Frugal Living: The Beginner’s Guide

Frugal living is being intentional with your money. You spend your money where you want to, and how you want to. Frugal people prioritize what’s important to them and direct their money to the important things.

It doesn’t mean trading what you want for seconad best. You can still have your favorite foods, vacations, and anything else. It’s all in how you direct your money. How you budget and how you save.

Being frugal allows you to create your process. You decide what’s important and how you will proceed to acquire what you want.

Menu

- What Is Frugal Living?

- Frugal vs. Cheapskate

- Let’s Talk About Saving Money.

- Why Live Frugally?

- How To Live A Frugal Life?

- Frugal Mindset.

- Budgeting

- Planners.

- Spending Journals.

- Savings.

- Emergency Fund

- Sinking Fund.

- DIY (Do It Yourself).

- Investments.

III. Frugal Living Applications.

- Grocery Shopping.

- Debt

- Auto

- Credit Cards

- Rent/Mortgage

- Passive Income

- Conclusion.What is frugal living?

What is frugal living

Frugal living is determining what is important to you and allows you to easily set goals to attain it.

Frugal people are thrifty; they don’t waste money on items or services that aren’t important to them or needed. They’re conservative with their money. This means they’re reluctant to borrow money they’d prefer to pay cash.

For example, American business magnate and billionaire, Warren Buffet, still lives in the house he bought in 1957 for $31,500. Now that’s the perfect example of frugal living.

1 . Frugal vs cheapskate

What’s the difference between being frugal and being a cheapskate? A person who is frugal saves and conserves their money to improve their quality of life.

On the other hand, a cheapskate doesn’t save money. They hoard money, even when it’s to their disadvantage. They don’t save money to improve the quality of their life, they save or collect it just to have it because of fear, greed, or obsession.

Why live frugally?

The easy answer is it works. You get more bang for your buck being frugal than if you weren’t frugal. A classic example is car payments.

I know a guy that pays $400 a month for car payments and a fourth of it is interest. Interest doesn’t add value to your life, nor does it add value to the item you bought. What interest does is detract from the quality of your life. You pay money and in return receive nothing.

If he’d paid cash for the car, he wouldn’t be wasting money on interest. He could save, invest, or spend the interest he paid on something worthwhile.

If he had saved the money to buy a car, he would not be paying interest and that’s frugal. Yes, being frugal is being economical.

A Frugal lifestyle starts with money management.

“Your debt is someone else’s side hustle.”- Unknown

How To Live A Frugal Life?

Living frugally is a different kind of freedom. It’s the kind of freedom that allows you to have a better lifestyle without requiring extra money. Because you’re financially prudent, you save money and don’t waste it on unnecessary products and services.

Frugal Mindset

The ancestor of action is a thought. Ralph Waldo Emerson

To live frugally first begins with a decision (frugal mindset), second a plan, and third must be followed with self-discipline. You’re familiar with discipline, it’s the reason you obey law enforcement. It’s also the reason why you might exercise. Getting in shape physically takes commitment and getting your finances in shape will require the same.

If you want to decide what you are going to do with your money and your time, then you better have a plan. Not a temporary plan, one that caters to your “Big Picture”.

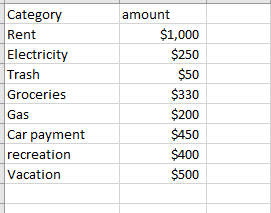

To plan, you need to know your money and determine where you want your money to go. You’ll need spending management tools. You’ll need a budget, planners, and a spending journal.

Budget

Think of a budget as a roadmap for your money. It’s the reason why it is essential to financial success. You’re telling your money where you want and need your money to go.

Before I go into any further detail don’t think of a budget as a headache or a pain in the ___…, you fill in the blank.

Personal finance should always equate to freedom; it’s yours, it’s personal, and that’s exactly what it is.

Shift your perspective of the work you put into personal finances as working to gain freedom. The ability to do what you want to.

