How To Choose The Right Used Car And Save Big Money

Buying the right used car will save you lots of money. So, what goes into choosing the right used car?

You’ll look for a used car you can afford that will allow you to safely accomplish the purposes for which you need a vehicle. Finding the right one won’t be as hard as you may think. Armed with the right information, you can do this. I have a process I use when I buy a “new” car… new to me that is. I use it whenever I’m in the market for a car, including the last vehicle I purchased, one I picked up just over a year ago in late 2019. The process is based on my Used Car Checklist, which I laid out in an earlier post. I highly recommend reading it. You may be surprised at the difference in how much I paid for my car compared to the price of a similar, factory-new one. It’s important to get more car for your money.

We all know you can have many years of happy motoring if you select the right used car. But, if you pick the wrong used car, it can be financially devastating. So the question is how to choose the right used car and save big money. Here’s a guide that will help you to pick the right previously owned car.

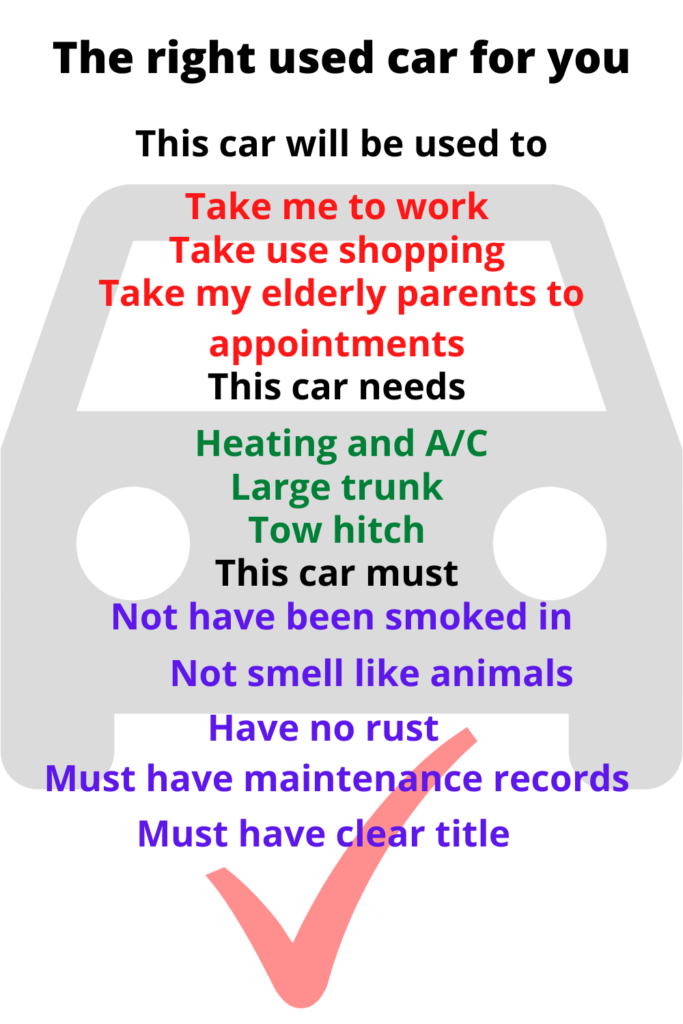

What Do You Expect

What is the main reason you’re looking for a car? The truth is most of us use our cars for various purposes, but when we’re looking for one there can be circumstances that should influence our choice: It’s not always easy to get a child out of a car seat if you have a two-door model. The same could be true of older adults trying to get in or out of the backseat. Also, they could need either need a low entry or something with a higher seat. If you carry pets in your car, the type of material that covers the seats could be a factor. Maybe you want a car just to get back and forth from work and/or school? To run the errands that come with living? Here are another couple of ideas to consider: Is this vehicle going to do more than just get you to the same places routinely. For example, is this car going to do more than just get you to and from work? Could it actually be an element of your work? Conversely, could this car be essentially for entertainment?

All of the above are important because they contribute to the body style or interior furnishings of the used car that will be right for you. That will influence how much you’ll pay. Be sure the car you purchase satisfies the reason you’re buying it.

BTW: For any number or reasons (dependability far from home is one, looks is another), a car dedicated to business or pleasure will probably cost more than one for general use. Just as with new cars, used car prices will vary depending on make, model, and amenities, but you will save a lot of money buying a used car versus a new one of the same type.

