How I Trained Myself to Save Money… You Can Do It Too

Do you have trouble saving money? I think all of us would like to have money in savings. But doesn’t it seem no matter how hard you try, you just can’t save anything? That you’re always short of money? I know the feeling. I used to have that problem, but I don’t anymore. I trained myself to save money (and, in the process, gained a frugal mindset). What follows is an account of my training exercises for saving money. Exercises rather like an athlete do to excel in his sport…

In previous posts I’ve talked about being in the Navy and about a Chief who took interest in me. He helped me learn how to manage money; that includes saving it. I’m continually glad he was willing to help me train to save money.

The military pays well. Even early in my Navy career, I had a decent income, but that doesn’t mean I used my money wisely. I had some lessons to learn about money management and saving.

It wasn’t uncommon for me to be broke about halfway between paydays. (Military paydays occur twice a month on the 15th and 30th.) Being broke with a week to go before payday was uncomfortable, but I was sure things could be worse. And, it did get worse. One day, my car broke down. The estimated cost of the repair was considerably more than I could immediately afford. This happened a day or two after a payday, and I’d already spent most of my paycheck. As usual, I was broke again and had the better part of two weeks to wait before I could get work done on the car. You can imagine (or maybe you already know from experience) how inconvenient not having my own transportation was. While I waited for payday to roll around, I was at other people’s mercy to get to the base.

Before this incident happened, I’d had a few close calls, some “Aha!” moments. I been aware for a while that I needed to start saving money… I just didn’t know how to do it. (There were more than a few failed attempts.) Anyway, I was unhappy and pretty vocal about it while I was waiting for payday.

I think what got Chief’s attention was my complaining about the “unfairness” of it all. I soon (frequently) found myself sitting in front of his desk, talking about some aspect of work in the shop, and the conversation would drift into what was going on in my life. It didn’t take long for him to work in the general topic of finances, then mine in particular. Almost without me knowing it, I was receiving an education in training myself to save money and on being frugal.

The First Exercise in Training Myself to Save Money: Learn Where My Money’s Going

Chief handled me very well. He didn’t criticize or come on as father. He made suggestions. In our first talks he let me ramble about how hard it was always being short of money. He said he knew a lot of guys found themselves in the same situation. He agreed that it was inconvenient and aggravating. One day, after letting me go on for a while, he asked me if I could remember how I spent my pay—how much, on what, and when. Of course, I could rattle off some things, but there was a lot I couldn’t account for.

At that point, Chief pulled a small notebook out of his pocket and said it was his spending journal. He said he always carried one with him and wrote down every expenditure, listing what he bought, how much it cost, time and date, and usually where he’d made the purchase. Towards the end of every day he transferred the information to a master list of similar expenditures (call them categories). He advocated keeping daily, weekly, and monthly totals for each category. He suggested I give it a try for 6 to 8 weeks (3 to 4 pay periods) and see what it could tell me about my spending habits.

For a while, I resisted this… I called it “busywork”. But Chief was persistent. Eventually, I agreed but only half-heartedly. At the end of the 8 weeks, we talked about the results. Unfortunately, my numbers didn’t correspond to my pay. (And Chief would know; at one time, he’d been an E-3.) I was told I should work the spending journal again and to be more conscientious about recording the numbers.

This time, I made the effort. I worked, exercised, practiced, made it a habit… I trained myself to keep that spending journal. Even before the end of the second 2 months, I could see that I was making a lot of indulgent purchases. There were times I spent about $10 dollars a day buying black coffee with sugar and/or bottles of Mountain Dew. And that was back in the ’80s! How did I rationalize the need for so much soda and coffee? (Today, from both financial and health perspectives, we’d say I needed little to none.) Sugary beverages weren’t my only excessive purchases. They’re just easy for me to reference. I’ve never lost the urge for them. In order to save money, however, I’ve learned to limit consumption.

The first exercise in training myself to save money was to get a comprehensive view of where my money was going. Knowing the what, the when, the where, and the how much money you’re spending can help you understand why you’re spending it. And that’s your business, but I’ll tell you what I think my reason was: I was on a proverbial hamster wheel. At some point in time, I began to overspend. Overspending resulted in a cash shortage, and in frustration I spent more, which—again—made me short of cash. It was a cyclic habit that I figured out was immature. But hey! I was young.

