the broader insurance landscape.

Today, the U.S. insurance sector is a complex and integral part of the nation’s financial system.

When we say how to stop living paycheck to paycheck it is by building an emergency fund, managing debt, increasing income through opportunities like side jobs, living below your means, setting financial goals, automating savings, avoiding impulse spending, negotiating bills, and staying financially informed.

Enhance your financial prospects by investing in Education and upskilling.

Acquire new skills through courses or workshops to increase earning potential, opening doors to better career opportunities and improved financial stability.

The role of insurance in financial security is pivotal.

It serves as a safeguard, allowing individuals and businesses to navigate uncertainties by providing compensation for covered losses.

Insurance creates a collective pool of resources through the payment of premiums, contributing to overall stability and peace of mind.

The role of insurance

Insurance provides financial protection against unexpected events, helping to mitigate the impact of various challenges and uncertainties.

Choosing the appropriate amount and type of insurance ensures that you have valuable assistance when unforeseen events occur.

It’s about finding the balance that suits your individual needs and circumstances.

Incorporating insurance into your financial plan is a prudent strategy that protects against unexpected events, enhancing your financial portfolio’s overall stability and resilience.

Fundamental Role of Insurance

The fundamental role of insurance in risk management is to transfer the financial burden of potential losses from an individual or entity to an insurance company.

It helps mitigate the impact of unforeseen events, providing a mechanism for spreading and sharing risks across a larger pool.

This safeguards individuals and businesses and contributes to overall economic stability by promoting financial security and resilience.

The fundamental role of insurance is financial stability lies in its ability to provide a financial safety net.

Insurance helps individuals and businesses manage and cope with unexpected financial losses.

By transferring risk to insurance companies, policyholders can mitigate the impact of unforeseen events, promoting stability in personal and business finances.

This, in turn, contributes to a more secure and resilient financial environment at both individual and societal levels.

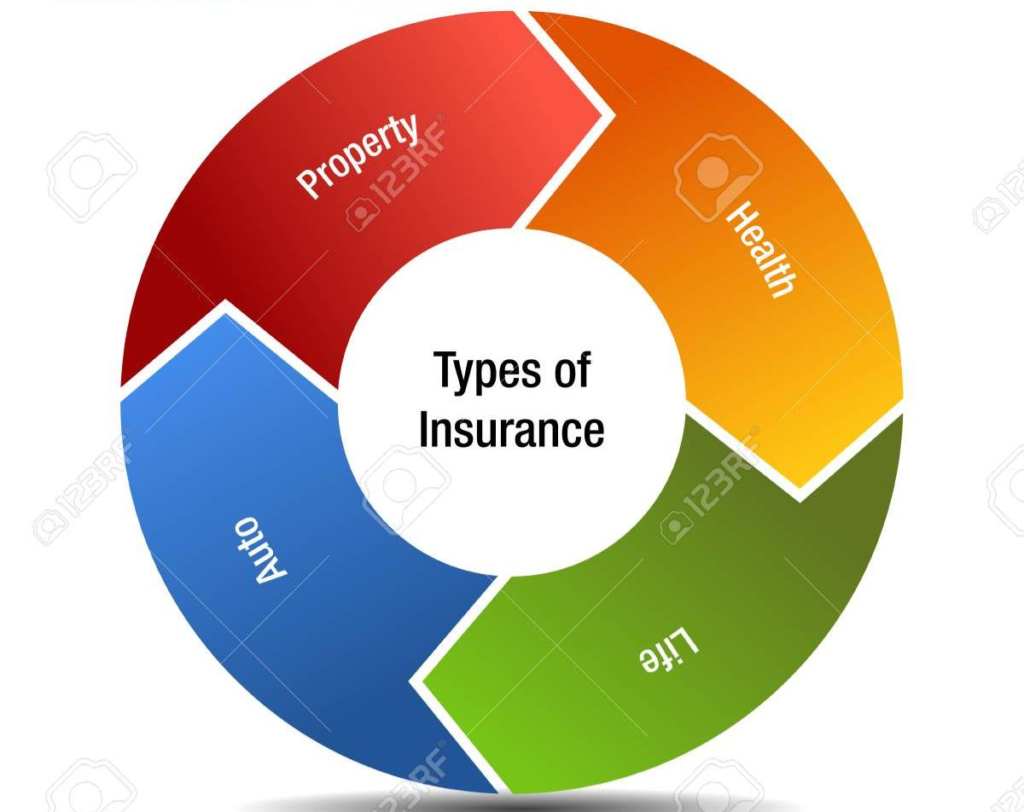

Types of Insurance

Health insurance is a type of coverage that pays for medical and surgical expenses incurred by the insured.