Know What Amenities You Need/Want

Cars can come with many extras. Before you even start to look, decide what you need. You can also have a list of amenities you’d like but may not necessarily need. And be sure you know if there is anything you don’t want. (Amenities can work as bargaining chips for both the buyer and the seller.)

Here’s what I mean: I use my computer… let’s just say everywhere, so I need to be able to charge it when necessary. I prefer a car that has a USB port, but an old-time lighter socket and an adapter will work fine. I’ll even supply my own adapter, but if the socket doesn’t work, the seller has to prove to me that replacing the fuse will fix it; I’m not interested in dealing with what could be a wiring problem. (Also, if the seller shows me that changing the fuse will fix the problem, he might as well leave the new fuse in place—for free.)

Another amenity I need is air conditioning, mostly to combat humidity. I want heat too. I won’t buy a car that has a heat or air conditioning problem. Something I don’t need is a roof rack. And I absolutely don’t want a sunroof. I wouldn’t ever use it and it’s a good place to get a leak.

Note: I’ll buy a car that has things I don’t need, but I will pay fair market value for the car, not fair market value of the car plus whatever is installed that I don’t need. As for “amenities” I don’t want? I’ve already said they can be bargaining chips. I might buy a car with an extra that I don’t want, if it has several things I do want. It depends on how badly the seller wants the vehicle to go; I’ll try to convince the seller to drop his price a bit and—possibly—pay slightly less than fair market value for the car.

Use Online Resources To Begin Pricing

Once you know what you want a car to do for you, it’s time to do a reality check. When you buy a used car, the question is the same as when buying a new one: How much car can you afford? Make, model, and customization determine the price of a new car. The same is true for a used one with age, condition, and mileage also influencing the asking price. The difference is that most new car buyers are trying to figure out how much they can afford to make in monthly payments. And, yes, dealers generally have payment plans available for used cars, but I recommend the frugal move of saving in advance and making a cash purchase. By itself, this will save you a lot of money in interest payments. (Note: I’m sure you know private sales are almost always cash.)

If for no reason other than finances, you may need to reconsider your choice of vehicle. Even if you plan to make payments, it’s wise to know approximately how much you can expect to spend well ahead of the time to buy your car (months, even years are good). Do some research to learn the fair market value for the type of car you want. You’ll want to know the base value and how much each of the factory addons or accessories increase the price. You should expect to pay fair market value or a little less. Also, if you start tracking specific models for fair market value (years) ahead of your purchase, a sharp decline in price, or lack of decline, can give you a very good idea as to quality of the car(s) you’re interested in. BTW: You don’t have to be currently interested in buying a car to start saving for your next one. (You’ll need one eventually.) Personally, I like to have at least $8,000 in savings that I could put towards the right used car—just in case I encounter a sudden need for a vehicle.

There are a number of free online services that can help you determine the amount you should expect to pay for any used car you’re interested in. My favorites are Kelly Blue Book and Edmunds. They’re user friendly and accurate. Go to either website to see what the price would be if you found a car of the year and make (plus extras) you’re looking for.

Here’s how I use those online resources: I start my search at either KBB or Edmunds. I put in a search query for the type and year of the car I’m interested in. If it comes back as out of my price range, I add a few years to the age of the car and try again. This gives me the age and price range to look for when I get serious about finding a car. It helps me keep my expectations real. As I said above, sometimes I have to reevaluate what I think I want in comparison to what I can afford. (Sometimes, I’m pleasantly surprised.) Since I do this research to find the types of vehicles that fit my price range before I begin shopping, I can really focus on choosing the right used car when I do shop. I don’t have to wonder if I can afford it. Instead, I can concentrate on its condition.

Inspect Each Car Carefully

When you find a car you’re interested in, take the time to inspect it carefully. Earlier I suggested that you read my Used Car Inspection post. It’s a checklist that makes it easy for you to evaluate the condition of a vehicle before you buy it.

A lot of people are more comfortable with buying a used car if they can have their mechanic inspect it before they make the purchase. I certainly can’t discourage that. After all, you’re buying a used car. It doesn’t need to be perfect, and you don’t want to buy someone else’s problem, but you will have to pay your mechanic for his evaluation. You can do your own inspection to vet the car first to make sure it’s worth taking it in. That can save you some time and money.

