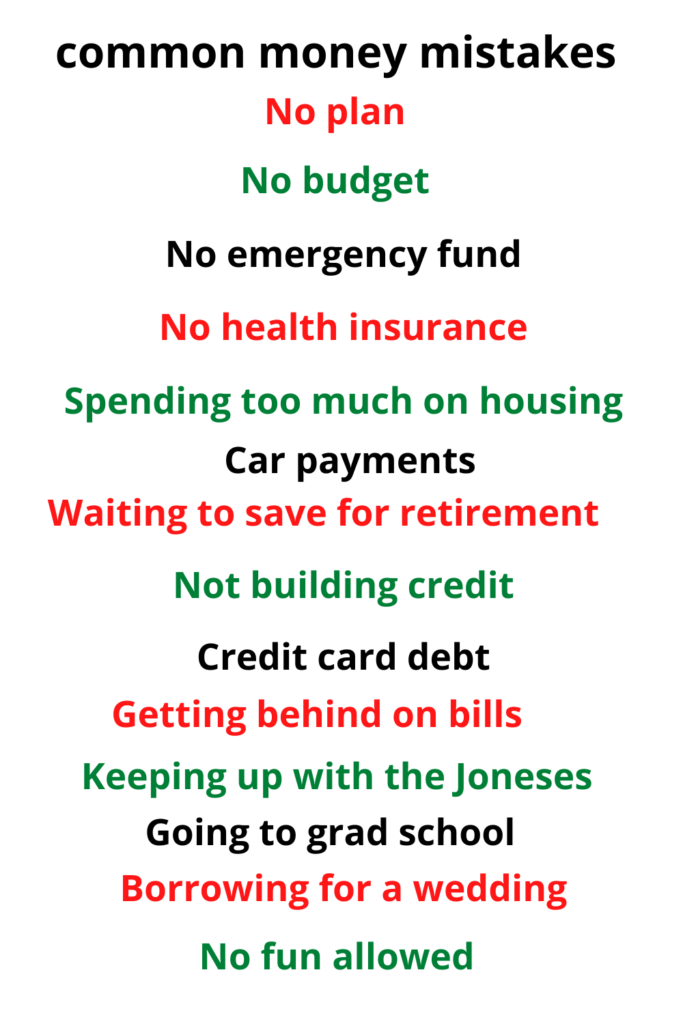

Money Mistakes You Can Avoid

People make several common money mistakes. They don’t understand that they need a comprehensive plan for their money. A financial plan is a lot like a jigsaw puzzle. There are a lot of factors—puzzle pieces—involved, basically everything you need money for. A puzzle isn’t complete until all the pieces are in the right place. Leave a piece out of the puzzle or jam one into the wrong place and it becomes obvious the picture isn’t right. Personal finances are much the same. If you aren’t dealing with each factor as a specific part of the whole, you’re making a money mistake. Here is a list of money mistakes you can avoid.

Money Mistakes You Can Avoid

There’s good news: Most money mistakes can be easily corrected.

Take a look at the list below. It lists common money mistakes, what makes each mistake, and how to avoid or correct the problem.

No Plan

Thinking that you can prosper without a financial plan may be the most basic money mistake you could make. There is an adage, “If you don’t plan, plan to fail.” You need a plan. Where do you want to be in 5 years, 10 years, 20 years? You need goals and mini goals—milestones.

The reason

Not having a plan is a money mistake because it’s human nature to spend what we have on hand. We tend to forget what we really want out of life. Instead, we chase after whatever we “really” want right now.

It’s important to set goals, but the object is to accomplish them. Who wants to work for something they never achieve? By having a plan laid out with goals and mini goals you’ll be able to gauge your progress. (Mini goals are the steps you take to accomplish your intent, your overall goal, which is financial security now and in the future.)

Solution

Make a plan with goals and the steps it will take to meet them. Then, stick to it. (That doesn’t mean you won’t modify it from time to time.) What do you want your financial picture to look like at the end of this year? Next year? When it’s time for your kids to go to college? At retirement? Or any other significant time in life? Your plan should allow for every facet of life that requires funding. Having a good plan will help you avoid money mistakes.

No Budget

Not having a budget is a common money mistake. Without a budget your money can lose its potential quickly. If you don’t have a budget, you’re walking out the financial part of this journey we call life without a map or navigational tools. To put the point on this, I don’t think you can honestly tell me that there is any facet of life that has (absolutely) no financial element to it.