It can provide financial protection by covering some of the costs associated with routine and emergency medical care, including hospital stays, doctor visits, prescription medications, and other healthcare services.

Life insurance is a contract between an individual and an insurance company, where the insured pays regular premiums in exchange for a lump-sum payment, known as the death benefit, to be paid to the beneficiaries upon the insured’s death.

This financial protection helps support the family or dependents of the deceased, covering expenses such as funeral costs and debts and providing ongoing financial support.

Auto insurance is a type of insurance coverage that provides financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle.

It typically includes coverage for damage to the insured’s vehicle, liability coverage for injuries or damage caused to others, and medical expenses.

Homeowners/renters insurance is a type of property insurance that provides coverage for personal belongings and liability protection.

Homeowners insurance is for those who own a home, covering the structure and its contents, while renters insurance is for those who rent, covering personal belongings and liability within the rented space.

Both policies help protect against financial losses from theft, fire, or accidents, providing a crucial safety net for homeowners and renters.

Disability insurance provides financial protection by replacing a portion of an individual’s income if they become unable to work due to a disabling injury or illness.

This insurance aims to help policyholders maintain their living standards by providing a steady income stream during periods of disability when they cannot perform their regular job duties.

Liability insurance is a type of coverage that protects individuals or businesses from the financial consequences of legal claims or lawsuits.

It typically covers damages and legal expenses if the policyholder is found legally responsible for injuring someone else or damaging their property.

Choosing the Right Insurance

When choosing insurance, assess your needs by considering health, property, and financial stability.

Identify potential risks and select coverage that aligns with your specific requirements and budget.

When comparing insurance policies, scrutinize coverage limits, deductibles, exclusions, and premium costs. Pay attention to policy reviews, customer feedback, and the insurer’s reputation for prompt claims processing.

A thorough comparison ensures you select the most suitable policy for your needs.

Evaluate insurance costs by examining premiums, deductibles, and potential out-of-pocket expenses. Balance affordability with adequate coverage to meet your needs.

Consider long-term expenses and factor in any discounts or bundling options insurers offer.

Insurance in Financial Planning

Integrating insurance into financial planning involves aligning coverage with specific financial goals.

Consider life, health, and property insurance to safeguard against unexpected events.

Ensure your coverage supports your financial objectives, providing security and minimizing risks to your overall financial plan.

Insurance is crucial in estate planning by providing liquidity to cover potential taxes and debts.

Life insurance, for instance, can be used to ensure that beneficiaries have the necessary funds to settle estate expenses, preventing the forced sale of assets.

It serves as a strategic tool to protect and transfer wealth efficiently

While insurance primarily serves a protective role, specific policies, like cash-value life insurance, can function as investment tools.

These policies accumulate a cash value over time, offering a savings component.

However, it’s essential to carefully assess the returns and fees associated with insurance-based investments compared to other investment options to determine their suitability for your overall financial portfolio.

Insurance in Financial Planning

Common insurance challenges include understanding policy terms, navigating complex coverage details, and managing premium costs.

Misconceptions may arise due to unclear policy language.

In case of disputes or denials, carefully review your policy, gather relevant documentation, and communicate with your insurer.

If issues persist, consider seeking guidance from a consumer protection agency or legal counsel to effectively address and resolve the dispute.

Future Trends in Insurance

Future trends in insurance involve significant technological advancements, including using artificial intelligence for underwriting and claims processing.

Telematics and IoT devices are shaping policies based on real-time data.

The industry is also adapting to blockchain for secure transactions and smart contracts.

The evolving landscape includes a shift toward personalized and on-demand coverage, reflecting changing consumer preferences and expectations.

Conclusion

Insurance plays a pivotal role in mitigating financial risks by protecting against unexpected events.

It serves as a safety net, offering financial support in times of need.

Beyond risk management, insurance contributes to financial planning, estate planning, and even as an investment tool in some instances.

As technology advances, the insurance industry is evolving to meet changing consumer demands, incorporating innovations like AI, IoT, and blockchain to enhance efficiency and offer more tailored coverage options.