Now, I just said that you don’t want to buy someone else’s problem… At the same time, you don’t want to overrate minor flaws. Take rust for example: Most people see any rust on a car and they immediately become skeptical about buying it. The truth is, some rust may not be that bad. I’ll buy a car with some surface rust on it, because I know how to fix the problem. If, however, the rust is excessive or deep, I won’t buy it. In that case, it’s probably not worth the cost and time required to make the repair. The point is, your level of knowledge and ability to make repairs can be your guide as to whether a car is worth purchasing, worth taking to your mechanic for a professional opinion, or not worth keeping as a prospective purchase. My checklist will help you keep issues of concern in mind.

The Car’s History

When we talk about issues, it’s helpful to have a car’s history. Carfax does an awesome job of tracking vehicles and keeping reports on them. It’s an excellent resource.

A Carfax report tells the vehicle’s “life” story, whether it’s been in an accident or flood—any major events you should know about. The report also tells you what maintenance has been done to the car. It might be a walk away moment if, as you read, you notice an item that’s required frequent repair or adjustment.

On the other hand, if you get a report of regular maintenance, you’ll know the car was well taken care of. Regular maintenance includes things like oil and filter changes, as well as major events such as changing the timing belt, at intervals advised by the manufacturer. (Using the Carfax report, you can compare the recommended maintenance to what was actually performed.)

While an inspection and “background check” on any used car you’re interested in will give you a very good idea of its condition. They can, in fact, save you a lot of after purchase expense and frustration, but to make sure you pick the right used car, you need to know how it handles. You need to do a road test.

Do A Serious Test Drive

A serious test drive is essential to finding a vehicle that performs well. While you’re driving, pay attention to what’s going on with the car. The test drive isn’t the time to engage in conversation that doesn’t relate to the vehicle; don’t spend the time you’re driving just chatting with the seller. You should, however, ask about any irregularities you notice.

I’ll give you a list of some important concerns:

- Does the transmission shift smoothly? If not, it could be an indication of a bad transmission.

- Do you smell burnt or hot oil? An oil leak could be serious, depending on where it is.

- Do you smell gasoline? If it’s leaking in the engine compartment, it could cause a fire.

- Do the brakes work well on all four wheels? Pulling to the left or right is a problem.

If you experience any of the above, make arrangements for your mechanic to look into them before you purchase the vehicle. They may not be dangerous or costly to repair, but you need to know. The right used car is one in good condition when you buy it. You want to save money, not put out a lot to make it right.

There may be other issues you sense during the test drive. If you’re not comfortable with the seller’s explanations, talk to your mechanic. I’ve already said how I feel about the heat and air conditioning. I always want to test them (and make sure the fan works!). Or, I have my mechanic take a look at the systems. (Air conditioning can be hard to test in the winter.)

Another thing that may warrant taking the car to a mechanic after the test drive is nonworking gauges, warning signals, and dash lights. If these didn’t come on properly or at appropriate times, have the seller try new fuses. If new fuses don’t fix the problem, a component, sensor, or the wiring could be bad. Those can be expensive fixes, but—sometimes—your mechanic will tell you a fix can be put off for a while, maybe quite a while.

Be Ready To Walk Away

When you’re in the market for a used car (this applies to new cars as well), there may be a point when you need to walk away… The first time I heard someone say this, I thought about price: The car’s priced too high for me and the seller is firm… That’s one valid issue. Here are some more:

- You don’t like the car: Just because the seller has given you some time or needs money does not put you under obligation to buy from him. You are looking for a vehicle that’s right for you. If you don’t like the car walk away.

- The car was misrepresented in an advertisement: If this is so, then the seller brought you in under false circumstances. Misleading statements or claims are a good reason to walk away.

- The car has problems you can’t live with: If you can’t reasonably live with it, you’ll eventually spend money taking care of it (like me and a malfunctioning air conditioner). Believe me, I know from experience. Walk away.

- The Carfax report reveals a major problem: Carfax has a good reputation for accuracy. I trust their report. I’d walk away.

- You discover problems during your inspection or test drive: You need a car, not necessarily this car. Walk away.