As I said, your reasons for spending money the way you do is your business, but it does affect the way you do the business of managing your money. When you begin keeping a spending journal, you could be in for a real eyeopener… I mean, I couldn’t believe I spent $10 a day on beverages. (A cup of coffee or soda each cost about $1.00 to $1.50 at fast food places back then.) That $10 is equal to $27 or $28 now.

Keeping a spending journal is a practice I still maintain. It keeps me honest.

Of course, Chief and I talked about my spending habits. On the good side, I (mostly) paid my regular expenses on time; rent, utilities, food, and fuel were covered. Once those were taken care of, I tended to blow through the rest of my pay. There were, of course, those sugary beverages. And, if I wanted to see a movie, eat out, get a new shirt, buy my wife some flowers…do whatever, as long as I had cash to cover it, I did it. On the other hand, when something unexpected occurred, it was hard to find money to cover the cost. That was the bad side.

The Second Exercise in Training Myself to Save Money: Recognize Priorities

After I had a good idea of how I spent my money, Chief suggested I go through my spending journal master list and prioritize the expenses and purchases. I felt I had a handle on that. I knew better than to not cover my bills. (People got kicked out of the Navy over that.) Here’s a list of my priorities at the time: rent, car payment, utilities, food, fuel, clothes (including uniforms), recreation (Chief said recreation included my coffee and Mountain Dew habit), and gifts.

Figuring the order of priority took some work. I really tried to make recreation (which covered a pretty wide variety of treats, entertainment, and activities) rank higher. According to Chief, that was a “no go”. And the reason fuel was so low on the list? I lived within walking distance of almost everything—except work. (And, as you can tell from what I’ve already said, there were times I had to beg a ride onto the base.) Once I had my priorities in order, Chief suggested keeping the list with the average amount of money I spent on each category per pay period where I could review it and compare it to the data I continued to collect in my spending journal.

After a while, it sank in that the expenditures at the high end of my priority list were necessities. The ones at the lower end were mostly “I wants”. That lead to a breakthrough… I began to understand how spontaneous spending on things of lower priority affected my ability to comfortably cover the cost of the higher ones. Also, the holidays were coming; I would need to do some serious gift shopping. And Chief (ever the voice of conscious) asked what I would do if I had another car problem. How am I supposed to know? Deal with it when it happens?? If it happens??? That’s when he suggested I add another category to the top of my priorities, something to cover a sudden, unexpected expense—an emergency fund to which I would make a contribution every pay period. And that was my introduction to both budgeting and long-term savings.

The second exercise in training myself to save money was to put some priorities on my spending, but I needed something to help me stay focused. It was coming… Chief said, using the figures I had gathered in my spending journal, I should have a fair idea of what my spending tendencies were. He suggested I develop a working budget by setting some parameters for various expenditures and record actual figures on a spreadsheet to better help me keep track of them and to make reviewing them easier. He also wanted me to add still another category dedicated to saving. (So, now, I’m supposed to save money specifically for emergencies and more money just for the sake of saving it? This guy was out to cramp my style.)

The Third Exercise in Training Myself to Save Money: Make a Budget and Plot It Out on a Spreadsheet

The word “Budget” may make some of you uncomfortable. When Chief suggested having a budget, I didn’t want to hear it. To me it carried the same sense as “bound”, “hobbled”, or even “shackled”. Chief explained that it’s true a working budget sets specific spending limits (usually based on income) for individual expenditures within a recurring set time (often a month). Those limits insure you have the money to do what’s needed and, eventually (if not immediately), allow for your wants. He said that rather than think of a budget as a set of limits I might want to consider it a set of allowances that I might not need to fully use. The excess could be used as I wished or added to savings. (It was, after all, my money.) He did, however, expect me to use realistic figures and be diligent about keeping the spreadsheet up to date.

Figuring the allotments wasn’t too hard. My pay was consistent, as were most of my “needs”. (If yours aren’t, you’ll have to do some averaging.) Rent, electricity, water, trash, car payment, and car insurance were the just about the same every month. Food and fuel varied some but not much; I could get good averages for those. I didn’t have a credit card. And before I dealt with how much I’d allow for things like clothes, treats, and gifts, Chief was pushing for me to commit to making regular deposits to both that emergency account and a savings account… Because this was my money we were talking about, and because I did want money for my “wants”, I was only willing to do one of those. I agreed to having a single account. It would be a savings account that could function as an emergency account if I needed it to. I can assure you it wasn’t long before the savings account was tapped for an emergency, but it was awhile before I really saw the wisdom in keeping separate accounts. (BTW: Separate accounts doesn’t necessarily mean separate bank accounts. It means separate categories on the spreadsheet; at the time, I only needed one bank account.)

