How to simplify frugal living

Frustrating! That’s how some people view their efforts to live frugally. They overwhelm their lives trying to do all the things they can think of to save money. With organization and time management, you can simplify your frugal lifestyle. Let me show you how to simplify frugal living.

My definition of simplify: When I say “simplify”, I mean, do less or make something easier to do. Frugal minded people tend to be detail conscious. After all, we often find great savings in small increments. (Save a little here, cut a bit of spending there…) Sometimes, we can get too caught up in all the possibilities. Life can become difficult and complicated. That defeats the purpose of being frugal. Your frugal lifestyle is meant to enhance your peace of mind when it comes to money. And what facet of life isn’t influenced by money? (It feels good when funds are needed and you can say, “I’ve got this covered!”.)

Simplifying your frugal lifestyle makes sense. The degree of difficulty and complication you encounter as you live (frugal lifestyle, or not) tend to complement each other. When it seems like there’s not enough time to get things done or that details are too complicated to work through, it’s often because you have too much to do. If you have too much to do, think “less”. Look for ways to decrease your workload by reducing the number of things you do or put more order in the way you do them. You’ll see more on this below when you read my suggestions for simplifying your life.

Why choose to be frugal in the first place? Maybe you want to be debt free, build an emergency account, put more money into your retirement plan, or do anything that requires a long-term financial commitment. It’s important to know your “Why?”. Any monetary adjustments you make to your lifestyle will be easier and more fulfilling when you understand why you’re making them.

Here’s an example: One of my pet peeves used to be making car payments. (Maybe you’re encumbered with those now?) When I was a new driver, it was generally accepted that a young man would drive a “beater”—an older, well used (think abused) car that you could pick up for about $150 dollars. For a teenager, that was a significant amount of money, but if you lived at home and had a job, it didn’t take too long to accumulate that amount. And, since you were probably buying the car from a relative or neighbor, you often got the vehicle to drive while you paid it off (That was an introduction to car payments.) You were on a sort of honor system, and your parents saw to it that you stuck with it. I got my first car that way, and I can tell you I wished there’d been some way for me to just pay for it outright. It was hard to give up that kind of money weekly. Within a couple of years, I started buying used cars off lots and making payments, usually paying them off in about a year.

Sometime in the mid-80s, I bought a new Toyota Corolla. With total financing, included interest, the price tag was just over $8,600—about $180 a month for 48 months—4 years. (BTW: Today, a similar Corolla costs more than twice the price I paid for mine in the ’80s, and you might be financing it for up to 8 years, maybe more.) Anyway, about a year into the payments, I’d had enough of that commitment. I hated spending money that was basically doing nothing for me. After all, I already had the car, but the loan company held my title. (It was certainly not an honor system.) Also, someone who lived a frugal lifestyle was coaching me on finances. I sold that car for enough cash to pay off the loan. Then, I used money I had in savings to buy an old, but decent, used car and began to pay myself back with the monthly payments I’d been sending to the loan company. I continued putting that amount away for three years at which time I had more than enough money to pay cash for a better used car. Since then, I’ve had an ongoing commitment to put aside money ahead of time for the purpose of replacing whatever vehicle I was currently driving.

About now, you might be scratching your head and asking, “What’s the point?”. Well, there are a couple of points. One, if I pay cash, I don’t have to pay interest for using someone else’s money (a significant part of any loan). The other is that should an emergency occur and money is really needed, I’ll have cash to resolve it. (Again, I won’t have to pay someone for the use of their money). Both are good reasons to avoid financing a car. That’s my “why” for not making car payments and I’ve made it an ongoing goal.

Set goals. Goal setting helps you know where you stand in relation to your “Why?”. Setting goals is essential to achieving what you want. Did you know that most New Year’s resolutions last only six weeks? That’s because we don’t initially write them down or track them. The same is true about most of our goals. When they’re not written out, most goals turn into wishes; wishes are not real goals. As you set goals write them out. Then, keep them where you can refer to them and (this is important) track your progress. As I write out my goals, I break them down into steps (mini goals). I record them on a calendar in abbreviated form and mark them off as I accomplish each. I’ve written an article on how to set goals. That article lays everything out for you.

Do less and achieve more.

Make routines. Routines save time. Providing order, they make things more convenient. There’s a saying: You don’t have to reinvent the wheel every time you do something. If you have a routine, you don’t endlessly have to think about how to do a task. Routines curtail chaos and promote peace of mind. Here’s an example: My wife and I make dinner (which for us happens to be lunchtime, since I work nights) together. We make enough of whatever we’re fixing to have some leftovers for me to take to work for my lunch break. When we’re done eating, I pack my lunch in containers and put them in the refrigerator. I also put my lunchbox on the counter near the fridge. This saves me time when I’m getting ready for work. It also keeps me from forgetting to take my lunch. Forgetting my lunch would lead to spending extra money. I’d need to pick up something at a drive-thru on my way to work (not frugal) or do without (not pleasant).