The reason

If you don’t have a budget, you’re not holding yourself accountable for your spending. It’s easy to fall into the trap of spending money simply because you have it. You’re likely to find yourself overspending on things that catch your attention in the moment, and then running out of money before you have more funds come in (as in a paycheck). That makes it hard to maintain a consistent lifestyle now, and you might as well forget about preparing for the future.

Solution

Develop a budget and live by it; it’s central to your financial plan. A budget tells you how much money you have to spend on…anything…everything. Of course, that doesn’t mean that most of us can have everything we want, at least not all at once. But, it’s amazing how much our money can do for us when have a financial plan and live by a budget. By the way, a budget (and, for that matter, your overall financial plan) is not static. Life is a progression of phases. We have to make our finances adapt to them, but neither your plan nor your budget should be so fluid that they change at every new circumstance. That’s why they’re made to take into account both your now and the future. If you have a workable budget and are faithful to it, it can maximize the power of your money.

In conjunction with your budget, I’d like to encourage you to keep a spending journal. It will help you track how much you spend and on what. It’s a handy tool for budgeting.

Note: Most of the common money mistakes that follow can be avoided by developing and following a budget that allows for funds to cover the need.

No Emergency Fund

Unexpected things happen. Often they’re unpleasant and expensive. If you don’t have an emergency fund to handle the financial aspect of these occurrences, you’re making a common money mistake.

The reason

If you don’t have funds set aside to handle emergencies, where will you get the money you need to deal with it? Without accessible funds you’ll either go into debt or have to sacrifice money you planned to use for other purposes. Either of those alternatives can, at a minimum, disrupt life now and slow down (maybe end?) progress to secure your future. Not having an emergency fund is a common money mistake.

Solution

Include an emergency fund category in your budget. Every payday contribute a set amount to it until it’s full funded. It’s recommended that you have enough money to handle your monthly bills for three to six months. (Personally, I’d say six months at a minimum.) You can set up an Emergency Account, a bank account specifically for this money, or keep them reserved in an account that holds money for a number of purposes. Either way these funds need to be dedicated for emergency use only.

Having emergency funds adds stability to your finances. You’ll have the cash to handle LIFE when it happens. Funding an emergency account should be at the top of your list of important things to do. It’s not hard, I’ve written an article that explains how to fund your emergency account.

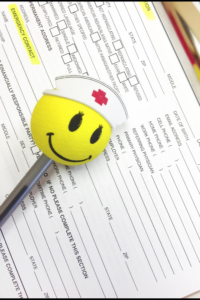

No Health Insurance

Think of it like this: If you don’t have health insurance, it’s very likely you would be liable for any and all of your medical expenses.

The reason

Routine medical attention isn’t inexpensive. If you need care beyond routine—a major medical event—the increase in cost could be devastating. To not have health insurance is a common money mistake.

Solution

The solution is pretty simple: Get health insurance. But, there’s more. You need to understand your deductibles and out of pocket maximums. Those figures can help you decide if it would be to your (financial) benefit to go ahead and have an ultimately necessary, but not particularly urgent, procedure done, rather than putting it off.

The idea behind health insurance is to protect you and your family from the full cost of illness and injury. To an extent, you could think of health insurance as a sort of specialized emergency fund. I have a friend who was in good health. (So we thought.) At age 36, he had a heart attack and he didn’t have health insurance. The final bill was more than the price of a large house. There are organizations that may be able help pay those bills, but you never know (1) if/when you’ll need their services (So you can’t have their help lined up ahead of time) and (2) how much help you’ll qualify for. It’s better to have a category for health insurance in your budget.

Spending Too Much On Housing

“Your eyes were bigger than your stomach.” Many of us heard that when we were children after we’d helped ourselves to an abundance of food (in my case dessert), then couldn’t finish what we had on our plates. As adults we may hear “He’s house rich, but cash poor.” The people this is said of took on more than they could handle.

The reason

If you’re spending too much on housing, you probably can’t save money. You may even have to use funds that should go for something else. That’s a common money mistake.

Solution

If you’re looking for a place to live, know your limits. Don’t allow anyone to talk you into something you can’t afford. If you’re already in housing that’s too expensive, you may need to consider moving to a less expensive place, or get a roommate.

The amount of money we allocate for housing needs to be in keeping with our overall financial picture—income, other expenses, and savings projects. Will the place you now live in or the one you’re considering moving into make you strapped for cash? Will you be able to meet all your other bills? Will you be able to save money? Will you be able to afford a generally pleasant lifestyle? Do yourself a favor and take an honest look at your cost of housing. Will the place you live allow you to have a life? It’s a budgeting matter.