When I put together my first budget, computers weren’t nearly as common as they are now, so I had to buy a spreadsheet. They were sold (and still are) wherever other office supplies were sold—office supply stores, drugstores, etc. They come in huge tabletlike pads that you filled out by hand. Now, you can easily find spreadsheets online. Microsoft Excel is one, but there are others.

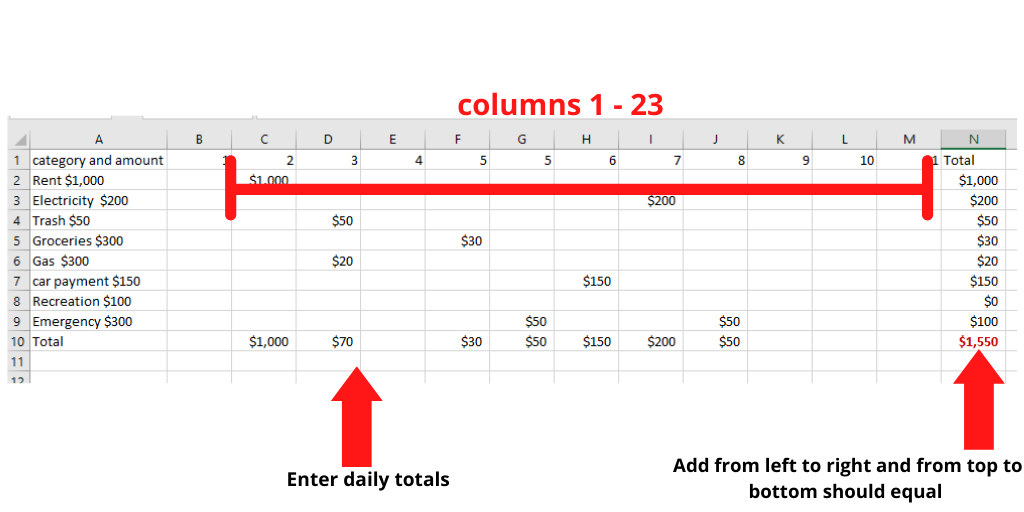

I want to present a very basic spreadsheet similar to the first one I made. A spreadsheet isn’t hard to fill out. It’s basically a grid and I used a month-long format. I labeled the horizontal lines with my budget categories such as Rent, Water, Electricity, Gas, Trash, Food, Car Payment, Insurance, Fuel, Clothing, Entertainment, Saving, etc. That area is also where I noted how much I planned to allow myself for spending in each particular category over the course of a month. (Note: The very last line was for daily totals. The next to last line was for the Savings/Emergency category. My reasoning for that? My goal was to add to that category on a regular basis; deductions were the norm for the other categories… Having Savings last just made bookkeeping easier.) The vertical columns are for recording total daily expenditures (or deposits as in the case of the Savings category.) I allowed 32 columns—one for every possible day of any month with the 32nd column designated to linear totals. The last thing to do was to add up the daily totals and the monthly totals separately. Assuming I added and subtracted correctly, that number would be the same for each and I could enter it in the lower right-hand corner. That sum would tell me if I’d stayed on budget for the month.

Here is a sample of a spreadsheet. Seeing an example of a should clarify the process:

The third exercise in training myself to save money began with learning how to make a budget and keep track of the my whole financial “picture” using a spreadsheet. I say it began with those practices because learning to live on a budget was the real exercise. Chief had me commit to keeping to my budget for three months.

At the end of the three months, we talked about the experiment (not that I hadn’t been getting encouragement all along). I felt pretty good about the way things had gone. The only thing that I could say is that I wished I could have mined my Savings/Emergency fund a bit for more Entertainment money. I mean, the holiday season had come and gone during this exercise, but I’d made the scheduled deposits and the balance was already impressive—at least to me. Chief brought up that I’d done well enough with what had been allowed for gift giving and other festivities. He also pointed out that there had been no need to tap the funds in Savings for an emergency. What if there had been one and I’d already “played” with the money? He said adding sinking funds to my saving regimen would help me see how important Savings are as a tool, not a toy.

