How to Track Debit Card Usage

How do you keep track of your debit card expenditures? I use my checkbook register. My method is accurate and easy. Knowing how much money you have is frugal. I’m going to show you how to track debit card usage

The Checking Account/Debit Card Link

When you use your debit card, money is removed from your checking account.

Note: When I use my debit card, the transaction usually posts to my checking account immediately (within a few minutes). There are, however, occasional exceptions. Sometimes, they take a few days to show up—but, eventually, they do. The delay makes it easy to forget about them and puts you at risk of overdrawing your checking account. That given, it makes sense to track your debit card transactions daily.

Track Debt Card Charges and Balance Your Checkbook

Since debit card transactions are really a function of your checking account, it’s almost a “no duh” to use your check register to track them. After all, the money to cover both comes from the same fund. If you track your checks in a register (and you should), you’re already half done, just include your debit card transactions along with any other output or deposits to the account. Reconcile/balance the numbers once a day and you’ll know how much money remains for you to work with.

Tracking your debit card transactions along with the other functions of your checking account in one register makes it easy to accurately assess your available funds.

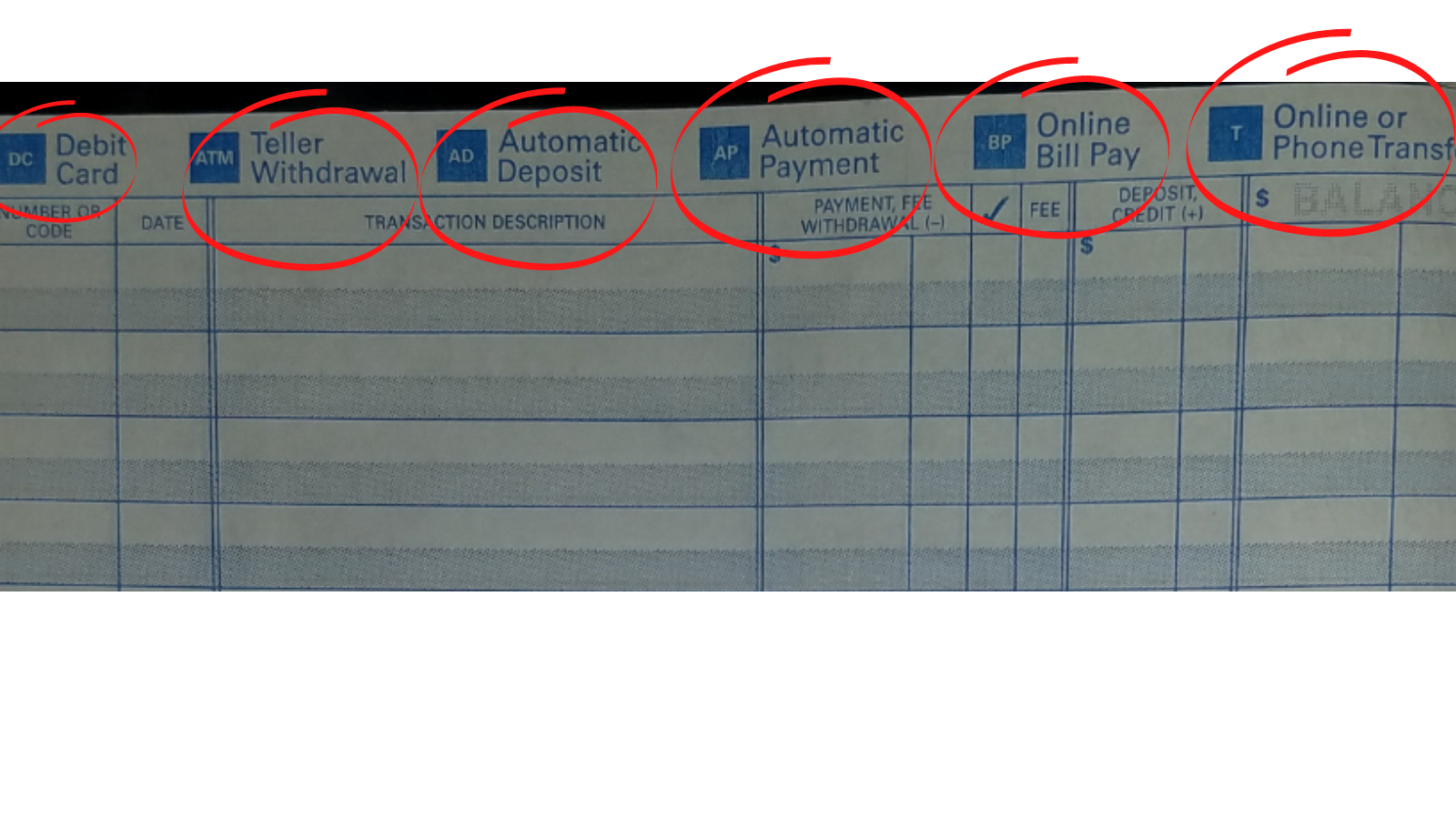

Most checkbook registers look something like this:

I’ve circled a set of codes in the top section. You can use these codes to easily identify functions your checking account covers in addition to a written check. They let you distinguish Debit Card and ATM transactions, Automatic Deposits or Payments, Online Bill Pay, and Online/Phone Transfers. In addition, I use a D for any cash/check deposits I make. Of course, you’ll identify any checks you write by the number in the upper right corner of the check.