My best friend was able to retire and move to Vietnam because he was frugal. Now he and his wife travel the world.

Now, it may not be your dream to travel the world but whatever your dream is stick with me, and I’ll show you how to make your dreams a reality.

Key Budgeting Results:

- You’ll save money

- You’ll be in control and plan for the future

- You’ll live your best life

- You’ll live your dreams and then some

Planners

Planners

Using planners will save you time and money. You might have upcoming events that require planning: like vacations, weddings, furthering your education, or retirement.

The idea of a planner is to organize workflow. The planner starts at a logical beginning and ends with the event taking place.

There’s something magical, if you will, about writing a plan. It’s a multi-sensory approach to creating your life. You visualize, write, and speak about what you’re going to do with your time and effort. And you know what they say…,” time is money.”

In a way, planners are checklists of what needs to be done. It eliminates the “did I do this, or did I do that?” It’s in the planner if you did: it’s checked off or strike through it. If it’s not checked off or strike through, then you didn’t do it.

There are many types of planners, or you can make your own. Either way, adding a planner to your frugal living regime will save you money because you’re organized, plus giving you time to research and find the best financial solution.

Key Results of Planners:

- Organize your time

- Prioritize your financial needs

- Provide Actionable Steps

- You don’t forget to do things that need to be done

- Avoid late fees and another unnecessary spending

- Sets time and financial requirements

- Stress Anxiety and Worry-free

Spending journal

Most people can’t tell you what they had for breakfast yesterday. So why would you expect the average person to remember all the money they spent in one day? Then multiply that by seven., they won’t.

And for this, we have a spending journal that will help you track your spending and show you where your leaks are (where you are losing money).

If you’re trying to gain better control of your money or if you’re that “one” who forgets where all that money went. A spending journal is for you.

Every time you spend money you should enter it into your spending journal. It doesn’t matter if it’s cash, credit/debit card, echeck, or cryptocurrency. Enter everything you spend when you spend it and how you spend it.

I know what you’re thinking…, Do you want me to write all this down? Again, think about self-discipline, multi-sensory, and freedom.

Within a few weeks, you’ll begin to see patterns. You’ll know exactly where your money goes. Now you’re empowered to decide whether you change your spending habits or continue spending the way you do.

Key Results of Spending Journals

- You quickly identify where your money is going

- You quickly identify bad spending habits

- knowing where your money is going will give you the power to save more and plan better.

- You have more control over your money meaning you have more control over your present and futur

Saving

The basic definition of saving money is; the money you pay yourself after bills, spending, and investing. But, the TRUE definition of saving is: paying yourself first. Afterall, you don’t work for free. This money symbolizes your power to purposefully have money set aside in a savings account or other low-interest-earning account.

When paying yourself first, you’re automatically living below your means, this equates to you having built-in freedom. You can take advantage of unplanned events such as: when the gang goes out after work, or you decide to catch a movie at the last moment.

There’s other perks to having a surplus of money. I’m sure you have an array of ways to spend extra cash.

Extra money

Parkinson’s law simply says that work requires the amount of time you allot for it. Meaning, if you assign tasks for a certain amount of time, usually you can complete the task in that amount of time.

We’ve all done it. We had a task that needed to be completed and decided to get-er-done. You gave it an amount of time and did it.

Giving you more time for something else. Remember “time is money”

If you budget your money and remain determined to make it happen…, it will. You’ll reap all the benefits of frugal living and have extra money.

Yielding a surplus for you to invest, save, or spend.

“There’s a difference between saving money and spending less” –Douglas Antrim

So many times, I’ve heard people say “I bought this on sale; I saved X number of dollars!” Not so fast.

Here’s the facts: If you planned to buy it and you spent less than planned; you spent less money. But you didn’t necessarily save money. What happens to the surplus money determines whether you spent less or saved money.

What did you do with the money you didn’t spend? If you took it home and redirected the money to another fund; waiting to spend it. Then you’ve saved money.