- Follow your gut: Sometimes, you may feel something is off. Again, there are other vehicles available. It’s probably best to walk away.

You may find other reasons to walk away. Understanding that there more cars out there is huge. The right used car for you will save you money, not just in the initial purchase, but in maintenance and other on-going costs. That said, before you commit to buying any vehicle, you should get an insurance quote.

Consult Your Insurance Agent

When we buy a used car, we generally count on spending less for insurance than we would on a new car of the same type… That’s the rule of thumb, but it’s not written in stone. It’s best to check with your insurance agent to find out for sure. Most people do this right before they buy the car.

When I bought my last car, I called my insurance agent from the car lot: Last fall I was looking at a 2001 Toyota Camry. When I called him, my insurance agent gave me a quote of less than $50 a month if I pay every 6 months. That quote was for collision only, but that’s all I need. If I had been looking at new, 2020 model of the same car, I’m sure I’d be making payments, so I’d need full coverage. Those payments would be around a little over $80 a month. (I paid for the 2001 on the spot.)

Lower insurance is just one savings advantage. Just looking at the issue of insurance, you’re probably beginning to see what I mean when I say you can save big money by buying the right used car. But to bring it home, I want tell you about the advantages that led to saving big money when I purchased the 2001 Camry versus the 2020 version. In fact, since the year’s almost over, let’s figure the 2020 I’m looking at is a used car. Its price is still high enough that I’d have to make payments and that means paying interest. (I think paying to use someone else’s money is a waste of my money.)

See Where The Savings Are

In November 2019 I bought a 2001 Toyota Camry 4D CE/LE/XLE. I paid $2500 cash for it and had $500 worth of repairs done (the car had a small oil leak I wanted fixed, and I had the thermostat replaced.) I was aware of the issues with those items, and the quoted cost for the repair was acceptable to me. So, initially, I had $3,000 in the car. This means, if it did nothing but sit in my driveway, the car itself would cost me $250 a month for the first year ($3,000/12=$250).

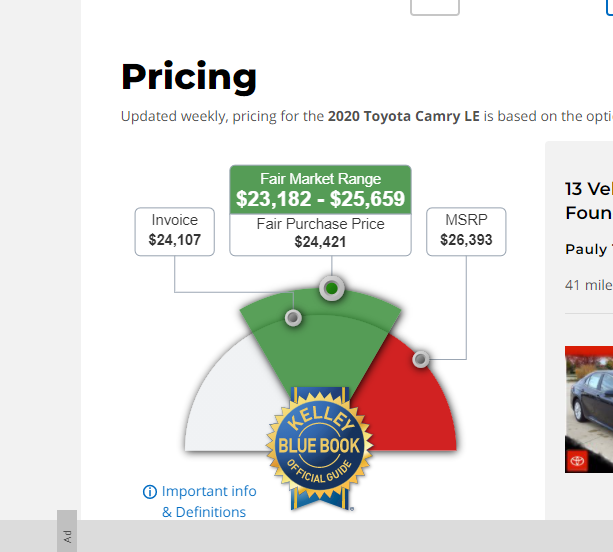

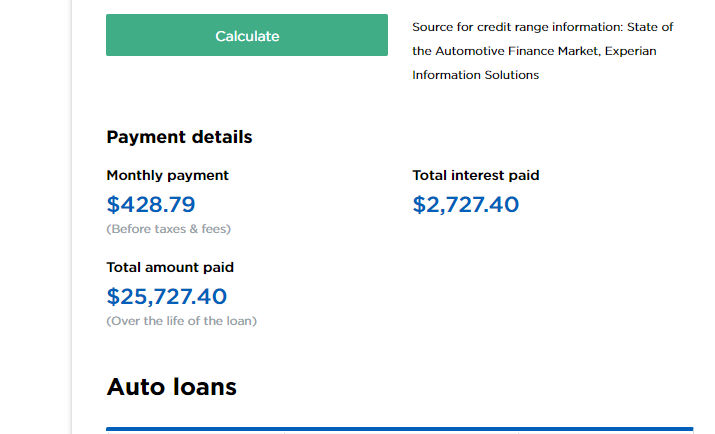

Take a look at the graphic below. It shows that if I bought a used 2020 version of the same Toyota today, it would cost me about $23,000. If it were possible to make payments for the car alone (say for 5 years—60 months), they would be about $383.34 a month. That’s a pretty hefty payment, and remember, even though it would only a year old, we’re talking about a used car. At that price, it means I’ve already saved close to $20,000 by buying the 2001.