I’m certainly not the only person who uses this little routine. Maybe you do too? It’s practiced by thousands of people daily. It saves time and money. It also yields a measure of contentment (a full stomach). It’s a frugal practice.

The following are some, How to simplify frugal living . These really are just a few examples. They can save you time and money, reducing any sense of frustration. When you consider them, I’m sure you’ll come up with some that fit your own frugal lifestyle. We each have to be comfortable in the way we live. Frugal living is no different; it can be customized.

Shop online. Walmart and a growing number of other stores offer online shopping. You can purchase what you want and pick it up curbside. This saves a lot of time and frustration. Some stores will deliver your groceries to your home, or ship them to you—think Amazon.

Simplify your grocery shopping. When it comes to buying groceries, I was a serious bargain hunter. I still am, but I’m smarter about it now. I used to go from store to store. Time after time, I’d pick up a few items that were on sale at one place then move on to the next to do the same. Grocery shopping could literally take all day. I did save money on groceries shopping this way, but the cost in fuel and also wear and tear on the car added up. Subtract that from the savings on food along with the fact that it took so much time was disappointing. I eventually decided this method of shopping was not giving me value for my time. The process needed to be streamlined (made less complicated). I considered where I actually made the majority of my purchases. Now, it’s rare for me to stop at more than two stores for groceries.

I have 3 other practices I regularly use to save time and money when I grocery shop:

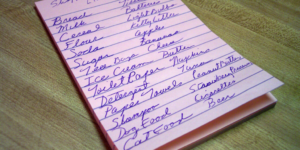

- I use a shopping list for each store. This reminds me to pick up items I really need. It also helps eliminate duplicate purchases at the second store and limits impulse buying.

- I use coupons. I paperclip the appropriate coupons to the shopping list for the store where I’ll use them. On my shopping lists, I also mark the items for which I have coupons. That way I remember to take advantage of the savings. (Note: In the past, if you had a coupon for several of the same item, it was smart to keep those things together to save time verifying numbers at checkout. That’s a habit that’s not been necessary for a while. Almost every store has computerized registers that keep track of that information by barcode. This make things much simpler when you’re unloading your cart.)

- While I consciously work to limit impulse buying, I do take advantage of unexpectedly low or sale prices on items I use regularly. If you don’t yet do this, I’m sure you will after you read my article on how I make a stock pile of food bought on sale. It shows you how I save money by buying staple products in quantity. The plan is simple (easy and uncomplicated).

Avoid the pharmacy. If you regularly need to visit the pharmacy for prescriptions refills, consider mail ordering them. You can have your prescriptions mailed or shipped to you, and it may cost less than if you purchase them instore. Take a look at healthwarehouse. (There other vendors of this type also.)

Running errands will be less time consuming if you plan ahead. Try to get as many done as possible per trip. If you’re leaving your house/work and then returning, try to run the errands in a circle. If you’re running errands on your way to work from home or on your way back home after work, it makes sense to do them in as straight a line as possible. Since you won’t be running back and forth across town, these routines will save you time and gas (think money), and when you’re finished, you’ll be close to your ultimate destination. You will have imposed order and management over what had been a hectic habit.

Pay bills online. Most businesses accept money online, and your bank probably has an online bill pay feature. Be frugal about using it. Inquire about any charge for using bill pay. If there is, you may want to change to a bank that is more accommodating, or you can find a bill paying service online that doesn’t charge you; the recipient pays for the service.

Paying your bills online simplifies the process. You eliminate concern over the timely delivery of a check in the mail. It also keeps the cost of paying bills down. (Printed checks are expensive.)

Conclusion

Every lifestyle requires some kind of money management. Some methods are more efficient than others. A frugal lifestyle is designed to maximize every dollar’s buying power and give you funds sufficient to deal with…well, life.

Often the idea of frugal living inspires a visual that looks too much like someone trying to squeeze the last little bit of toothpaste out of the tube. There’s always a bit left that might just come out if we continue to push just a little more. Usually, it ends up being too hard (too much work) to do. That’s frustrating and it’s wrong. Frugal living should eliminate frustrations. Don’t use excessive measures to make your money go farther. Instead, rely on simple routines and practices that give you the satisfaction of knowing you’ve used your money wisely.

In this post, I’ve shared some of the routines and practices that typify what you can do to keep your frugal lifestyle simple. Generally, they incorporate doing less. They should inspire you to come up with some of your own. What can you not do and still meet your goals? Get rid of frustrations generated by having too much to do. Take gratification in your frugal lifestyle.

One last note: If you have questions, leave a comment. I’ll get back to you as soon as I can.