New Car Payments

New cars come with large monthly payments and they can take 5+ years to pay off. A used car would probably work just as well as long as you know what to look for when you buy the car

The reason

That the car is new isn’t really the problem. Unfortunately, a new car comes with a big price tag that, usually, takes a long time to pay off. Taking on that responsibility is a common money mistake. The average monthly new car payment in the first quarter of 2019 was $554, and as I said above, payoff for many will take more than 60 months. In fact, the average loan was written for 72 months—6 years—and 84 months—7 years—is not unheard of. That amount of money and time should be fairly significant to almost everyone. (And don’t try to argue that money and life are separate issues. They’re very much interwoven.) Dedicating that time and that money to buying a vehicle equals giving up a big chunk of your life for something that will, eventually, have to be replaced. At that point in the future, how much time and money will it be necessary to sacrifice?

While I’m talking about time, money and new cars, there’s another huge problem. New cars depreciate on the average of 47% in the first 3 years of ownership. At the end of the three years, you’ll be making payments on an item that has, essentially, lost half its value, but total payments you owe may still be equal to more than half the original cost. It doesn’t make sense to make such a purchase.

Buying a new car is a money mistake because the car takes so long to pay off, depreciates considerably and you will have paid so much for it that you can never really recoup the expense.

Solution

Save money and buy a good use car with cash.

Waiting To Save For Retirement

Time passes more quickly than most of us realize. It’s a common money mistake to put off financial preparation for retirement.

The reason

The reason waiting to start saving for retirement is a mistake is that you lose the opportunity to maximize the earning potential of your money. Think of it like this: By not saving for retirement, you are choosing to not accept the return on invested funds that can be reinvested. Essentially, that unrealized potential costs you money.

Solution

As soon as you can, make a category in your budget for retirement. Contributions should be regular and increase as your financial situation improves. Most people need a financial planner to help them with this process as it may include a mix of venues for making money. Interest bearing saving accounts and a variety of investments are common, but not exclusive; my wife’s grandfather bought and sold property.

The sooner you start saving for retirement the better. You’ll have more years to save and reinvest. That can make a huge difference in how much you’ll have when it becomes time to live off those funds. Budgeting saving for retirement should be imperative.

Not Building Credit

Having no credit history is about as bad as having a poor credit rating. Either is a common money mistake.

The reason

Business uses our credit report as a lens to see our worth. I’m not just talking about whether or not to extend credit or authorize loans and mortgages. Of course, those decisions can influence the type of car we get to drive, the cost of insurance and where we can live (and where we live can affect the quality of education our kids receive). But that’s not all. Another reason not building good credit is a money mistake is that more and more companies are using your credit report as a basis for hiring you. (Essentially, are you going to deliver for them—or not?)

Solution

Build a positive credit history and you’ll have a good credit score.

Sounds simple, doesn’t it? The catch is that it takes time. With some research, however, you can find some legitimate ways to speed up the process a bit. One popular way is to save enough money to buy a car. (I recommend a good used car.) Instead of paying for the car outright, take out a loan. You can make the payments for several months, maybe a year and then use you savings to pay it off. This will get you out of paying some of the interest you’d owe on the loan and the history of regular payments can help your credit score.

Whatever you do, be very careful to not to overextend yourself financially. That would be detrimental to your credit score. The better your credit history, the better you credit score, the better off you are. You need good credit.

Note: Anyone who regularly reads my posts knows I constantly preach “Use cash. Don’t use credit.” In light of that, the above might sound a little confusing, but I think I’ve explained why you need a good credit score and I do get back into my routine in the next section.

Credit Card Debt

Credit cards are so convenient. See something you need (or just want), reach into your pocket or purse and voila! You have instant money. You can purchase it. But…that money really isn’t yours. You have to pay it back, and when it’s time to do so, it may not be convenient at all. Paying back that debt can be a problem.

The reason

Credit card debt is a threefold money mistake.

1) You commit your disposable income to paying an unnecessary bill.

2) You’ll pay a lot in interest.

3) Many credit card purchases are for instant gratification, rather than things you really need.

Solution

Unless you have the money to pay the card off at the end of the billing cycle, don’t use it to buy anything. (I pay mine off the same day I make the charge.)

Credit cards are designed to separate you from your money. They were created to make it easier for you to obligate your money (even money you don’t have), and to generate money (in interest and late fees) for the banks that issue them.