Now, here’s an issue that’s important to me: At a price of $23,000, I definitely would have to make payments to afford the 2020. That means I have to add interest to the monthly payments. That’s going to make them close to $429—an increase of about $35 a month. (Nobody but your grandpa will let you just pay the value of the car over time.) The graphic above shows that over the life of the loan (60 months) I would pay about $2700 in interest. The interest alone would be more than what I paid for my 2001.

This financing information comes from Nurd Wallet

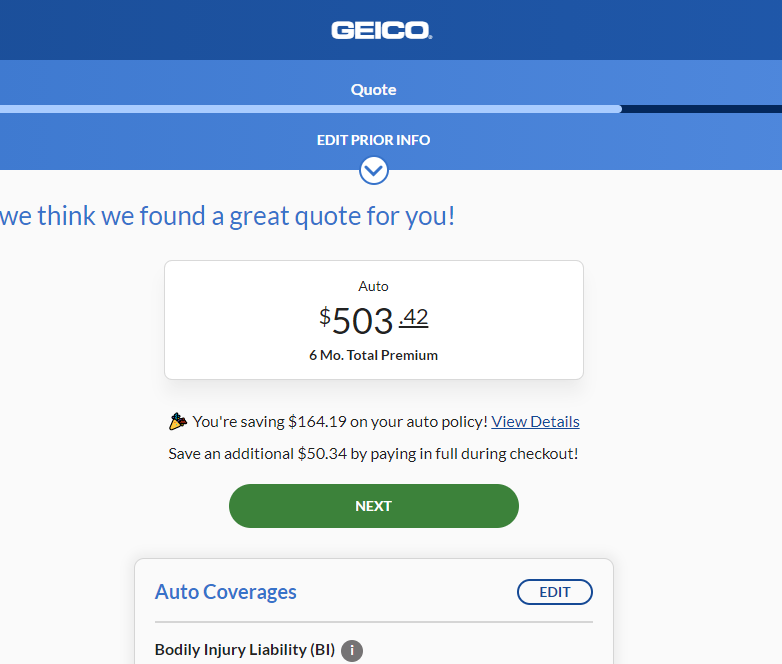

We also need to address insurance: Because I’d be financing the 2020 Toyota, I’d have to carry full coverage. Through Geico it would be $503.42 every six months. (You could pay monthly, but it would cost more.)

Because I only need collision, my insurance payment is less than $300 every 6 months. That’s a savings of about $400 a year.

How Choosing Right Used Car Yields Big Money

- Do a thorough inspection and test drive. Walk away from problems. You’ll save big money.

- Pay the depreciated price of the car. I always choose a car with enough age that lets me pay less than half the price of the original cost of car. That’s big money.

- Pay cash. The interest on a loan is a waste of money. Put the equivalent of what would be your interest payments into savings. That’s big money

- Recognize that you’re saving money on insurance. That’s big money.

Doing these things allows me to enjoy big savings every time I buy a used car. I’ve owned my 2001 Toyota for 13 months. It’s now rolled over 200,000 miles, and my mechanic tells me he feels like I can count on doing only regular maintenance for the next year; He foresees no major problems. If I don’t need any repairs, it will cost me $125 a month to have that car in the driveway. ($3,000 / 24 = $125) And, yes I know none of us buys a vehicle just have it sit in the drive, but for the purpose of this topic, that scenario keeps the issues clear. Choosing the right used car has saved me big money.

Q Do you always have good luck with used cars?

A Yes, because I tend to err on the side of caution. If I’m not sure, I walk away.

Q Do you always pay cash for your cars?

A Yes. I expect each of my cars to last several years and every payday during that time I put a set amount into my savings for the sole purpose of having the cash to replace it when it becomes necessary.

Q Is there anything else I should know?

A Not really, but I recommend reading my article on inspecting a used car. I’ve provided a link to it in the first paragraph of this post.

Q Do you buy from private sellers or car lots.

A I’ll buy from either, but they must allow me the time I need to inspect the vehicle.