The Fourth Exercise in Training Myself to Save Money: Using Sinking Funds

As I just said, when we talked about how living on a plan—my working budget—was different than just using my money for things as they came up, I had mentioned to Chief that I’d been tempted to use some of my savings on things to make the holidays more fun. He said there was a way to accommodate those expenses and others that could be more serious: Use sinking funds.

A sinking fund receives regular, dedicated deposits for a set period of time. Essentially, you need to know how much money you want to save for something and how many pay periods you’ll have before you’ll need the money. (Note: Time frames are estimates. Once you’ve met the total needed for a particular sinking fund, you can just maintain it within your savings account until it’s time to use it for its designated purpose.)

I thought a sinking fund for the holidays sounded like a good idea, so we looked at what I anticipated needing in about 9 months. Of course, you need to remember that this was in the 1980s, so the price of everything was considerably less than you’d spend today.

Gifts for 4 parents @ $10 each $40

Gifts for 4 siblings @ $5 each $20

Gifts for my wife $25

Extra food $20

Entertainment $30

Total $145

So, I’d have 18 pay periods to save $145. That came to $8.05 a pay period. (I rounded that down to $8.) It was doable. And, when the holiday season came around again, I was very happy; I was financially prepared for it.

Now, would you like to hear something funny? Back in the ’80s many banks offered a 10-month savings program called a Christmas Club. For all practical purposes, Christmas Clubs were sinking funds. You set a savings goal. Equal, weekly deposits were encouraged and interest was paid, but it was difficult to make an early withdrawal. Chief’s plan, however, had me keep my money in my savings account… You have to remember that interest rates on savings were much higher in that era. He figured commingling the funds would increase the amount of earned interest and that all the interest would remain in the savings account after I withdrew the funds that constituted the sinking fund. That principle still holds true even though current interest rates are much lower. Also, in dire need, I could have taken out any or all the money from my savings account. That makes a case for having an emergency fund. It also means it’s important to keep track of the various sinking funds within your savings account. (A spreadsheet works).

As for important, let’s talk a bit more about how sinking funds are essential to your fiscal stability…

Your working budget covers the more or less routine expenses of life. We all know, however, there are times when life is anything but routine. We also know that when life is not routine, it tends to be expensive. Despite the fact that some nonroutine circumstances may come without much warning, and that there are many more things that could need to be maintained, repaired, or replaced than anyone has the fiscal resources to cover (or, for that matter, even think of), it’s wise to prepare for as many as we can. For example, quickly, with regard to your car, how many things can you think of that do or may require attention? I can guarantee that however many that is, the possibilities are more than twice that number.

When it comes to my car, I have a sinking funds for oil changes, new tires, brakes, and a replacement for whatever I’m currently driving. Another thing I start saving for as soon as I buy one is a new computer.

Any particular sinking fund is will provide a way to normalize or lessen the impact on my working budget of one of those expenses. They’re designed to cover the ifs and the when of LIFE. That given, the more sinking funds you have, the less likely it will be that you need to find a way to stretch the capabilities of your working budget when the time comes to do repairs and replacement.

The fourth exercise in training myself to save money was becoming accustomed to using sinking funds as a way to prepare for occasional or potential expenses. One last thing that Chief told me about sinking funds is that I might save for something that never occurs or that something urgent may require a reassigning of funds. He said my next exercise would be in recognizing that a budget is designed to be an authoritative statement on spending, but it also needs some provision for life changes.

The Fifth Exercise in Training Myself to Save Money: Getting Ready for Change

By now, I knew that my working budget was a money management plan that made it easier to have a life while paying to live. I realized having savings and sinking funds were a really good ideas because things happen. For that same reason, Chief wanted me to seriously consider having separate savings and emergency accounts. (Again, I could keep the funds in the same bank account, but separate on the spreadsheet.) Me? I was still having a hard time understanding the need for that. My working budget was taking care of everyday living and any money I saved would help me cover unexpected expenses. Wasn’t that right? Chief’s answer was “Yes, and No.” He told me I still wasn’t seeing the big picture.

I asked for an explanation.