If you made the popular decision to spend the surplus money, then you didn’t save money. You spent less for the purchase you just made and missed the opportunity to save.

You’ve probably heard of a term called “impulse buying”, it’s where you make a purchase you didn’t plan/budget for: you didn’t save money, you spent money.

I’m trying to make a point. To save money, you need to be conscious about your spending.

If you spent what you “saved” in the above example, you didn’t save money. To save money you need to have it somewhere.

Emergency funds

Shakespare said that “all the world’s a stage” and he’s correct. Life is improvised. No one knows what will happen next. Sometimes it’s a happy surprise but unfortunately sometimes it’s not. You never know when or what the next emergency will be, but one can agree it’s much better to be prepared.

What was your last emergency? Were you prepared to handle it?

The idea of emergency funds is to have the money on hand when you need it and avoid borrowing money or dipping into your expense budget to pay for the unexpected event.

I have a friend that’s buying a house. He’s so overextended with bills, mortgage, car payments, and other things that when his water heater went out, he was unable to have it replaced for several months. That’s a long time to be taking cold showers.

He was finally able to secure a loan for the water heater and labor. The loan was a high-risk, and high-interest rate loan. Now, not only has he added one more monthly bill to pay, he’s also gonna pay double for that water heater.

The rest of the story is, he’ll be buried in debt for many years to come, if not forever.

Key Result of Emergency Funds:

- You’re prepared for emergencies

- You wouldn’t need to borrow or finance.

- Peace of mind

Sinking funds

Have you ever saved up to buy something? That’s a sinking fund. Using sinking funds will help you to remain debt-free. You can have as many as you want or need. You can save for everything: from tires to weddings and anything in between.

Sinking funds serve three main purposes:

- Sinking funds back up emergency funds, so you’ll avoid dipping into an emergency fund.

- Sinking funds give you the ability to save for things that could be an emergency, if neglected.

- You can save for anything, even things you want.

Consider this: If you own a car, you know you’ll need to buy tires someday. If you save the money for the tires in a sinking fund designated for “car tires”, before you need them. When the day comes to buy new tires, you have the money on hand.

No financing is involved.

Take this one step further. You have the money saved for your tires in your sinking fund. One day you’re on your way to the store, and you blow a tire.

If you’ve bought tires recently, you know it’s almost impossible to buy just one. Usually, you need to buy two or all four. It’s a safety thing.

If you have the money saved. You buy the tires and have them installed and balanced. You avoid borrowing money and paying interest, you can drive safely on the road now and you don’t raid your emergency funds. That’s an added layer of financial security or peace of mind.

Let’s take this one more step….,

Everything you own will one day need to be repaired or replaced.

Some of these items are necessary and their loss would constitute an emergency (like tires for the car). It makes good sense to plan for their repair or replacement.

What would be an emergency in your life? Maybe it would be a water heater for the house, a loss of your car, or your medical insurance deductible? You need to decide.

You might ask, why have a sinking fund if I have an emergency fund? A sinking fund is a set amount, there’s a goal. An emergency fund has no cap off amount; so you’ll want your emergency fund to constantly grow and earn interest.

If you have sinking funds to repair or replace the things you would constitute as an emergency, in the event of their loss, you’re adding another layer of financial protection.

You can save for things you want: vacation, college for your children, or their children.

Key Results of Sinking Funds:

- Allow you to save for individual things or events

- Add financial security

- Allow you to plan effectively

DIY (Do It Yourself)

Not long ago, a friend of mine took his home PC to the shop to have it repaired. The computer, after being on for a few minutes, would turn itself off and it took hours for it to be usable again.

The following week, my friend returned to the shop to pick up his computer. He learned the technician cleaned out the computer tower using low-pressure air to remove dust build-up around the fan causing it to overheat and shut down.

This cost my friend $90.

If he’d done the work himself, he could have bought a can of air for $5, and cleaned the inside of the tower himself. Saving a week of no use and $85.