The Recording Process

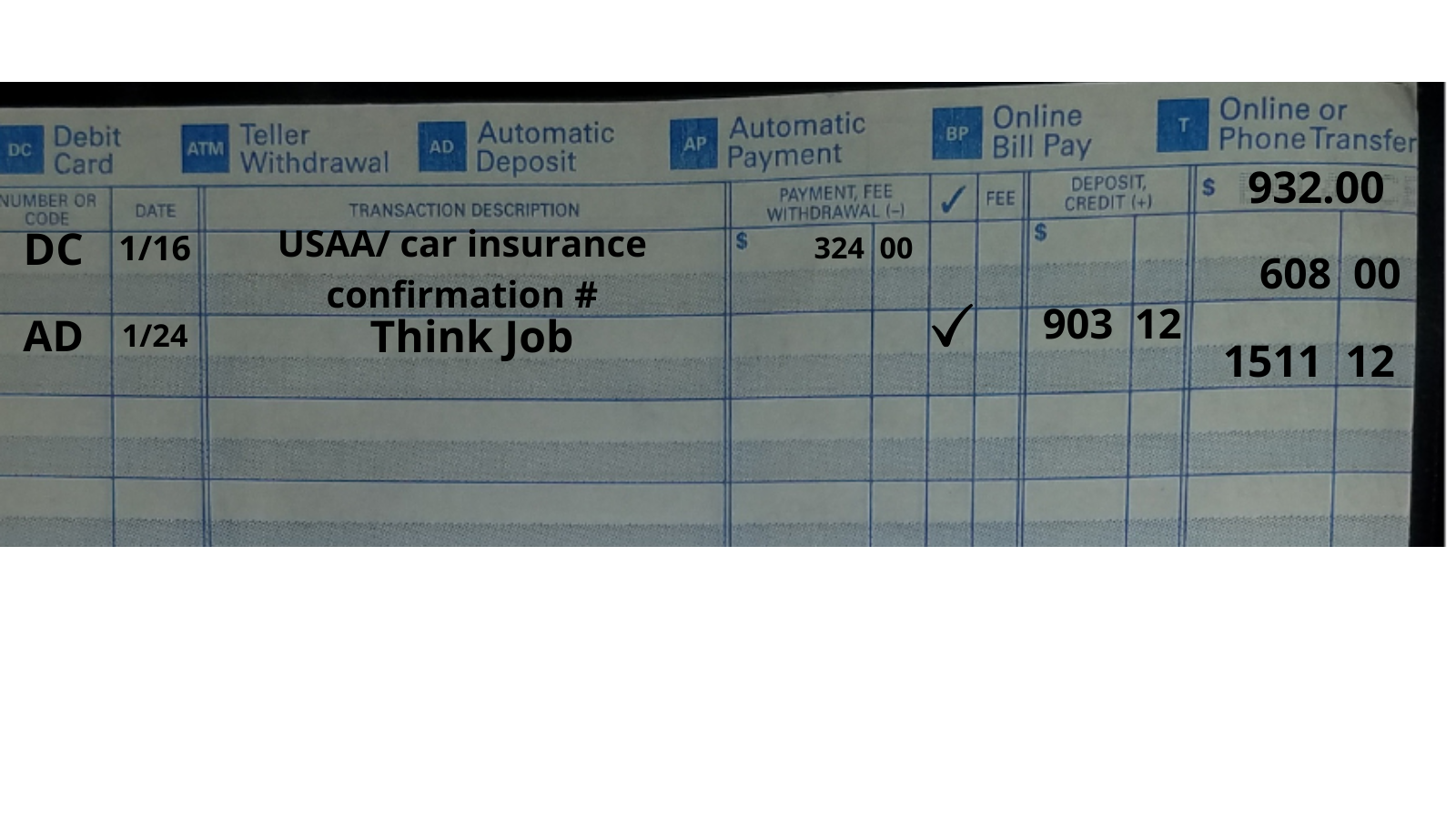

When you look at the register, you can see that it’s a series of lines and columns. I’ll get to the columns, but notice the horizontal rows, in mine they alternate—white and blue. Yours may have different colors, but all the checking registers I’ve seen use alternating colors. I use the white lines to document all transactions including debit card purchases. I use the blue lines for notes, especially confirmation numbers when I’ve made purchases on the internet or by phone. (Yes, that means I may have a blank space if there’s no collateral information to record, but I use it to keep pertinent details together.)