Chief said that taking care of the today’s financial needs is important. Preparing for the future is equally so. The way to do that was to put to work the money I saved. Its job was to earn more money (in interest and investment dividends) which in turn would earn still more. He said the budget and saving method I currently had in place were designed to finance the present and events that could occur presently, as in tomorrow or within a few years, but I needed to make provision for a future that would extend well beyond tomorrow, next week, or next year.

He said I needed to realize that life continually moves forward. In fact, it could be argued that I’d live a series of futures each of which would come with its own set of financial requirements that my budget would have to accommodate, and all the while I’d need to be saving for what was still to come. In other words, a budget is not a static document. It has to change to meet the needs of the time… And saving is always a need.(So, it was a good thing I was training myself to save money.)

The case for a concerted effort in saving was becoming very clear. Still, wasn’t an emergency fund just another form of saving? Why view it as a separate entity? Chief said to consider an emergency fund as something similar to the shock absorbers (struts) on my car. Just as shocks help the car survive a nasty bump in the road, a well-funded emergency account can go a long way in keeping a financial plan intact when something unexpected and expensive happens (like a period of unemployment).

I got the point: “Chief are you talking about a lifestyle based on saving money?” He confirmed it. He said saving money I earned was only the beginning. I needed to find ways to save more money. I asked if he was suggesting I get a part time job. He said that would be one way to bring in more money to save, and I could consider it. But he wanted me to look again at my spending journal for more habitual expenditures that could be cut back or eliminated like my coffee/soda obsession. He said to look at my living habits, too. (Wasted money lurks in a sloppy lifestyle.)

I found I could start using coupons, shop sales, turn out the lights, use less fuel by walking instead of driving when I ran errands… You know, there are hundreds of ways to save a little money and all those small amounts add up. The important thing is to train yourself to get those small amounts into savings and add them to the funds that are working for you.

Before I go any further, I want to tell you that this fifth exercise in training myself to save money initiated a change in my mindset (attitude) about money. As I was training myself to save small amounts of money in preparation for big life changes, I really began to see it as something to employ rather than something to just spend. I may not have been very familiar with the concept of frugality, but I was becoming frugal. Since then, being frugal has become a basic tenet in my life.

Of course, the frugal mindset is about saving money which isn’t the same as being miserly. It’s about using my money to get more out life now while building sufficient financial stability to ensure a future I can look forward to. When I peruse my spending habits (which I do often), I temper any cuts or reductions with a view of the ongoing enjoyment of life now. That said, getting comfortable with the idea of keeping track of expenditures, weighing their value, initiating a workable spending/saving plan and just understanding the value and power of money took me about a year. It could have been accomplished a lot quicker, but Chief worked at my pace and he had one more exercise he wanted me to train with.

The Sixth Exercise in Training Myself to Save Money: Never Quit Training

Eventually, a day came when Chief told me he felt like I was regularly practicing the basics for building a decent financial future. He encouraged me to stick with the plan, to keep finding more ways to save money: to keep training myself to save money. To step it up a notch, he suggested I read books and consider the suggestions of some of the then current financial gurus. He also said he’d be glad to discuss their ideas with me because “There are some crazy ones out there.”

One popular idea was to live on credit and pay it off every month. Yeah, right… And people didn’t realize that was a disaster waiting to happen??? Today, with cash-back cards, it can be worthwhile to make charges and pay them off that same day. But those weren’t available in the ’80s. Also, automatic payments were created in part because so many military personnel thought they could pay ahead against their credit debt when they left on deployments: Before they left, they’d make one payment equal to the minimum due for however many months they expected to be gone… And they’d come home to huge late fees and, sometimes, legal problems.

Conclusion

I had about another year of working with that chief before he was transferred to another command. I gained a lot of useful knowledge from him that I’ve been able to build on since. I still use a spending journal. The information from the journal helps me keep my spending habits in line. When I pair it with periodic reviews of my priorities, I’m able to revise my working budget so I can live comfortably and maximize my savings. Some of those savings would be easy to turn into cash. (Most of my sinking funds are included in this form.) Other savings fund a retirement account and are building my financial future. I have an emergency account that could cover somewhat more than six months of living expenses at this time. Right now, I’m working on increasing that. I’d like to have a year’s worth of resources, given current economic trends. (In other words, I’m preparing for change.) Just as an athlete never quits training, I want to continue training myself to save money, and you can do it too.

How I trained myself to save money is ongoing. Learning to save money and be better at anything is a commitment.