Part of being frugal is taking care of your stuff because it extends the life of the item and you don’t need to repair or replace it as often.

The added plus is you can make the repairs much cheaper than hiring someone to do it for you.

You may not be able to fix everything, but you can repair many things.

The easy jobs like taking a can of air to your computer every couple of months. Can save you a lot of money in the long run.

It doesn’t stop there: because of platforms like Youtube or Skillshare you can not only learn to do anything, you can also ditch extra cost items like gym memberships, dance classes, and tutoring sessions.

Doing It Yourself is also about maximizing the money you already invested in your smartphone or computer device, and most importantly your monthly internet and wifi bill.

Key results for DIY (Do It Yourself)

- Saves Extra Money

- Give you peace of mind

- Maximize Your Dollars

Investing

Your buying power is constantly being challenged. This is something you MUST acknowledge. Inflation is a problem. The price of everything keeps going up and it’s not going away. If you have long-term projects and goals like sending your young children or grandchildren to college or retiring. You can rest assured it’ll be so much more expensive in 5 years or more than it is now.

If you’re only saving money, like putting it in a savings account, under your mattress, or in jars…, you’re losing buying power. For one, most savings accounts don’t keep up with inflation, under the mattress might get burnt or stolen, and the jar theory doesn’t gain interest at all.

For all these reasons and more: To gain wealth you must have investments.

Pro tip: Saving money does have its place but so does investing. Before you begin to invest you should have a strong emergency fund. The pros recommend 3 to 6 months of living expenses.

Investing requires a commitment for a long period of time, usually five years or more. It’s not a get rich quick scheme. It’s a race for turtles, slow and steady wins. The big picture: future financial security.

Investments aren’t savings, they aren’t emergency funds either: If you keep withdrawing money from your investments to cover emergencies or everyday living expenses, you aren’t investing.

Additionally, you may be penalized for early withdrawal.

Key results for investing

- Helps you build wealth

- Keeps ahead of inflation

- Makes long term goals more achievable

Frugal Living Applications

Areas in your life you can save money and how to do it,

Grocery shopping

Did you know the average family spends over $400 a month on groceries? That’s $4800 a year. That’s a lot of money. The good news is, there’re easy ways to bring the cost of grocery shopping down. Using techniques like buying in bulk, using coupons, buying generic, and stockpiling will decrease your grocery bill.

Buying in bulk is buying in large quantities to receive a cheaper price. Some of the more popular stores that sell food in bulk are Sam’s and Costco.

Coupons will save you money if you use them correctly.

Buying generic is buying the cheaper brand. Generics are known for being the same or almost the same as big-name brands like Kraft and Dole.

Stockpiling food dovetails with buying in bulk, using coupons, and buying generically. Buy more than you need now for future use.

Key results for groceries

- You can buy generic: still eat the same foods you normally would

- You can coupon: it save a lot of money

- You can buy in bulk: you get more for less

Debt

Debt is bad for two reasons. The more you’re obligated to pay out each month, the less you have to pay yourself, save, and invest.

When you’re in debt, you pay interest. Interest doesn’t add value to the item you bought, nor does it add value to your life. It’s just a waste of money.

When you’re in debt you also compromise your financial security by having less disposable income.

Debt leverages your future. If you’d saved and invested your money instead of paying someone else and paying interest you would be closer to your financial freedom.

Key results for debt

- Debit makes it harder to save and invest

- Debit in the form of paying interest does not add value

- Debt is throwing money away

Credit Cards

It’s unreasonable to think you’ll never need a credit card. It’s almost impossible to rent a car or buy airline tickets without one. Credit cards make buying online easier.

Credit cards are like money. Just because you have it doesn’t mean you need to use it.

If you do own credit cards, use them to your advantage.

I buy everything with a credit card. Because I earn money in the form of rewards points. The credit card I use pays 1.5 percent for every purchase. I pay the credit card off before the end of the billing cycle, get my reward funds, then save and invest it.