Note: If you have the self-discipline to stick to the following plan, there is a way to turn the tables and earn a little “extra money”: Get a cash back rewards credit card. Make purchases with it for things you normally pay cash for, but under no circumstances spend more than you can afford to pay off with a single payment. Then, pay off your card each month before your billing cycle ends. Of course, the keys to this plan are (1) not overspending and (2) paying off the balance before interest can be added in.

Getting Behind On Bills

If you have ever gotten behind on your bills—utility, mortgage, credit card, loans of any type (including student loans)—you’re not surprised this is included on this list of common money mistakes. With many lenders taking aggressive legal action for collection, it’s an unpleasant situation that makes it difficult to move forward.

The reason

When you get behind on your bills, you get caught in a downward spiral. You owe money for goods and services from the past that you’re now required to pay for with money you’re just now bringing in—maybe. More likely, it’s money you hope will come in the future. Late fees and the possibility of losing property and services exasperate the situation. You’re also financially vulnerable. If your money is obligated to pay for the past, how will you pay for any new problems that crop up? (You know, the principle of Murphy’s Law: If something can go wrong, it will and at the worst time.) Unfortunately, current troubles aren’t the only reason getting behind on your bills is such huge money mistake. The record of late payments stays in your credit history for years and has a long-lasting effect on your credit score. That means should you really need a loan or mortgage, it will be harder to get (maybe impossible) and the interest will higher, much higher.

Solution

Pay off delinquent bills as quickly as possible. (Usually, that’s much easier to say than to do—right?) You’ll want to communicate with the businesses and service providers you owe back payments to. Negotiate for time and payment amounts. And when you have an agreement, stick to it. Bankruptcy is an alternative. Just be aware, it’s not a cure-all; some bills like taxes and student loans cannot be cleared by bankruptcy.

Regardless, of payback agreements or bankruptcy, you’ll need to work on rebuilding a positive credit history. Pay your bills on time and take actions to show you’re now financially responsible. (See the section on building credit that appears earlier in this post.) And save.

So that you can prevent it from happening again, it’s important to understand the reason you got behind on paying your bills. Was it because of reckless spending, or did something catastrophic happen? If your delinquent bills are because of reckless spending, you need to live by a budget, probably a strict one. If there was a medical or some other emergency, or you lost your job did you have an emergency account? Emergency funds are essential to good financial health. As you begin the rebuilding process and put together a budget, an Emergency Fund should a priority. Just remember a budget can’t help you if you won’t live by it.

Now, I’d like to address a few issues that are more or less societal. Often, they have an emotional factor involved. I’m including these to emphasize that we need to think about why we want to spend money on the things we do. We need to consider if these kinds of expenditures will really work to our advantage or whether it would be a money mistake. These are examples. After your read through them, I’m sure you’ll come up with some of your own.

Keeping Up With The Joneses

Keeping up with the Joneses is just what it sounds like. It’s an idiom that means you want what your neighbors have. Whether in material goods or activities, you don’t want to be outdone. The social (and emotional) element in this is that you want to be perceived as successful.

The reason

Purchasing something because someone else has is the wrong reason to buy anything. It’s a common money mistake. Keeping up with the Joneses always involves spending money on goods and services you don’t necessarily need. Later, you may find you don’t use or even want them. These purchases are often impulsive and expensive. You may have to borrow money to finance them. (Your neighbors probably did.) It can lead to overextension and missed payments which are serious problems.

You know there’s another Jones saying: “I’ve got a jones” or “He’s jonesing.” It’s slang for craving, as in an addiction. The addiction doesn’t necessarily have to be for drugs. It could be a great desire for love, or sports, or anything. Keeping up with the Joneses usually turns out to be an expensive jonesing.

Solution

Learn what’s important to your own lifestyle. Live your value system not someone else’s. Have a budget that incorporates the means to save money for things that will enhance your life. Don’t make your life an imitation of another’s.

Going To Grad School

This one is kind of an iffy subject. We’ve been indoctrinated to believe that post-graduate degrees are of great value, that they’re a doorway to professional advancement, respect, and money. They’re also costly. A cost average across all fields of study shows it takes upwards of $30,000 to get either a masters or doctorate degree, and the price can go much higher. There is a significant amount of financial aid available, but many people studying for these degrees need to take loans. Funding an advanced degree might be a money mistake.

The reason

In some professions a masters or doctorate degree won’t make much, if any, difference in your pay over course of your career. An example would be a number of counseling specialties. (You’ll want to do some research on your own profession.) Do you want to spend several years and a lot of money to not profit from it? Depending on your field (and specialty), getting a masters or doctorate degree might not be a financially sound decision.