Now, about those columns:

The column on the far-left labeled Number or Code is where your check number or appropriate code goes—DC when you want to indicate a debit card transaction.

The purpose of the Date column is self-evident, but it’s a small area, use figures for convenience: 01/14 for January 14. There’s a place on the cover of the register to record the time span it’s in use, the year can go there. Also, regardless how few transactions I have in a register, at the end of a year (and you may use more than one register in the course of the year), I close it and start with a fresh one on January 1 of the new year.

In the Transaction Description column write the name of the business/store/person you’re paying and what you’re paying for (such as USAA/Car Insurance.) And, here’s where the blue row comes in handy. It could be used for that last bit of info i.e., Car Insurance. Alternatively, you could write in a confirmation number.

Deductions: Payments/Withdrawals/Fees should be recorded in the column to the right of the description. This would include debit card transactions, teller withdrawals, and all other outlays (checks, transfers, and automatic, online, or phone payments). That’s certainly the logical procedure for transactions that are payouts, but what’s with the column marked “Fee”? The answer is that some banks (and credit unions) have a small service charge for written checks (and some may charge for cashing incoming two-party personal checks). Where imposed, policies associated with this fee vary from bank to bank. If your bank charges such a fee, it must be subtracted just like a payout transaction when you reconcile your checkbook. Note: The term “Fee” shows up in two places, the first in the column with Payments and Withdrawals, the second as a separate small column. That’s a bookkeeping decision that almost presents a redundancy. You can include the fee in the amount of the transaction or list it separately in the Fee column, one or the other, not both. (The same would hold true for fees charged if you make ATM withdrawals.)

Payouts such as debt card transactions and checks aren’t the only function of your register. There’s a column for Deposits and Credits. This where you record amounts deposited to your account, whether you do them or they come from another source—think your job or your parents. Debit card refunds and other credits also go in this column too.

OK… It might look like I skipped a column, the one with a check mark at the top. This column is for indicating when an item, outgoing or incoming, clears your account. (I thought it appropriate to wait to discuss this until I’d dealt with those issues.) Until it clears, a transaction is pending. It’s important to watch for any pending debit card transaction to clear before you check it off. You want to be sure the final amount is accurate; it might be different than when it first posts. For example, if you use your debit card to pay for a meal and include a tip, it’s not unusual for only the price of the meal to show up when the transaction first posts to your account. A few days later, the amount will change to include the tip. Then the transaction will clear… This is normal for that type of transaction, but occasionally (not very often) there’ll be a computer error and an amount will change that shouldn’t. Should this occur, you’ll need to contact your bank to initiate a resolution process. (You may also have to contact the merchant you did business with.)

The last column on the right is your running total. The figure is determined by subtracting or adding the amount of each transaction with the total above it. By keeping track of your expenditures daily, you’ll know how much money you have for meeting your needs (and wants) until more comes in. (I’m serious about doing this daily. Bookkeeping goes much more smoothly if it’s done regularly and if you have a routine for doing it.)

Do the Work

You need

- Your day’s receipts

- Your checkbook register

- Your bank’s online checking leger

- Organize your receipts. This could be in the order of purchase or by amount—greatest to least or least to greatest—but do it the same way every day. This is solely for your convenience; it keeps the procedure simple and regular. The order in which the transactions clear the bank will rarely match your order of entry. (Note: Keep your receipts until they clear.)

- Make entries in your register starting on the left side with the transaction type and work to the right. Double check the amount of the transaction when you record it and compare it to the corresponding figure in your online register.

- Tally your numbers and make sure your copy and the bank figures reconcile.

The However

The procedure above works perfectly if everything clears at once (and many transactions do). But the tally will never come out correctly if anything is still pending. To get your numbers to match the bank’s you’ll have to add back in anything in your register that’s still pending. You’ll also have to subtract any deposits and credits that haven’t cleared. (When I was young, we had to wait for the bank to send out a paper statement once a month to do a reconciliation. Seeing the information online/on demand greatly reduces the opportunity for error.)

One more thing: Should your figures not reconcile, there’s a mistake somewhere… This is a good reason to keep your receipts. Don’t immediately assume the bank is in error, double check your work. (Some banks will charge you a fee if they search for the problem and you’re found to be at fault.

Benefits of Tracking Your Debit Card Usage

- You always know what your balance is

- You’re less likely to overdraw your account

- It’s easier to stay on budget

- It will help you spend less and save more money

FAQ

Q: Is overdraft protection is a good idea?

A: Think about it this way: You need to manage your money better. Overdraft protection is a small loan from the bank to cover the amount you overdrew. You have to pay it back, and you’re charged interest. If you reconcile your checking account daily, you shouldn’t need it.

Conclusion

This is how I track my debit card usage. It’s fast and easy.