By not carrying a balance I don’t pay interest and the credit card company pays me!

Key results for credit cards

- Credit cards are essential

- Credit cards simplifie making many purchese

- You can earn extra money using credit cards

Auto

So many people buy new vehicles every year or two or three. They become trapped in the new car payment cycle and never become debt-free. It’s easy to do. On the other hand, if you buy a good used car, you’ll save money in depreciation, insurance, and interest.

A car depreciates faster when it’s new and slows with the age of the car. Buying a used car makes sense because you’ll pay less for the car, insurance is cheaper, and if you need to finance the purchase you’ll pay less in interest because you’re financing less.

Key results for used cars

- They are cheaper to buy

- They cost less to insure

- You have more money left over at the end of the month

Rent/mortgage

Most young people can hardly wait to get out on their own. They want their own place to live and call it home. They have dreams of living the life they want, and no one’s going to tell them what to do. They’ll have friends over, throw parties, come and go as they wish.

After the “newness” wears off they’re faced with the harsh reality. Having a place of your own is expensive.

If you’ve been on your own for a while. You know exactly what I’m talking about.

Having a place to live is a huge expense. You’ll have rent/mortgage, home insurance, electricity, trash pickup, and much more. The good news is, it doesn’t have to be this way. There are financial advantages to renting or homeownership.

Young or not so young there’re ways to reduce the living expenses of having your own place.

Key Results for Rent/Mortgage

- Get a roommate

- Rent space: think garage or spare bedroom

- Move to a less expensive place

- Double your residence as a home business or office

- Reduce your electric bill

- DIY’s like, cutting your own grass

- Reduce your water bill

Additional income Passive Income

Usually, when you say passive income people conjure up ideas of doing nothing and being paid for it (dream on). There’s nothing further from the truth. Passive income is choosing to work when you don’t have to.

There are many opportunities to earn more money, but they all require you to make the decision to work instead of doing something else.

Side Hustle

We all want more: a better home, vacations, or quality of life. If money is a problem, start a side hustle. There’s always a demand for trustworthy people willing to work. Starting your side hustle will allow you to work when you want and not jeopardize your regular job. Side hustles are in the category of self-employment and entrepreneurship.

The advantage is you have control over your time and money. You can still be present for important family functions such as band performances and game night.

Part-Time Job

Another way to earn more money is through a part-time job. Some people don’t want the responsibilities of self-employment like finding customers or documenting income and expenses for taxes. This makes finding a part-time job ideal for them. The only disadvantage might be, it’s like having a second job: you may no longer have the freedom to work when you want.

Key results of Passive Income

- There are plenty opportunities to earn more money

- Self-employment or entrepreneurship: you’re in control of your time and money

- Part-time work earn extra money with less responsibility

Retirement Planning

Frugal living is important to everyone. When you are young you don’t relize how important being frugal is, but you approach the are to retire it becomes more and more important.

There are more and more people that can’t afford to retire or at least they think they can’t afford to retire but in truth there are things you can do to ensure they can retire with dignity.

Conclusion

The mindfulness practice speaks heavily about living in the now. However, being financially mindful is about the present and the future. Most people don’t give a lot of thought to the way they spend money. They just pay the bills, shop, and live life.

They’re under the assumption, they’ll never be able to do what they want anyway. You know what I’m talking about: the dream vacation, finishing school, putting kids through college, and a whole list of other aspirations. Your life doesn’t need to be this way.

Financial mindfulness begins with frugal living. Living frugally is being certain that you’ll live better than you do now. You’re empowered and you’re in total control: you direct your earnings to the things that are meaningful. Most importantly you understand how to stop wasting money.

Remember, living frugally isn’t a characteristic; it’s a choice…., a lifestyle. You make the decision to learn and unlearn habits and ideas that work against your financial freedom. Then you get to decide what’s important to you, and what works for you.

- Warren Buffett – Wikipedia