Solution

Don’t assume getting more education will result in greater earnings. Before you commit to a course of study, know what you’re likely to gain from it. You have to pay attention to the trend in your industry. Most of us need to ensure that we’ll be financially compensated for investing in our profession.

All that given, I think I’d like to add a few notes:

1) If you’re getting a higher education, because you want to enhance your ability to do your job regardless of pay compensation, good for you.

2) If you’re hoping more education will bring you more respect…that’s an emotional issue. Be careful. Respect is more likely to come with career advancement and increased earnings. If you are in a field where an advanced degree isn’t likely to yield those rewards, you may want to rethink spending the money it will take to get one.

3) I began this section saying that going to grad school is an iffy topic and I’ve spent a lot of time urging caution. Now, I feel the need to say there are some fields in which getting your masters or doctorate can be very profitable. Corporate Finance is an example. Again, you have to some research to determine if going would be worthwhile financially for you.

4) Everyone thinking about grad school needs to analyze their reasons for going. Is the degree likely to bring you the goal you’re after. You just need to accept that not every profession has the same educational threshold for advancement and earning more money—and by extension, respect.

Ok. I’d still like to cover a couple of more topics with emotional elements…

Borrowing Money For A Wedding

I know some of you will vehemently disagree with me over this, but it’s never a good idea to borrow money for anything that decreases in value. To take this principle a step further, weddings have no financial value. They’re simply a product of emotion. If we’re talking about money, a wedding can’t decrease in value, because they never had any value. But, weddings tend to be expensive. Borrowing money to finance your wedding could be a money mistake.

The reason

Borrowing money to pay for a wedding is a money mistake because you’ll really be financing something intangible—a memory. Since memories aren’t financial assets, you’ll never recoup those funds. As with other loans you’ll have to pay for the use of that money in interest. Also, monthly loan payments limit the amount of disposable income you’ll have. Acknowledged or not, repaying the loan will add stress to your new life.

Solution

Way ahead of time, start saving for your wedding. You don’t even have to have a love interest when you start saving, just do it. I’m saying this to everyone who believes they’ll marry someday—men and women alike. I’m saying this because more and more couples are paying for their own weddings; more and more parents can’t afford to finance it for you. I’ve written an article about sinking funds and how to use them. Financial preparation for a wedding is a perfect use for a sinking fund. And should you ever decide you won’t have a wedding? I’m sure that in every phase of life you could find a good use for those funds.

Note: I’m not saying don’t have a great wedding. Do create that memory. Just don’t borrow to do it. By the way, honeymoons and vacations are other memory makers you should save for ahead of time.

Next is the final common money mistake I want to discuss in this post: Ignoring the fun things in life—and you know emotion has a role in what we consider “fun.”

No fun Allowed

If you don’t allow some funds for fun, you’re making a common money mistake.

The reason

By not setting money aside for fun you run the risk (almost a certainty) of making an unplanned splurge. For most of us, go too long without fun—entertainment or pleasant distraction—and something snaps. We rob ourselves and use money designated for something in particular to appease our need for a break. And, sometimes, we don’t quit. Because we didn’t allow for our need for fun, we ruin our budget.

Solution

Include funds for recreation in your budget. Since all work and no play makes for a very dissatisfying life, it needs to be included as a category in the budget. Of course, we need to balance what we dedicate towards fun with other financial responsibilities. And that’s the purpose of having a budget…

Balance—Pulling It All Together

To a great extent, this whole article has been about balance and a responsible approach to addressing our needs and wants. Regardless of what those are, most of them involve money in some way. That’s why we need a financial plan for now and the future. (You always have to keep the future in mind.) Your money will only go so far. A budget will help you optimize what your money can do for you. Your budget and some frugal thinking will keep you from making some common money mistakes.

Common money mistakes you can avoid are usually a result of not considering what you want in light of what you need. Think about some of the examples I’ve used: You want the convenience of a credit card, but you don’t want to be buried in credit card debt; when you use your credit card, pay it off: You need transportation, but you don’t need new car payments; plan ahead, accumulate the funds to buy a good used car. Use similar practices whenever you spend money. Ultimately, you do this because your biggest need is to take care of the requirements of life now and in the future. Part of that need is satisfying some wants. And, in general, what is our greatest want? It’s to be happy. Avoiding common money mistakes can go a long way towards achieving that.